Kite Realty Group Trust (NYSE:KRG) (“KRG”) reported today its

operating results for the third quarter ended September 30, 2019.

“As previously announced, we have

completed our Project Focus disposition program. We now have a

top-tier balance sheet to complement a high-quality portfolio

concentrated in the southern U.S.,” said John A. Kite, Chairman and

CEO. “Additionally, our operations team continued to deliver

strong results, leasing another 562,000 square feet this quarter

and raising our portfolio leased rate to 95.4%. We look

forward to a strong finish in 2019 and continued momentum into

2020.”

Financial Results

- Realized net loss attributable to common shareholders of $19.7

million, or $0.24 per common share, for the third quarter and $15.8

million, or $0.19 per common share, for the nine months ending

September 30, 2019.

- Generated Funds from Operations of the Operating Partnership as

adjusted (FFO) of $33.3 million, or $0.39 per diluted common share,

for the third quarter and $108.3 million, or $1.26 per diluted

common share, for the nine months ending September 30, 2019.

- Increased Same-Property Net Operating Income (NOI) by

2.3%. Year-to-date Same-Property NOI grew by 2.0%.

Portfolio Operations

- Annualized base rent (ABR) for the operating retail portfolio

was $17.64, an increase of $0.87 year-over-year.

- Retail leased percentage was 95.4%, an increase of 190 basis

points year-over-year.

- Small shop leased percentage was 92.0%, an increase of 110

basis points year-over-year.

- Executed 70 new and renewal leases during the third quarter,

representing a total of 562,200 square feet.

- GAAP leasing spreads of 42.4% (24.3% cash basis) on 10

comparable new leases, 9.5% (6.3% cash basis) on 44 comparable

renewals, and 12.3% (7.9% cash basis) on a blended basis.

- Executed 246 new and renewal leases for over 1.7 million square

feet through September 30, 2019.

Transaction Highlights

- Sold 8 non-core assets for a total of $213 million during the

third quarter.

- Acquired Nora Plaza, a 140,000 sf community center anchored by

Whole Foods and a non-owned Target in Indianapolis, IN for a

purchase price of $29.0 million.

- Subsequent to quarter end, sold an additional 3 non-core assets

for $31.6 million.

- Total non-core asset sales year-to-date of $502 million at a

blended cap rate of approximately 8%. The weighted average

sale date for sold assets was June 2019.

Balance SheetAs of September

30, 2019, KRG’s net-debt-to-EBITDA ratio was 6.0x. Following

the asset sales and corresponding debt paydown subsequent to

quarter end, KRG’s proforma net-debt-to-EBITDA is 5.9x. KRG

has limited debt maturing through 2021 and zero drawn on its line

of credit.

GuidanceKRG is raising 2019

same property NOI growth guidance from 1.50% - 2.50% to 2.00% -

2.50% and narrowing 2019 FFO guidance from $1.61 - $1.69 per share

to $1.63 - $1.67 per share.

| |

|

2019 Earnings Guidance1 |

| |

|

Low |

|

High |

|

Net Income Guidance |

|

$ |

(0.16 |

) |

|

$ |

(0.12 |

) |

| Add: Impairment Charges |

|

0.43 |

|

|

0.43 |

|

| Add: Depreciation and

Amortization |

|

1.54 |

|

|

1.54 |

|

| Add: Loss on Debt

Extinguishment |

|

0.11 |

|

|

0.11 |

|

| Less: Gain on Sales of

Operating Properties, net |

|

(0.29 |

) |

|

(0.29 |

) |

| 2019 FFO, as Adjusted,

Guidance |

|

$ |

1.63 |

|

|

$ |

1.67 |

|

|

|

|

Previous |

|

Current |

|

Change at Midpoint |

|

| SP NOI Growth |

|

1.50% - 2.50% |

|

2.00% - 2.50% |

|

0.25% |

|

| 2019 Project Focus

Dispositions |

|

$415M - $500M |

|

$502M |

|

$44M |

|

| 2019 FFO

Guidance |

|

$1.61 - $1.69 |

|

$1.63 - $1.67 |

|

— |

|

|

_________ |

|

1 |

The Company’s 2019 guidance is based on a number of factors, many

of which are outside the Company’s control and all of which are

subject to change. The Company may change its guidance during

the year if actual or anticipated results vary from these

assumptions, although the Company undertakes no obligation to do

so. |

Earnings Conference CallKite

Realty Group Trust will conduct a conference call to discuss its

financial results on Wednesday, November 6, 2019, at 10:00 a.m.

Eastern Time. A live webcast of the conference call will be

available on KRG’s corporate website at www.kiterealty.com. The

dial-in numbers are (844) 309-0605 for domestic callers and (574)

990-9933 for international callers (passcode 8392857). In

addition, a webcast replay link will be available on the corporate

website.

About Kite Realty Group

TrustKite Realty Group Trust is a full-service, vertically

integrated real estate investment trust (REIT) that provides

communities with convenient and beneficial shopping experiences. We

connect consumers to retailers in desirable markets through our

portfolio of neighborhood, community, and lifestyle centers. Using

operational, development, and redevelopment expertise, we

continuously optimize our portfolio to maximize value and return to

our shareholders. For more information, please visit our website at

kiterealty.com.

Safe HarborCertain statements

in this document that are not historical fact may constitute

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. Such statements are based on assumptions and

expectations that may not be realized and are inherently subject to

risks, uncertainties and other factors, many of which cannot be

predicted with accuracy and some of which might not even be

anticipated. Future events and actual results, performance,

transactions or achievements, financial or otherwise, may differ

materially from the results, performance, transactions or

achievements, financial or otherwise, expressed or implied by the

forward-looking statements. Risks, uncertainties and other factors

that might cause such differences, some of which could be material,

include, but are not limited to: national and local economic,

business, real estate and other market conditions, particularly in

light of low growth in the U.S. economy as well as economic

uncertainty caused by fluctuations in the prices of oil and other

energy sources and inflationary trends or outlook; the risk that

KRG may not be able to successfully complete the planned

dispositions on favorable terms – or at all; financing risks,

including the availability of, and costs associated with, sources

of liquidity; KRG’s ability to refinance, or extend the maturity

dates of, its indebtedness; the level and volatility of interest

rates; the financial stability of tenants, including their ability

to pay rent and the risk of tenant bankruptcies; the competitive

environment in which KRG operates; acquisition, disposition,

development and joint venture risks; property ownership and

management risks; KRG’s ability to maintain its status as a real

estate investment trust for federal income tax purposes; potential

environmental and other liabilities; impairment in the value of

real estate property KRG owns; the impact of online retail

competition and the perception that such competition has on the

value of shopping center assets; risks related to the geographical

concentration of KRG’s properties in Florida, Indiana and Texas;

insurance costs and coverage; risks associated with cybersecurity

attacks and the loss of confidential information and other business

interruptions; and other factors affecting the real estate industry

generally. KRG refers you to the documents filed by KRG from time

to time with the SEC, specifically the section titled “Risk

Factors” in KRG’s and the Operating Partnership’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2018, which

discuss these and other factors that could adversely affect KRG’s

results. KRG undertakes no obligation to publicly update or revise

these forward-looking statements, whether as a result of new

information, future events or otherwise.

| |

|

Kite Realty Group TrustConsolidated

Balance Sheets(Unaudited) |

| |

| ($ in

thousands) |

|

|

|

|

| |

|

September 30, 2019 |

|

December 31, 2018 |

| Assets: |

|

|

|

|

|

Investment properties, at cost |

|

$ |

3,153,436 |

|

|

$ |

3,641,120 |

|

|

Less: accumulated depreciation |

|

(666,291 |

) |

|

(699,927 |

) |

| |

|

2,487,145 |

|

|

2,941,193 |

|

| |

|

|

|

|

| Cash and cash equivalents |

|

40,442 |

|

|

35,376 |

|

| Tenant and other receivables,

including accrued straight-line rent of $27,487 and $31,347,

respectively |

|

50,017 |

|

|

58,059 |

|

| Restricted cash and escrow

deposits |

|

9,548 |

|

|

10,130 |

|

| Deferred costs and

intangibles, net |

|

76,739 |

|

|

95,264 |

|

| Prepaid and other assets |

|

37,121 |

|

|

12,764 |

|

| Investments in unconsolidated

subsidiaries |

|

12,868 |

|

|

13,496 |

|

| Assets held for sale |

|

— |

|

|

5,731 |

|

| Total

Assets |

|

$ |

2,713,880 |

|

|

$ |

3,172,013 |

|

| Liabilities and

Shareholders’ Equity: |

|

|

|

|

| Mortgage and other

indebtedness, net |

|

$ |

1,198,584 |

|

|

$ |

1,543,301 |

|

| Accounts payable and accrued

expenses |

|

77,492 |

|

|

85,934 |

|

| Deferred revenue and other

liabilities |

|

89,556 |

|

|

83,632 |

|

| Total

Liabilities |

|

1,365,632 |

|

|

1,712,867 |

|

| Commitments and

contingencies |

|

|

|

|

| Limited Partners’ interests in

the Operating Partnership and other redeemable noncontrolling

interests |

|

45,383 |

|

|

45,743 |

|

| Shareholders’

Equity: |

|

|

|

|

|

Kite Realty Group Trust Shareholders’ Equity: |

|

|

|

|

|

Common Shares, $.01 par value, 225,000,000 shares authorized,

83,963,983 and 83,800,886 shares issued and outstanding at

September 30, 2019 and December 31, 2018, respectively |

|

840 |

|

|

838 |

|

|

Additional paid in capital |

|

2,080,094 |

|

|

2,078,099 |

|

|

Accumulated other comprehensive loss |

|

(20,209 |

) |

|

(3,497 |

) |

|

Accumulated deficit |

|

(758,558 |

) |

|

(662,735 |

) |

|

Total Kite Realty Group Trust Shareholders’

Equity |

|

1,302,167 |

|

|

1,412,705 |

|

| Noncontrolling Interests |

|

698 |

|

|

698 |

|

| Total

Equity |

|

1,302,865 |

|

|

1,413,403 |

|

| Total Liabilities and

Shareholders' Equity |

|

$ |

2,713,880 |

|

|

$ |

3,172,013 |

|

| |

| |

|

Kite Realty Group TrustConsolidated

Statements of OperationsFor the Three and Nine

Months Ended September 30, 2019 and

2018(Unaudited) |

| |

| ($ in thousands,

except per share data) |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

| Revenue: |

|

|

|

|

|

|

|

|

|

Rental income |

|

$ |

72,573 |

|

|

$ |

83,513 |

|

|

$ |

234,726 |

|

|

$ |

256,696 |

|

|

Other property related revenue |

|

2,260 |

|

|

2,129 |

|

|

4,910 |

|

|

8,119 |

|

|

Fee income |

|

110 |

|

|

105 |

|

|

304 |

|

|

2,430 |

|

| Total

revenue |

|

74,943 |

|

|

85,747 |

|

|

239,940 |

|

|

267,245 |

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

Property operating |

|

11,041 |

|

|

12,092 |

|

|

33,939 |

|

|

37,184 |

|

|

Real estate taxes |

|

9,640 |

|

|

11,205 |

|

|

29,775 |

|

|

32,351 |

|

|

General, administrative, and other |

|

6,709 |

|

|

4,865 |

|

|

20,523 |

|

|

16,364 |

|

|

Depreciation and amortization |

|

31,985 |

|

|

36,858 |

|

|

101,333 |

|

|

115,864 |

|

|

Impairment charges |

|

8,538 |

|

|

— |

|

|

37,723 |

|

|

38,847 |

|

| Total

expenses |

|

67,913 |

|

|

65,020 |

|

|

223,293 |

|

|

240,610 |

|

| (Loss) gain on sale of

operating properties, net |

|

(5,714 |

) |

|

— |

|

|

24,965 |

|

|

8,329 |

|

| Operating

income |

|

1,316 |

|

|

20,727 |

|

|

41,612 |

|

|

34,964 |

|

|

Interest expense |

|

(14,302 |

) |

|

(16,058 |

) |

|

(46,884 |

) |

|

(49,141 |

) |

|

Income tax benefit of taxable REIT subsidiary |

|

41 |

|

|

27 |

|

|

189 |

|

|

78 |

|

|

Loss on debt extinguishment |

|

(7,045 |

) |

|

— |

|

|

(9,622 |

) |

|

— |

|

|

Equity in loss of unconsolidated subsidiary |

|

(11 |

) |

|

— |

|

|

(677 |

) |

|

— |

|

|

Other expense, net |

|

(116 |

) |

|

(379 |

) |

|

(444 |

) |

|

(643 |

) |

| Net (loss)

income |

|

(20,117 |

) |

|

4,317 |

|

|

(15,826 |

) |

|

(14,742 |

) |

|

Net loss (income) attributable to noncontrolling interests |

|

382 |

|

|

(379 |

) |

|

10 |

|

|

(604 |

) |

| Net (loss) income

attributable to Kite Realty Group Trust common

shareholders |

|

$ |

(19,735 |

) |

|

$ |

3,938 |

|

|

$ |

(15,816 |

) |

|

$ |

(15,346 |

) |

| |

|

|

|

|

|

|

|

|

| (Loss) income per

common share - basic and diluted |

|

$ |

(0.24 |

) |

|

$ |

0.05 |

|

|

(0.19 |

) |

|

(0.18 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average common shares

outstanding - basic |

|

83,960,841 |

|

|

83,706,704 |

|

|

83,914,923 |

|

|

83,670,038 |

|

| Weighted average common shares

outstanding - diluted |

|

83,960,841 |

|

|

83,767,655 |

|

|

83,914,923 |

|

|

83,670,038 |

|

| Cash dividends

declared per common share |

|

$ |

0.3175 |

|

|

$ |

0.3175 |

|

|

$ |

0.9525 |

|

|

$ |

0.9525 |

|

| |

|

|

|

|

|

|

|

|

| |

|

Kite Realty Group TrustFunds From

OperationsFor the Three and Nine Months Ended

September 30, 2019 and

2018(Unaudited) |

| |

| ($ in thousands,

except per share data) |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

| Funds From

Operations |

|

|

|

|

|

|

|

|

|

Consolidated net (loss) income |

|

$ |

(20,117 |

) |

|

$ |

4,317 |

|

|

$ |

(15,826 |

) |

|

$ |

(14,742 |

) |

| Less: net income attributable

to noncontrolling interests in properties |

|

(132 |

) |

|

(285 |

) |

|

(396 |

) |

|

(979 |

) |

| Less: loss (gain) on sales of

operating properties |

|

5,714 |

|

|

— |

|

|

(24,965 |

) |

|

(8,329 |

) |

| Add: impairment charges |

|

8,538 |

|

|

— |

|

|

37,723 |

|

|

38,847 |

|

| Add: depreciation and

amortization of consolidated and unconsolidated entities, net of

noncontrolling interests |

|

32,266 |

|

|

37,045 |

|

|

102,119 |

|

|

115,501 |

|

| FFO of the

Operating Partnership1 |

|

26,269 |

|

|

41,077 |

|

|

98,655 |

|

|

130,298 |

|

| Less: Limited Partners'

interests in FFO |

|

(627 |

) |

|

(986 |

) |

|

(2,365 |

) |

|

(3,127 |

) |

| FFO attributable to

Kite Realty Group Trust common shareholders1 |

|

$ |

25,642 |

|

|

$ |

40,091 |

|

|

$ |

96,290 |

|

|

$ |

127,171 |

|

| FFO, as defined by

NAREIT, per share of the Operating Partnership -

basic |

|

$ |

0.31 |

|

|

$ |

0.48 |

|

|

$ |

1.15 |

|

|

$ |

1.52 |

|

| FFO, as defined by

NAREIT, per share of the Operating Partnership -

diluted |

|

$ |

0.30 |

|

|

$ |

0.48 |

|

|

$ |

1.15 |

|

|

$ |

1.52 |

|

| |

|

|

|

|

|

|

|

|

| FFO of the Operating

Partnership1 |

|

$ |

26,269 |

|

|

$ |

41,077 |

|

|

$ |

98,655 |

|

|

$ |

130,298 |

|

| Add: loss on debt

extinguishment |

|

7,045 |

|

|

— |

|

|

9,622 |

|

|

— |

|

| FFO, as adjusted, of

the Operating Partnership |

|

$ |

33,314 |

|

|

$ |

41,077 |

|

|

$ |

108,277 |

|

|

$ |

130,298 |

|

| FFO, as adjusted, per

share of the Operating Partnership - basic and

diluted |

|

$ |

0.39 |

|

|

$ |

0.48 |

|

|

$ |

1.26 |

|

|

$ |

1.52 |

|

| |

|

|

|

|

|

|

|

|

| Weighted average common shares

outstanding - basic |

|

83,960,841 |

|

|

83,706,704 |

|

|

83,914,923 |

|

|

83,670,038 |

|

| Weighted average common shares

outstanding - diluted |

|

84,107,482 |

|

|

83,767,655 |

|

|

84,057,484 |

|

|

83,719,308 |

|

| Weighted average common shares

and units outstanding - basic |

|

86,073,433 |

|

|

85,768,857 |

|

|

86,013,028 |

|

|

85,717,440 |

|

| Weighted average common shares

and units outstanding - diluted |

|

86,220,075 |

|

|

85,829,808 |

|

|

86,155,588 |

|

|

85,766,710 |

|

| |

|

|

|

|

|

|

|

|

| FFO, as defined by NAREIT, per

diluted share/unit |

|

|

|

|

|

|

|

|

| Consolidated net (loss)

income |

|

$ |

(0.23 |

) |

|

$ |

0.05 |

|

|

$ |

(0.18 |

) |

|

$ |

(0.17 |

) |

| Less: net income attributable

to noncontrolling interests in properties |

|

— |

|

|

— |

|

|

— |

|

|

(0.01 |

) |

| Less: Loss (gain) on sales of

operating properties |

|

0.07 |

|

|

— |

|

|

(0.29 |

) |

|

(0.10 |

) |

| Add: impairment charges |

|

0.10 |

|

|

— |

|

|

0.44 |

|

|

0.45 |

|

| Add: depreciation and

amortization of consolidated and unconsolidated entities, net of

noncontrolling interests |

|

0.37 |

|

|

0.43 |

|

|

1.18 |

|

|

1.35 |

|

| FFO, as defined by

NAREIT, of the Operating Partnership per diluted

share/unit1 |

|

$ |

0.31 |

|

|

$ |

0.48 |

|

|

$ |

1.15 |

|

|

$ |

1.52 |

|

| |

|

|

|

|

|

|

|

|

| Add: loss on debt

extinguishment |

|

0.08 |

|

|

— |

|

|

0.11 |

|

|

— |

|

| FFO, as adjusted, of

the Operating Partnership per diluted share/unit |

|

$ |

0.39 |

|

|

$ |

0.48 |

|

|

$ |

1.26 |

|

|

$ |

1.52 |

|

|

____________________ |

| 1 |

“FFO of the

Operating Partnership" measures 100% of the operating performance

of the Operating Partnership’s real estate properties. “FFO

attributable to Kite Realty Group Trust common shareholders”

reflects a reduction for the redeemable noncontrolling weighted

average diluted interest in the Operating Partnership. |

| |

|

Funds from Operations (FFO) is a widely used performance measure

for real estate companies and is provided here as a supplemental

measure of operating performance. The Company calculates FFO, a

non-GAAP financial measure, in accordance with the best practices

described in the April 2002 National Policy Bulletin of the

National Association of Real Estate Investment Trusts ("NAREIT"),

as restated in 2018. The NAREIT white paper defines FFO as net

income (calculated in accordance with GAAP), excluding depreciation

and amortization related to real estate, gains and losses from the

sale of certain real estate assets, gains and losses from change in

control, and impairment write-downs of certain real estate assets

and investments, and after adjustments for unconsolidated

partnerships and joint ventures.

Considering the nature of our business as a real estate owner

and operator, the Company believes that FFO is helpful to investors

in measuring our operational performance because it excludes

various items included in net income that do not relate to or are

not indicative of our operating performance, such as gains or

losses from sales of depreciated property and depreciation and

amortization, which can make periodic and peer analyses of

operating performance more difficult. FFO (a) should not be

considered as an alternative to net income (calculated in

accordance with GAAP) for the purpose of measuring our financial

performance, (b) is not an alternative to cash flow from operating

activities (calculated in accordance with GAAP) as a measure of our

liquidity, and (c) is not indicative of funds available to satisfy

our cash needs, including our ability to make distributions. Our

computation of FFO may not be comparable to FFO reported by other

REITs that do not define the term in accordance with the current

NAREIT definition or that interpret the current NAREIT definition

differently than we do. For informational purposes, we have

also provided FFO adjusted for loss on debt extinguishment.

| |

|

Kite Realty Group TrustSame Property Net

Operating IncomeFor the Three and Nine Months

Ended September 30, 2019 and

2018(Unaudited) |

| |

| ($ in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2019 |

|

2018 |

|

% Change |

|

2019 |

|

2018 |

|

% Change |

| Number of properties for the

quarter1 |

86 |

|

|

86 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Leased percentage at

period end |

95.3 |

% |

|

93.9 |

% |

|

|

|

95.3 |

% |

|

93.9 |

% |

|

|

| Economic Occupancy

percentage2 |

92.2 |

% |

|

92.0 |

% |

|

|

|

92.3 |

% |

|

92.7 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Minimum rent |

$ |

51,206 |

|

|

$ |

50,374 |

|

|

|

|

$ |

161,900 |

|

|

$ |

160,181 |

|

|

|

| Tenant recoveries |

15,505 |

|

|

15,270 |

|

|

|

|

47,312 |

|

|

46,444 |

|

|

|

| Bad debt |

(569 |

) |

|

(395 |

) |

|

|

|

(1,555 |

) |

|

(1,261 |

) |

|

|

| Other income |

341 |

|

|

395 |

|

|

|

|

1,088 |

|

|

947 |

|

|

|

| |

66,483 |

|

|

65,644 |

|

|

|

|

208,745 |

|

|

206,311 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Property operating

expenses |

(8,635 |

) |

|

(8,436 |

) |

|

|

|

(25,963 |

) |

|

(26,306 |

) |

|

|

| Real estate taxes |

(8,800 |

) |

|

(9,276 |

) |

|

|

|

(27,281 |

) |

|

(27,479 |

) |

|

|

| |

(17,435 |

) |

|

(17,712 |

) |

|

|

|

(53,244 |

) |

|

(53,785 |

) |

|

|

|

Same Property NOI3 |

$ |

49,048 |

|

|

$ |

47,932 |

|

|

2.3 |

% |

|

$ |

155,501 |

|

|

$ |

152,526 |

|

|

2.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Same

Property NOI to Most Directly Comparable GAAP Measure: |

|

|

|

|

|

|

|

|

|

|

|

| Net operating income - same

properties |

$ |

49,048 |

|

|

$ |

47,932 |

|

|

|

|

$ |

155,501 |

|

|

$ |

152,526 |

|

|

|

| Net operating income -

non-same activity4 |

5,104 |

|

|

14,413 |

|

|

|

|

20,420 |

|

|

42,754 |

|

|

|

| Other income (expense),

net |

24 |

|

|

(247 |

) |

|

|

|

(627 |

) |

|

1,865 |

|

|

|

| General, administrative and

other |

(6,709 |

) |

|

(4,865 |

) |

|

|

|

(20,523 |

) |

|

(16,364 |

) |

|

|

| Loss on debt

extinguishment |

(7,045 |

) |

|

— |

|

|

|

|

(9,622 |

) |

|

— |

|

|

|

| Impairment charges |

(8,538 |

) |

|

— |

|

|

|

|

(37,723 |

) |

|

(38,847 |

) |

|

|

| Depreciation and amortization

expense |

(31,985 |

) |

|

(36,858 |

) |

|

|

|

(101,333 |

) |

|

(115,864 |

) |

|

|

| Interest expense |

(14,302 |

) |

|

(16,058 |

) |

|

|

|

(46,884 |

) |

|

(49,141 |

) |

|

|

| (Loss) gain on sales of

operating properties |

(5,714 |

) |

|

— |

|

|

|

|

24,965 |

|

|

8,329 |

|

|

|

| Net loss (income) attributable

to noncontrolling interests |

382 |

|

|

(379 |

) |

|

|

|

10 |

|

|

(604 |

) |

|

|

| Net (loss) income attributable

to common shareholders |

$ |

(19,735 |

) |

|

$ |

3,938 |

|

|

|

|

$ |

(15,816 |

) |

|

$ |

(15,346 |

) |

|

|

| 1 |

Same Property NOI

excludes (i) The Corner, Courthouse Shadows, Glendale Town Center,

and Hamilton Crossing redevelopments, (ii) the recently completed

Fishers Station and Rampart Commons redevelopments, (iii) the

recently acquired Nora Plaza, and (iv) office properties. |

| 2 |

Excludes leases

that are signed but for which tenants have not yet commenced the

payment of cash rent. Calculated as a weighted average based

on the timing of cash rent commencement and expiration during the

period. |

| 3 |

Same Property NOI

excludes net gains from outlot sales, straight-line rent revenue,

lease termination fees, amortization of lease intangibles, fee

income and significant prior period expense recoveries and

adjustments, if any. |

| 4 |

Includes non-cash

activity across the portfolio as well as net operating income from

properties not included in the same property pool including

properties sold during both periods. |

| |

|

The Company uses same property NOI ("Same Property NOI"), a

non-GAAP financial measure, to evaluate the performance of our

properties. Same Property NOI excludes properties that have not

been owned for the full period presented. It also excludes net

gains from outlot sales, straight-line rent revenue, lease

termination fees, amortization of lease intangibles and significant

prior period expense recoveries and adjustments, if any. The

Company believes that Same Property NOI is helpful to investors as

a measure of our operating performance because it includes only the

NOI of properties that have been owned and fully operational for

the full quarters presented. The Company believes such

presentation eliminates disparities in net income due to the

acquisition or disposition of properties during the particular

quarters presented and thus provides a more consistent comparison

of our properties. The year-to-date results represent the sum of

the individual quarters, as reported.

NOI and Same Property NOI should not, however, be considered as

alternatives to net income (calculated in accordance with GAAP) as

indicators of our financial performance. Our computation of NOI and

Same Property NOI may differ from the methodology used by other

REITs, and therefore may not be comparable to such other REITs.

When evaluating the properties that are included in the same

property pool, the Company has established specific criteria for

determining the inclusion of properties acquired or those recently

under development. An acquired property is included in the same

property pool when there is a full quarter of operations in both

years subsequent to the acquisition date. Development and

redevelopment properties are included in the same property pool

four full quarters after the properties have been transferred to

the operating portfolio. A redevelopment property is first excluded

from the same property pool when the execution of a redevelopment

plan is likely and the Company begins recapturing space from

tenants. For the quarter ended September 30, 2019, the Company

excluded four redevelopment properties and two recently completed

redevelopments from the same property pool that met these criteria

and were owned in both comparable periods. In addition, the

Company excluded one recently acquired property from the same

property pool.

| |

|

Kite Realty Group TrustEarnings Before

Interest, Tax, Depreciation, and AmortizationFor

the Three Months Ended September 30,

2019(Unaudited) |

| |

| ($ in

thousands) |

|

|

| |

|

Three Months Ended September 30, 2019 or

Pro-Forma where Indicated |

|

Consolidated net loss |

|

$ |

(20,117 |

) |

| Adjustments to net

income |

|

|

| Depreciation and

amortization |

|

31,985 |

|

| Interest expense |

|

14,302 |

|

| Income tax benefit of taxable

REIT subsidiary |

|

(41 |

) |

| Earnings Before

Interest, Taxes, Depreciation and Amortization

(EBITDA) |

|

26,129 |

|

| Adjustments to EBITDA: |

|

|

| Unconsolidated EBITDA |

|

726 |

|

| Impairment charge |

|

8,538 |

|

| Loss on sale of operating

properties |

|

5,714 |

|

| Pro-forma adjustments3 |

|

(260 |

) |

| Loss on debt

extinguishment |

|

7,045 |

|

| Other income and expense,

net |

|

127 |

|

| Noncontrolling interest |

|

(132 |

) |

| Adjusted

EBITDA |

|

47,887 |

|

| |

|

|

| Annualized Adjusted

EBITDA1 |

|

191,548 |

|

| EBITDA for properties sold

subsequent to September 30, 2019 |

|

(2,220 |

) |

| Pro-forma Annualized

Adjusted EBITDA |

|

$ |

189,328 |

|

| |

|

|

| Company Share of Net

Debt: |

|

|

| Mortgage and other

indebtedness |

|

$ |

1,198,584 |

|

| Plus: Company Share of

Unconsolidated Joint Venture Debt |

|

22,148 |

|

| Plus: Net debt premiums and

issuance costs, net |

|

6,970 |

|

| Less: Partner share of

consolidated joint venture debt2 |

|

(1,120 |

) |

| Less: Cash, cash equivalents,

and restricted cash |

|

(51,003 |

) |

| Less: Pro-forma adjustment

4 |

|

(27,200 |

) |

| Company Share of Net Debt |

|

$ |

1,148,379 |

|

| Net Debt to Adjusted

EBITDA |

|

6.0x |

|

| |

|

|

| |

|

|

| |

|

|

| Proceeds from the sale of

properties subsequent to September 30, 2019 |

|

(31,600 |

) |

| Pro-forma Company Share of Net

Debt |

|

1,116,779 |

|

| Pro-forma Net Debt to

Adjusted EBITDA |

|

5.9x |

|

| 1 |

Represents Adjusted EBITDA for the three months ended September 30,

2019 (as shown in the table above) multiplied by four. |

| 2 |

Partner share of consolidated joint venture debt is calculated

based upon the partner's pro-rata ownership of the joint venture,

multiplied by the related secured debt balance. In all cases, this

debt is the responsibility of the consolidated joint venture. |

| 3 |

Relates to annualized EBITDA for properties sold and acquired

during the quarter and non-recurring non-cash adjustments. |

| 4 |

Relates to timing of quarterly dividend payment being made prior to

quarter-end resulting in four payments year to date. |

| |

|

The Company defines EBITDA, a non-GAAP financial measure, as net

income before depreciation and amortization, interest expense and

income tax expense of taxable REIT subsidiary. For informational

purposes, the Company has also provided Adjusted EBITDA, which the

Company defines as EBITDA less (i) EBITDA from unconsolidated

entities, (ii) gains on sales of operating properties or impairment

charges, (iii) other income and expense, (iv) noncontrolling

interest EBITDA and (v) other non-recurring activity or items

impacting comparability from period to period. Annualized

Adjusted EBITDA is Adjusted EBITDA for the most recent quarter

multiplied by four. Net Debt to Adjusted EBITDA is the Company's

share of net debt divided by Annualized Adjusted EBITDA. EBITDA,

Adjusted EBITDA, Annualized Adjusted EBITDA and Net Debt to

Adjusted EBITDA, as calculated by us, are not comparable to EBITDA

and EBITDA-related measures reported by other REITs that do not

define EBITDA and EBITDA-related measures exactly as we do. EBITDA,

Adjusted EBITDA and Annualized Adjusted EBITDA do not represent

cash generated from operating activities in accordance with GAAP,

and should not be considered alternatives to net income as an

indicator of performance or as alternatives to cash flows from

operating activities as an indicator of liquidity.

Considering the nature of our business as a real estate owner

and operator, the Company believes that EBITDA, Adjusted EBITDA and

the ratio of Net Debt to Adjusted EBITDA are helpful to investors

in measuring our operational performance because they exclude

various items included in net income that do not relate to or are

not indicative of our operating performance, such as gains or

losses from sales of depreciated property and depreciation and

amortization, which can make periodic and peer analyses of

operating performance more difficult. For informational purposes,

the Company has also provided Annualized Adjusted EBITDA, adjusted

as described above. The Company believes this supplemental

information provides a meaningful measure of our operating

performance. The Company believes presenting EBITDA and the related

measures in this manner allows investors and other interested

parties to form a more meaningful assessment of our operating

results.

Contact Information: Kite Realty Group TrustJason ColtonSVP,

Capital Markets & Investor

Relations317.713.2762jcolton@kiterealty.com

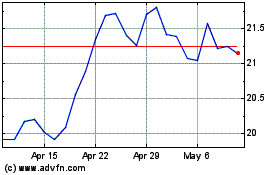

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

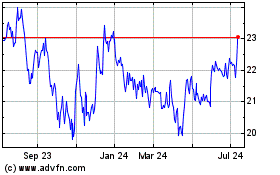

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Apr 2023 to Apr 2024