By Joe Flint and Ben Fritz

As big entertainment companies join forces through megamergers

and technology giants invest billions of dollars in new

programming, Lions Gate Entertainment Corp. is finding it tough to

stick to its script.

The independent studio behind "The Hunger Games" and "Orange is

the New Black" embarked on a strategy to roll up other small and

midsize entertainment companies in 2015, after media mogul John

Malone bought a stake. The purchase of Starz, a pay-TV network, for

$4.4 billion was the first step. Lions Gate's growth plans have

since stalled. In 2017, talks to sell itself to toy maker Hasbro

Inc. fell through.

Investors have sent Lions Gate shares down 42% from a peak last

summer, concerned about the studio's viability compared with

industry giants such as Walt Disney Co. and Netflix Inc. Revenue in

2018's final quarter fell 20% from a year earlier to $933.2

million, and net income dropped nearly 90% to $22.9 million.

Morgan Stanley analyst Ben Swinburne recently lowered financial

projections for the company and said in a report he is taking a

"more cautious long-term view" of its assets.

Some Lions Gate employees said they have found it difficult at

times to engage in long-term planning because they didn't expect

the studio to last long as an independent entity. "It feels like

the company has gone into extra innings," said one former

executive. Meanwhile, the company has been beset by internal

conflicts tied to the integration of Starz, as well as uncertainty

in reorganizing its motion-picture business and challenges in

finding new TV hits.

Lions Gate Vice Chairman Michael Burns and Chief Executive Jon

Feltheimer said in an interview that they have continued long-term

planning as usual. They said the studio is a healthy independent

company able to sell content to other distributors, and also to

invest in Starz as one of several subscription services that will

prosper in the coming years. They declined to comment on deal

making.

Starz, whose hit shows include "Power" and "Outlander," has 25

million U.S. subscribers, compared with HBO's 36 million. The

company is pursuing growth by expanding the channel's modest

international presence.

"We're well-positioned as both an arms merchant and with our own

platform," said Mr. Feltheimer. "I think ultimately Wall Street

will see it that way."

Many of Lions Gate's problems have to do with Starz. The deal

created a clear opportunity for Lions Gate's television-production

studio to make shows for Starz, according to analysts and people

inside the company. Yet, the first such show, a supernatural

thriller called "The Rook," will premiere this summer, nearly three

years after the acquisition.

Chris Albrecht, who ran Starz until early this year, regularly

balked at attempts by Lions Gate to give him shows that he felt

didn't fit on the network, people close to the company said.

Messrs. Feltheimer and Burns at times expressed frustration that in

their view Mr. Albrecht wasn't a team player and didn't spend

enough time focused on day-to-day operations, these people said.

Mr. Albrecht, who led Starz before it was acquired, would complain

that Lions Gate's declining share price was costing him personally,

some of the people said.

"I think we had some different ideas about how to run

things...and a bit less cooperation than I wanted," Mr. Feltheimer

said.

In February, Mr. Albrecht resigned at the urging of Mr.

Feltheimer, according to people familiar with the matter. Now, the

two companies are "working really closely," Mr. Feltheimer

said.

"I think it is fair to say I saw the next phase of evolution of

the company being more Starz-centric while being laser focused

about restoring and creating value for our shareholders," Mr.

Albrecht said in a statement.

Despite the friction, Starz has performed well financially, with

revenue increasing 4% to $366.8 million and profits up nearly 10%

to $134.1 million in the fiscal third quarter ended Dec. 31. It

added just over one million subscribers in 2018.

Competition from coming video services from Disney, AT&T

Inc.'s WarnerMedia and Apple Inc. could threaten Starz's growth.

Mr. Burns said technology companies also offer opportunities,

noting that Apple will be selling Starz subscriptions on its TV

service.

Lions Gate's movie business, meanwhile, has lost ground since

"The Hunger Games" series ended in 2015. Its attempts to create or

revive major film franchises have fizzled, including "Divergent,"

"Gods of Egypt," "Robin Hood" and this month's "Hellboy." The lone

exception has been the "John Wick" action movies, starring Keanu

Reeves. Also, filmmaker Tyler Perry recently released what he said

would be the final film in his successful "Madea" series, which

have been major moneymakers for Lions Gate.

Many of the company's top motion-picture executives have left in

the past 18 month, and new production starts have slowed. As a

result, Lions Gate is relying more on movies it acquires or

releases for partners. The company has recently finished assembling

a new senior team and is ramping production back up. Typically,

studios make more money from movies they produce themselves than

those they acquire from third parties.

Lions Gate faces a major challenge called "Chaos Walking." The

first of several planned adaptations of a series of young-adult

science fiction novels cost around $100 million to produce but

turned out so poorly it was deemed unreleasable by executives who

watched initial cuts last year, according to current and former

employees.

Lions Gate delayed the film's planned March release and is about

to begin three weeks of additional production, at a cost of

millions more, in the hope that new scenes will improve its

commercial prospects.

"We wouldn't be shooting more if we didn't think we could make

this movie work," said Mr. Feltheimer.

--Shalini Ramachandran contributed to this article.

Write to Joe Flint at joe.flint@wsj.com and Ben Fritz at

ben.fritz@wsj.com

(END) Dow Jones Newswires

April 21, 2019 11:14 ET (15:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

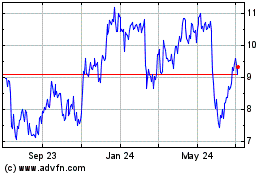

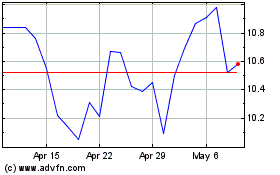

Lions Gate Entertainment (NYSE:LGF.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lions Gate Entertainment (NYSE:LGF.A)

Historical Stock Chart

From Apr 2023 to Apr 2024