Kilroy Realty Corporation (NYSE: KRC) today reported

financial results for its first quarter ended March 31,

2019.

First Quarter Highlights

Financial Results

- Net income available to common

stockholders per share of $0.36

- Funds from operations available to

common stockholders and unitholders (“FFO”) per share of $0.95

- FFO for the first quarter 2019 included

a positive $0.03 per share impact related to the improved credit

quality of a tenant for which the company recorded a bad debt

reserve in 2018

- The adoption of the new lease

accounting standard requires expensing of internal leasing costs

and third-party legal fees which had the impact of lowering first

quarter FFO by $0.02 per share when compared to what the results

would have been under the prior standard

- Revenues of $201.2 million

Stabilized Portfolio

- Stabilized portfolio was 92.5% occupied

and 96.2% leased at March 31, 2019

- Signed approximately 203,000 square

feet of new or renewing leases

Development

- In March, commenced construction on

Phase I of Kilroy Oyster Point in South San Francisco and 9455

Towne Centre Drive in the University Towne Center submarket of San

Diego

- Phase I of Kilroy Oyster Point

encompasses approximately 630,000 square feet of office and lab

space and represents a total estimated investment of $600.0

million

- 9455 Towne Centre Drive encompasses

approximately 160,000 square feet of office and lab space and

represents a total estimated investment of $125.0 million

- In March, transferred the $95.0 million

retail component of One Paseo, encompassing 96,000 square feet in

the Del Mar submarket of San Diego, from under construction to the

tenant improvement phase. The retail component is currently 92%

leased

Finance

- In February, repaid at par a mortgage

note for $74.3 million due June 2019

- In March and April, executed 12-month

forward equity sale agreements under the ATM program for 1,201,204

shares at a weighted average sales price of $75.92

- As of the date of this report, the

company had not drawn down any portion of the shares sold under the

forward equity agreements, including the transaction executed in

August 2018

Results for the Quarter Ended March 31, 2019

For the first quarter ended March 31, 2019, KRC reported

net income available to common stockholders of $36.9 million,

or $0.36 per share, including a $0.03 per share decrease

related to the expensing of indirect leasing costs in connection

with the adoption of the new lease accounting standard compared to

$36.2 million, or $0.36 per share, in the first quarter of

2018. FFO in the first quarter of 2019 was $99.8 million, or

$0.95 per share, including a $0.02 per share decrease related

to the expensing of indirect leasing costs in connection with the

new lease accounting standard adoption, compared to

$96.3 million, or $0.94 per share, in the year-earlier

quarter. Net income available to common stockholders and FFO for

the first quarter 2019 also included a positive $0.03 per share

impact related to the improved credit quality of a tenant for which

we recorded a bad debt reserve in 2018.

All per share amounts in this report are presented on a diluted

basis.

Net Income Available to Common Stockholders / FFO Guidance

and Outlook

The company has updated its guidance range of NAREIT-defined FFO

per diluted share for its fiscal year 2019 to $3.64 to $3.78 per

share, with a midpoint of $3.71 per share, reflecting management’s

views on current and future market conditions, including

assumptions with respect to rental rates, occupancy levels, and the

earnings impact of events referenced in this press release.

Full Year 2019 Range Low

End High End Net income available to common stockholders

per share - diluted $ 1.49 $ 1.63 Weighted average common

shares outstanding - diluted (1) 105,700 105,700 Net income

available to common stockholders $ 157,000 $ 172,000 Adjustments:

Net income attributable to noncontrolling common units of the

Operating Partnership 3,200 3,600 Net income attributable to

noncontrolling interests in consolidated property partnerships

17,000 20,000 Depreciation and amortization of real estate assets

241,000 241,000 Gains on sales of depreciable real estate — — Funds

From Operations attributable to noncontrolling interests in

consolidated property partnerships (26,500 ) (29,500 ) Funds From

Operations (2) $ 391,700 $ 407,100 Weighted

average common shares/units outstanding – diluted (3) 107,700

107,700 Funds From Operations per common share/unit –

diluted (2)(3) $ 3.64 $ 3.78

Key 2019 assumptions include:

- Dispositions of approximately $150.0

million to $350.0 million

- Flat same store cash net operating

income

- Year-end occupancy of 94.0% to

95.0%

- Total remaining development spending of

approximately $400.0 million to $500.0 million

________________________

(1) Calculated based on estimated weighted average shares

outstanding including non-participating share-based awards. (2) See

management statement for FFO at end of release. (3) Calculated

based on weighted average shares outstanding including

participating and non-participating share-based awards, dilutive

impact of stock options, contingently issuable shares, and shares

issuable under forward equity sale agreements and assuming the

exchange of all common limited partnership units outstanding.

Reported amounts are attributable to common stockholders, common

unitholders and restricted stock unitholders.

The company’s guidance estimates for the full year 2019, and the

reconciliation of net income available to common stockholders per

share - diluted and FFO per share and unit - diluted included

within this press release, reflect management’s views on current

and future market conditions, including assumptions with respect to

rental rates, occupancy levels, and the earnings impact of the

events referenced in this press release. Although these guidance

estimates reflect the impact on the company’s operating results of

an assumed range of future disposition activity, these guidance

estimates do not include any estimates of possible future gains or

losses from possible future dispositions because the magnitude of

gains or losses on sales of depreciable operating properties, if

any, will depend on the sales price and depreciated cost basis of

the disposed assets at the time of disposition, information that is

not known at the time the company provides guidance, and the timing

of any gain recognition will depend on the closing of the

dispositions, information that is also not known at the time the

company provides guidance and may occur after the relevant guidance

period. We caution you not to place undue reliance on our assumed

range of future disposition activity because any potential future

disposition transactions will ultimately depend on the market

conditions and other factors, including but not limited to the

company’s capital needs, the particular assets being sold and the

company’s ability to defer some or all of the taxable gain on the

sales. These guidance estimates also do not include the impact on

operating results from potential future acquisitions, possible

capital markets activity, possible future impairment charges or any

events outside of the company’s control. There can be no assurance

that the company’s actual results will not differ materially from

these estimates.

Conference Call and Audio Webcast

KRC management will discuss updated earnings guidance for fiscal

year 2019 during the company’s May 7, 2019 earnings conference

call. The call will begin at 10:00 a.m. Pacific Time and last

approximately one hour. Those interested in listening via the

Internet can access the conference call at https://services.choruscall.com/links/krc190425.html.

It may be necessary to download audio software to hear the

conference call. Those interested in listening via telephone can

access the conference call at (866) 312-7299. International callers

should dial (412) 317-1070. In order to bypass speaking to the

operator on the day of the call, please pre-register anytime at

http://dpregister.com/10126352. A

replay of the conference call will be available via telephone on

May 7, 2019 through May 14, 2019 by dialing (877) 344-7529 and

entering passcode 10126352. International callers should dial (412)

317-0088 and enter the same passcode. The replay will also be

available on our website at http://investors.kilroyrealty.com/CustomPage/Index?KeyGenPage=1073743647.

About Kilroy Realty Corporation

Kilroy Realty Corporation (KRC), a publicly traded real estate

investment trust and member of the S&P MidCap 400 Index, is one

of the West Coast’s premier landlords. The company has over 70

years of experience developing, acquiring and managing office and

mixed-use real estate assets. The company provides physical work

environments that foster creativity and productivity and serves a

broad roster of dynamic, innovation-driven tenants, including

technology, entertainment, digital media and health care

companies.

At March 31, 2019, the company’s stabilized portfolio

totaled approximately 13.2 million square feet of office space

located in the coastal regions of Los Angeles, Orange County, San

Diego, the San Francisco Bay Area and Greater Seattle and 200

residential units located in the Hollywood submarket of Los

Angeles. The stabilized portfolio was 92.5% occupied and 96.2%

leased. In addition, KRC had under construction five projects

totaling approximately 2.1 million square feet of office space that

was 26% leased and 801 residential units. KRC also had three

projects in the tenant improvement phase totaling approximately 1.2

million square feet of office, PDR and retail space of which the

office components of the projects are fully leased to Adobe and

Dropbox.

The company’s commitment and leadership position in

sustainability has been recognized by various industry groups

across the world. In September 2018, the company was recognized by

GRESB both as North American leader across all asset classes and a

global leader among all publicly traded real estate companies.

Other sustainability accolades include NAREIT’s Leader in the Light

award for the past five years, the EPA’s highest honor of Sustained

Excellence and winner of Energy Star Partner of the Year for the

past six years. The company is listed in the Dow Jones

Sustainability World Index. At the end of the first quarter, the

company’s stabilized portfolio was 63% LEED certified and 76% of

eligible properties were ENERGY STAR certified. More information is

available at http://www.kilroyrealty.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements are based on our current

expectations, beliefs and assumptions, and are not guarantees of

future performance. Forward-looking statements are inherently

subject to uncertainties, risks, changes in circumstances, trends

and factors that are difficult to predict, many of which are

outside of our control. Accordingly, actual performance, results

and events may vary materially from those indicated or implied in

the forward-looking statements, and you should not rely on the

forward-looking statements as predictions of future performance,

results or events. Numerous factors could cause actual future

performance, results and events to differ materially from those

indicated in the forward-looking statements, including, among

others: global market and general economic conditions and their

effect on our liquidity and financial conditions and those of our

tenants; adverse economic or real estate conditions generally, and

specifically, in the States of California and Washington; risks

associated with our investment in real estate assets, which are

illiquid, and with trends in the real estate industry; defaults on

or non-renewal of leases by tenants; any significant downturn in

tenants’ businesses; our ability to re-lease property at or above

current market rates; costs to comply with government regulations,

including environmental remediation; the availability of cash for

distribution and debt service and exposure to risk of default under

debt obligations; increases in interest rates and our ability to

manage interest rate exposure; the availability of financing on

attractive terms or at all, which may adversely impact our future

interest expense and our ability to pursue development,

redevelopment and acquisition opportunities and refinance existing

debt; a decline in real estate asset valuations, which may limit

our ability to dispose of assets at attractive prices or obtain or

maintain debt financing, and which may result in write offs or

impairment charges; significant competition, which may decrease the

occupancy and rental rates of properties; potential losses that may

not be covered by insurance; the ability to successfully complete

acquisitions and dispositions on announced terms; the ability to

successfully operate acquired, developed and redeveloped

properties; the ability to successfully complete development and

redevelopment projects on schedule and within budgeted amounts;

delays or refusals in obtaining all necessary zoning, land use and

other required entitlements, governmental permits and

authorizations for our development and redevelopment properties;

increases in anticipated capital expenditures, tenant improvement

and/or leasing costs; defaults on leases for land on which some of

our properties are located; adverse changes to, or enactment or

implementations of, tax laws or other applicable laws, regulations

or legislation, as well as business and consumer reactions to such

changes; risks associated with joint venture investments, including

our lack of sole decision-making authority, our reliance on

co-venturers’ financial condition and disputes between us and our

co-venturers; environmental uncertainties and risks related to

natural disasters; and our ability to maintain our status as a

REIT. These factors are not exhaustive and additional factors could

adversely affect our business and financial performance. For a

discussion of additional factors that could materially adversely

affect our business and financial performance, see the factors

included under the caption “Risk Factors” in our annual report on

Form 10-K for the year ended December 31, 2018 and our

other filings with the Securities and Exchange Commission. All

forward-looking statements are based on currently available

information and speak only as of the dates on which they are made.

We assume no obligation to update any forward-looking statement

made in this press release that becomes untrue because of

subsequent events, new information or otherwise, except to the

extent we are required to do so in connection with our ongoing

requirements under federal securities laws.

KILROY REALTY CORPORATION

SUMMARY OF QUARTERLY

RESULTS

(unaudited, in thousands, except per share

data)

Three Months Ended March 31, 2019

2018 Revenues (1) $ 201,202 $ 182,822 Net income

available to common stockholders (1) $ 36,903 $ 36,246

Weighted average common shares outstanding – basic 100,901 98,744

Weighted average common shares outstanding – diluted 101,443 99,214

Net income available to common stockholders per share –

basic (1) $ 0.36 $ 0.36 Net income available to common stockholders

per share – diluted (1) $ 0.36 $ 0.36 Funds From Operations

(1)(2)(3) $ 99,812 $ 96,285 Weighted average common

shares/units outstanding – basic (4) 104,062 102,030 Weighted

average common shares/units outstanding – diluted (5) 104,603

102,499 Funds From Operations per common share/unit – basic

(1)(3) $ 0.96 $ 0.94 Funds From Operations per common share/unit –

diluted (1)(3) $ 0.95 $ 0.94 Common shares outstanding at

end of period 100,967 98,840 Common partnership units outstanding

at end of period 2,023 2,071 Total common shares and

units outstanding at end of period 102,990 100,911

Stabilized office portfolio occupancy rates: (6) Greater Los

Angeles 95.6 % 93.9 % Orange County 90.3 % 89.6 % San Diego County

90.2 % 98.0 % San Francisco Bay Area 92.5 % 95.1 % Greater Seattle

88.8 % 90.2 % Weighted average total 92.5 % 94.3 % Total

square feet of stabilized office properties owned at end of period:

(6) Greater Los Angeles 3,956 4,182 Orange County 272 272 San Diego

County 2,046 2,043 San Francisco Bay Area 5,160 5,303 Greater

Seattle 1,802 2,066 Total 13,236 13,866

________________________

(1)

Effective January 1, 2019, the company

adopted ASC 842 “Leases.” Please refer to our consolidated

statements of operations for a description of the changes made to

our consolidated financial statements. In accordance with the

adoption of the new standard, previously reported periods are not

restated for the impact of the standard.

(2) Reconciliation of Net income available to common stockholders

to Funds From Operations available to common stockholders and

unitholders and management statement on Funds From Operations are

included after the Consolidated Statements of Operations. (3)

Reported amounts are attributable to common stockholders, common

unitholders, and restricted stock unitholders. (4) Calculated based

on weighted average shares outstanding including participating

share-based awards (i.e. nonvested stock and certain time based

restricted stock units) and assuming the exchange of all common

limited partnership units outstanding. (5) Calculated based on

weighted average shares outstanding including participating and

non-participating share-based awards, dilutive impact of stock

options, contingently issuable shares, and shares issuable under

forward equity sale agreements and assuming the exchange of all

common limited partnership units outstanding. (6) Occupancy

percentages and total square feet reported are based on the

company’s stabilized office portfolio for the periods presented.

Occupancy percentages and total square feet shown for March 31,

2018 include the office properties that were sold subsequent to

March 31, 2018.

KILROY REALTY

CORPORATION

CONSOLIDATED BALANCE

SHEETS

(unaudited, in thousands)

March 31, 2019 December 31, 2018

ASSETS

REAL ESTATE ASSETS: Land and improvements $ 1,184,496 $ 1,160,138

Buildings and improvements 5,300,313 5,207,984 Undeveloped land and

construction in progress 2,131,358 2,058,510 Total

real estate assets held for investment 8,616,167 8,426,632

Accumulated depreciation and amortization (1,441,506 ) (1,391,368 )

Total real estate assets held for investment, net 7,174,661

7,035,264 Cash and cash equivalents 49,693 51,604 Restricted

cash 6,300 119,430 Marketable securities 24,098 21,779 Current

receivables, net 28,016 20,176 Deferred rent receivables, net

280,756 267,007 Deferred leasing costs and acquisition-related

intangible assets, net 187,309 197,574 Right of use ground lease

assets (1) 82,794 — Prepaid expenses and other assets, net 50,360

52,873 TOTAL ASSETS $ 7,883,987 $ 7,765,707

LIABILITIES AND

EQUITY

LIABILITIES: Secured debt, net $ 259,878 $ 335,531 Unsecured debt,

net 2,552,883 2,552,070 Unsecured line of credit 185,000 45,000

Accounts payable, accrued expenses and other liabilities 373,691

374,415 Ground lease liabilities (1) 87,247 — Accrued dividends and

distributions 47,676 47,559 Deferred revenue and

acquisition-related intangible liabilities, net 138,973 149,646

Rents received in advance and tenant security deposits 55,457

60,225 Total liabilities 3,700,805 3,564,446

EQUITY: Stockholders’ Equity Common stock 1,010 1,007

Additional paid-in capital 3,976,204 3,976,953 Distributions in

excess of earnings (62,690 ) (48,053 ) Total stockholders’ equity

3,914,524 3,929,907 Noncontrolling Interests Common units of the

Operating Partnership 78,413 78,991 Noncontrolling interests in

consolidated property partnerships 190,245 192,363

Total noncontrolling interests 268,658 271,354 Total

equity 4,183,182 4,201,261 TOTAL LIABILITIES AND

EQUITY $ 7,883,987 $ 7,765,707

________________________

(1) Effective January 1, 2019, the company adopted ASC 842

“Leases,” which requires right of use assets and liabilities for

leases in which the company is the lessee to be presented on the

company’s consolidated balance sheets.

KILROY REALTY

CORPORATION

CONSOLIDATED

STATEMENTS OF OPERATIONS

(unaudited, in thousands, except per share

data)

Three Months Ended March 31, 2019

2018 REVENUES (1) Rental income $ 199,382 $ 162,871 Tenant

reimbursements — 19,150 Other property income 1,820 801

Total revenues 201,202 182,822 EXPENSES

Property expenses (1) 38,149 31,671 Real estate taxes (1) 18,639

17,146 Provision for bad debts (1) — (265 ) Ground leases (1) 1,972

1,561 General and administrative expenses 23,341 15,559 Leasing

costs (1) 1,757 — Depreciation and amortization 66,135

62,715

Total expenses

149,993 128,387 OTHER (EXPENSES) INCOME

Interest income and other net investment gain 1,828 34 Interest

expense (11,243 ) (13,498 )

Total other (expenses) income

(9,415 ) (13,464 ) NET INCOME 41,794 40,971

Net income attributable to noncontrolling common units of

the Operating Partnership (700 ) (751 ) Net income attributable to

noncontrolling interests in consolidated property partnerships

(4,191 ) (3,974 ) Total income attributable to noncontrolling

interests (4,891 ) (4,725 ) NET INCOME AVAILABLE TO COMMON

STOCKHOLDERS $ 36,903 $ 36,246 Weighted

average common shares outstanding – basic 100,901 98,744 Weighted

average common shares outstanding – diluted 101,443 99,214

Net income available to common stockholders per share – basic $

0.36 $ 0.36 Net income available to common

stockholders per share – diluted $ 0.36 $ 0.36

________________________

(1)

Effective January 1, 2019, the company

adopted ASC 842 “Leases,” which required the following changes for

all periods beginning and subsequent to January 1, 2019. In

accordance with the adoption of the new standard under the modified

retrospective method, previously reported periods are not restated

for the impact of the standard.

- All lease related revenue required to be reported as a single

component within rental income. For the three months ended March

31, 2019, rental income includes $27.5 million of tenant

reimbursements and $3.3 million of lease termination fees. - Rental

income to be presented net of provision for bad debts. For the

three months ended March 31, 2019, rental income includes a

recovery of provision for bad debts of $3.5 million.

- All property expenses paid directly by

the company and reimbursed by the tenant to be presented on a gross

basis. For the three months ended March 31, 2019, rental income and

property expenses both include $3.0 million of additional tenant

reimbursements and the related property expenses, which were

previously shown net in property expenses in prior periods. This

change has no impact to net income, Net Operating Income or Funds

From Operations.

- Non-tenant parking income to be presented in other property

income instead of rental income since recognized under ASC 606

“Revenue from Contracts with Customers” and outside the scope of

ASC 842 “Leases.”

- Real estate taxes for properties where

the company is a lessee under ground leases to be presented in

ground leases instead of real estate taxes. For the three months

ended March 31, 2019, ground leases includes $0.5 million of

property taxes for properties where the company is a lessee.

- Indirect leasing costs to be expensed as incurred and reported in

leasing costs.

KILROY REALTY

CORPORATION

FUNDS FROM

OPERATIONS

(unaudited, in thousands, except per share

data)

Three Months Ended, March 31 2019

2018 Net income available to common stockholders $ 36,903 $

36,246 Adjustments: Net income attributable to noncontrolling

common units of the Operating Partnership 700 751 Net income

attributable to noncontrolling interests in consolidated property

partnerships 4,191 3,974 Depreciation and amortization of real

estate assets 64,971 61,677 Funds From Operations attributable to

noncontrolling interests in consolidated property partnerships

(6,953 ) (6,363 ) Funds From Operations(1)(2)(3) $ 99,812 $

96,285 Weighted average common shares/units

outstanding – basic (4) 104,062 102,030 Weighted average common

shares/units outstanding – diluted (5) 104,603 102,499 Funds

From Operations per common share/unit – basic (2) $ 0.96 $

0.94 Funds From Operations per common share/unit – diluted

(2) $ 0.95 $ 0.94

________________________

(1) We calculate Funds From Operations available to common

stockholders and common unitholders (“FFO”) in accordance with the

2018 Restated White Paper on FFO approved by the Board of Governors

of NAREIT. The White Paper defines FFO as net income or loss

calculated in accordance with GAAP, excluding extraordinary items,

as defined by GAAP, gains and losses from sales of depreciable real

estate and impairment write-downs associated with depreciable real

estate, plus real estate-related depreciation and amortization

(excluding amortization of deferred financing costs and

depreciation of non-real estate assets) and after adjustment for

unconsolidated partnerships and joint ventures. Our calculation of

FFO includes the amortization of deferred revenue related to

tenant-funded tenant improvements and excludes the depreciation of

the related tenant improvement assets. We also add back net income

attributable to noncontrolling common units of the Operating

Partnership because we report FFO attributable to common

stockholders and common unitholders. We believe that FFO is

a useful supplemental measure of our operating performance. The

exclusion from FFO of gains and losses from the sale of operating

real estate assets allows investors and analysts to readily

identify the operating results of the assets that form the core of

our activity and assists in comparing those operating results

between periods. Also, because FFO is generally recognized as the

industry standard for reporting the operations of REITs, it

facilitates comparisons of operating performance to other REITs.

However, other REITs may use different methodologies to calculate

FFO, and accordingly, our FFO may not be comparable to all other

REITs. Implicit in historical cost accounting for real

estate assets in accordance with GAAP is the assumption that the

value of real estate assets diminishes predictably over time. Since

real estate values have historically risen or fallen with market

conditions, many industry investors and analysts have considered

presentations of operating results for real estate companies using

historical cost accounting alone to be insufficient. Because FFO

excludes depreciation and amortization of real estate assets, we

believe that FFO along with the required GAAP presentations

provides a more complete measurement of our performance relative to

our competitors and a more appropriate basis on which to make

decisions involving operating, financing and investing activities

than the required GAAP presentations alone would provide.

However, FFO should not be viewed as an alternative measure of our

operating performance because it does not reflect either

depreciation and amortization costs or the level of capital

expenditures and leasing costs necessary to maintain the operating

performance of our properties, which are significant economic costs

and could materially impact our results from operations. (2)

Reported amounts are attributable to common stockholders, common

unitholders, and restricted stock unitholders. (3) FFO

available to common stockholders and unitholders includes

amortization of deferred revenue related to tenant-funded tenant

improvements of $3.8 million and $4.3 million for the three months

ended March 31, 2019 and 2018, respectively. (4) Calculated

based on weighted average shares outstanding including

participating share-based awards (i.e. nonvested stock and certain

time based restricted stock units) and assuming the exchange of all

common limited partnership units outstanding. (5) Calculated

based on weighted average shares outstanding including

participating and non-participating share-based awards, dilutive

impact of stock options, contingently issuable shares, and shares

issuable under forward equity sale agreements and assuming the

exchange of all common limited partnership units outstanding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190506005791/en/

Tyler H. RoseExecutive Vice Presidentand Chief Financial

Officer(310) 481-8484orMichelle NgoSenior Vice Presidentand

Treasurer(310) 481-8581

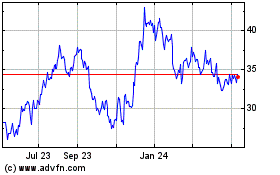

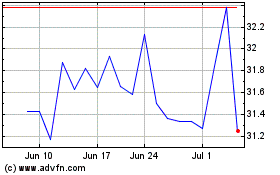

Kilroy Realty (NYSE:KRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kilroy Realty (NYSE:KRC)

Historical Stock Chart

From Apr 2023 to Apr 2024