Current Report Filing (8-k)

January 30 2020 - 9:29AM

Edgar (US Regulatory)

0000056873

false

0000056873

2020-01-29

2020-01-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report: January 30, 2020

(Date of earliest event reported)

The Kroger Co.

(Exact name of registrant as specified in

its charter)

|

Ohio

|

|

No. 1-303

|

|

31-0345740

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

1014 Vine Street

Cincinnati, OH 45202

(Address of principal executive offices,

including zip code)

Registrant’s telephone number, including

area code: (513) 762-4000

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on

which registered

|

|

Common

Stock $1 par value

|

KR

|

NYSE

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 7.01

|

Regulation FD Disclosure.

|

In response to investor inquiries regarding the Lucky’s Market decision

to commence a voluntary proceeding in the Delaware bankruptcy court on Monday, January 27, 2019, Kroger issued the following

statement:

As Kroger disclosed in its third quarter earnings announcement,

as a result of a portfolio review, we made the decision to divest our interest in Lucky’s Market. Given this decision to

divest, we recognized an impairment charge of $238 million in the third quarter of 2019. The portion of this charge attributable

to Kroger was $131 million. The impairment charge was a non-cash charge and reflects the write-down of our initial investment in Lucky's

Market as well as additional funding provided to operate and grow the business. As a result of the Lucky’s bankruptcy proceedings,

we expect to deconsolidate Lucky’s from our consolidated financial statements which will result in a non-cash charge for

GAAP purposes in the fourth quarter of 2019. We do not expect any incremental impact on adjusted EPS guidance for fiscal years

2019 or 2020 as a result of the bankruptcy proceeding.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

The Kroger Co.

|

|

|

|

|

|

|

|

January 30, 2020

|

By:

|

/s/

Christine S. Wheatley

|

|

|

|

Christine S. Wheatley

|

|

|

|

Group Vice President, Secretary and General

Counsel

|

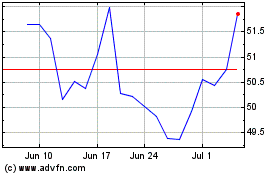

Kroger (NYSE:KR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kroger (NYSE:KR)

Historical Stock Chart

From Apr 2023 to Apr 2024