Lockheed Martin Buoyed by Record Orders -- Update

October 22 2019 - 6:50PM

Dow Jones News

By Doug Cameron

Lockheed Martin Corp. expects its order backlog to reach a

record $140 billion by the end of the year, showing the resilience

of some U.S. defense companies in the face of domestic budget

pressures and geopolitical turmoil.

The world's largest defense company by revenue said Tuesday that

while it expects sales growth to slow next year following surging

sales of missiles, space systems and its F-35 combat jet in 2019,

it will still generate more cash for dividends and stock

buybacks.

The Pentagon is working under a temporary budget that freezes

funding at current-year levels and prevents the launch of some new

programs, but Lockheed Martin said prior contracts and recent wins

in areas such as hypersonic missiles and radar systems provide a

long tail of future work.

U.S. defense companies have benefited from higher Pentagon

spending over the past two years, but investors remain concerned

about a domestic budget impasse as well as the outcome of the next

presidential election.

Lockheed Martin Chief Financial Officer Ken Possenriede said the

company expects to add $17 billion in orders this year, with the

backlog stretching out further than in recent years. This in part

reflects the big ramp-up in F-35 production, with deliveries set to

climb to 140 next year from 131 in 2019. A final deal for the sale

of more than 400 jets -- which at $35 billion would be the

largest-ever military contract -- is expected in the next couple of

weeks, he said.

Mr. Possenriede said the outlook for its Sikorsky helicopter

units was improving, having been a drag on the company in recent

quarters because of a downturn in demand for commercial choppers.

Sikorsky is building the new presidential helicopter fleet, as well

as new choppers for the Navy and the Air Force.

He said in an interview that staffing remains one of the biggest

challenges, though the logjam of security clearances that has

roiled the industry in recent years is clearing.

His comments came as Lockheed Martin reported forecast-beating

quarterly profit and raised its full-year guidance.

The initial 2020 outlook fell just shy of analysts'

expectations.

Profit in the September quarter rose to $1.61 billion from $1.47

billion a year earlier, with per-share earnings climbing to $5.70

from $5.18, well above the $5.02 consensus among analysts polled by

FactSet.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

October 22, 2019 18:35 ET (22:35 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

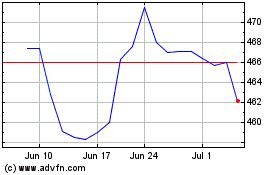

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

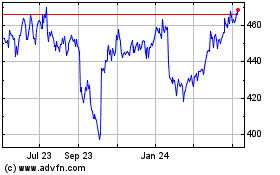

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024