L Brands Seeks Fix For Victoria's Secret -- WSJ

November 20 2018 - 3:02AM

Dow Jones News

By Khadeeja Safdar and Maria Armental

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 20, 2018).

L Brands Inc., trying to revamp business at its flagship

Victoria's Secret chain, on Monday said it is halving its annual

dividend and hiring a Tory Burch executive to lead the lingerie

division.

The retailer, which is on track to report its third consecutive

annual profit decline, said it plans to cut its annual payout to

$1.20 a share, starting with the March payout. The move will save

about $325 million in cash.

The company said John Mehas will be joining Victoria's Secret

early next year to succeed Jan Singer, who resigned last week. Mr.

Mehas currently serves as president of Tory Burch and previously

led Club Monaco.

In an earnings commentary, the company attributed the weak

performance at Victoria's Secret to a "poor assortment" and at its

PINK brand to "fashion errors in loungewear." Customers are

responding better to new bras and sleepwear at Victoria's Secret,

the company said.

Comparable sales at Victoria's Secret, which include digital and

same-store sales, fell 2% in the third quarter. Still, that was

better than analysts' projected 2.3% decline, according to FactSet

data.

The unit accounted for $1.53 billion of L Brands's total

quarterly sales of $2.77 billion. Much of the rest comes from Bath

& Body Works, whose sales have fared better. In the third

quarter, Bath & Body Works comparable sales rose 13% from a

year ago.

For 2018, the company said square footage at Victoria's Secret

in North America will decline about 1% and increase about 3% at

Bath & Body Works, yielding a total company increase of about

1%.

Victoria's Secret has generated years of growth with images of

busty supermodels and padded bras retailing at prices topping $50,

but new competitors have moved into the category with alternative

styles and messages. Many of them are gaining traction by

emphasizing more sizing options and advertising that includes

different body types.

L Brands's founder, longtime chairman and chief executive,

Leslie Wexner, took charge of Victoria's Secret more than two years

ago and made big moves. He changed leadership, shifted away from

catalog mailings, exited the swimsuit business and doubled down on

sports bras to address the rise of the so-called athleisure

trend.

Despite the changes, Victoria's Secret remains married to its

traditional sex-infused marketing and continues to emphasize its

store fleet, largely in malls across the country. In an interview

last year with The Wall Street Journal, Mr. Wexner defended his

focus on malls.

Since Victoria's Secret has continued to struggle, Mr. Wexner

has been pruning his portfolio of brands, announcing plans to close

the Henri Bendel handbag business after the holidays and explore

strategic alternatives for intimate-apparel chain La Senza.

Overall, for the 13 weeks ended Nov. 3, L Brands reported a loss

of $42.8 million, or 16 cents a share, compared with a year earlier

profit of $86 million, or 30 cents a share.

The company took an $80.9 million charge related to the

impairment of some Victoria Secrets stores and a $20.3 million

charge related to Henri Bendel's closing. Excluding these items, L

Brands said it had an adjusted profit of 16 cents a share.

Write to Khadeeja Safdar at khadeeja.safdar@wsj.com and Maria

Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

November 20, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

L Brands (NYSE:LB)

Historical Stock Chart

From Mar 2024 to Apr 2024

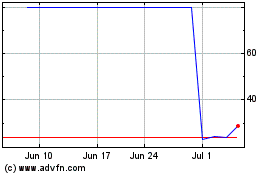

L Brands (NYSE:LB)

Historical Stock Chart

From Apr 2023 to Apr 2024