Virus Weighs on Lockheed Output -- WSJ

July 22 2020 - 3:02AM

Dow Jones News

By Doug Cameron

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 22, 2020).

Lockheed Martin Corp. said rising Covid-19 cases are affecting

production of its combat jets and missiles in Texas and Florida,

impacting an industry that had mostly dodged the financial fallout

from the pandemic.

The world's biggest defense company by sales on Tuesday cut its

expected deliveries of F-35 aircraft produced in Fort Worth, Texas,

by 15% for this year. It also flagged delays in shipments of

Hellfire missiles made in Orlando, Fla., because of supply-chain

issues as more workers tested positive and others were sent home as

a precaution.

The defense industry has been one of the U.S. economy's

most-resilient sectors, with its designation as an essential

industry allowing plants to avoid shelter-in-place orders. The

Pentagon also has accelerated contract payments to help the

sector's smaller suppliers.

Despite the production bumps in Texas and Florida, Lockheed

Martin said it doesn't expect the pandemic to have a material

impact on its finances this year. The company raised its 2020 sales

and profit guidance on Tuesday after reporting a forecast-beating

quarterly earnings.

The Pentagon has pledged to cover contractors' additional costs

from continuing work through the pandemic, and it is seeking more

than $10 billion in funding that has yet to be authorized by

Congress. The Pentagon's accelerated payments have helped push cash

through the supply chain to keep component makers afloat through

the pandemic. Lockheed Martin has also continued to hire staff.

Lockheed Martin is estimated by analysts to have incurred $2.5

billion in pandemic-related costs. The company said it assumed such

costs would be recovered, as it forecast per-share earnings this

year would rise to between $23.75 and $24.05, compared with its

previous forecast of $23.65 to $23.95.

The company boosted its order backlog to a record $150 billion

during the latest quarter, and Chief Executive Jim Taiclet said it

is positioned to weather either a flat or declining defense

budget.

Mr. Taiclet, who became CEO last month, said there could be a

silver lining from any downturn in defense spending, saying in an

interview that merger-and-acquisition opportunities could emerge in

areas such as mission systems, as well as partnerships in the 5G

network sector.

Lockheed Martin's second-quarter profit rose to $1.63 billion,

from $1.42 billion a year earlier, and per-share earnings excluding

one-time items climbed to $6.13, above the $5.72 consensus among

analysts polled by FactSet. Sales rose to $16.2 billion from $14.4

billion.

The Bethesda, Md.-based company added $1 billion to the top end

of its forecast for 2020 sales, which are now expected to be

between $63.5 billion and $65 billion, and boosted its closely

watched guidance for free cash flow.

Lockheed Martin shares rose 2.6%.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

July 22, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

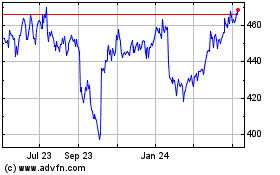

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

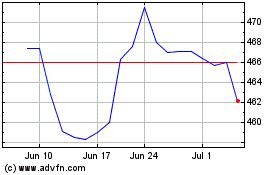

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024