Dassault Systemes Gets US Clearance for Medidata Acquisition, Sets New 2019 Targets

October 24 2019 - 2:03AM

Dow Jones News

By Olivia Bugault

Dassault Systemes SE (DSY.FR) said Thursday that the Committee

on Foreign Investment in the United States has approved its

proposed acquisition of Medidata Solutions Inc. (MDSO) and that it

has set new financial targets for 2019 due to the addition of the

U.S. medical-software maker in its account.

The French software maker said the CFIUS clearance was one of

the final conditions for the merger, which should be completed in

the coming days.

Dassault Systemes set new goals for its full-year and fourth

quarter due to the addition of Medidata. The company now expects

its 2019 non-IFRS revenue to come between 4.02 billion and 4.06

billion euros ($4.47 billion-$4.52 billion), while non-IFRS revenue

for its fourth quarter should range from EUR1.17 billion to EUR1.21

billion. Non-IFRS operating margin for 2019 should be around 32%,

it says, while earnings-per-share growth should be between 13% and

14% in 2019.

On an IFRS basis, revenue for its third quarter rose 14% to

EUR914.8 million from EUR804.5 million, Dassault said.

Dassault said Lockheed Martin Corp. (LMT) has selected its

3DExperience Platform to support digital-engineering initiatives,

but it didn't specify the financial details of the deal.

Write to Olivia Bugault at olivia.bugault@wsj.com

(END) Dow Jones Newswires

October 24, 2019 01:48 ET (05:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

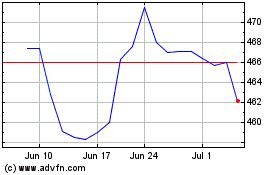

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

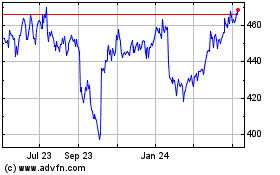

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024