Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

January 06 2020 - 4:20PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Statement Number 333-231727

The Kroger Co.

Pricing Term Sheet

Dated January 6, 2020

|

Issuer:

|

|

The Kroger Co.

|

|

|

|

|

|

Security Type:

|

|

Senior Notes

|

|

|

|

|

|

Trade Date:

|

|

January 6, 2020

|

|

|

|

|

|

Settlement Date:

|

|

January 13, 2020 (T+5)

|

|

|

|

|

|

Denominations:

|

|

$2,000 x $1,000

|

|

|

|

|

|

Ratings (Moody’s / S&P)*:

|

|

Baa1 / BBB

|

|

|

|

|

|

Principal Amount:

|

|

$750,000,000

|

|

|

|

|

|

Maturity Date:

|

|

January 15, 2050

|

|

|

|

|

|

Coupon:

|

|

3.950%

|

|

|

|

|

|

Benchmark Treasury:

|

|

UST 2.250% due August 15, 2049

|

|

|

|

|

|

Benchmark Treasury Price / Yield:

|

|

99-19 / 2.269%

|

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

T + 170 basis points

|

|

|

|

|

|

Yield to Maturity:

|

|

3.969%

|

|

|

|

|

|

Price to Public:

|

|

99.668% of the principal amount

|

|

|

|

|

|

Interest Payment Dates:

|

|

January 15 and July 15, commencing on July 15, 2020

|

|

|

|

|

|

Optional Redemption Provisions:

|

|

|

|

|

|

|

|

Make-whole Call:

|

|

Treasury Rate plus 30 basis points (prior to July 15, 2049)

|

|

|

|

|

|

Par Call:

|

|

On or after July 15, 2049 (six months prior to maturity)

|

|

|

|

|

|

CUSIP/ISIN:

|

|

501044 DN8 / US501044DN88

|

|

|

|

|

|

Joint Book-Running Managers:

|

|

BofA Securities, Inc.

|

|

|

|

Mizuho Securities USA LLC

|

|

|

|

RBC Capital Markets, LLC

|

|

|

|

Citigroup Global Markets Inc.

|

|

|

|

Fifth Third Securities, Inc.

|

|

|

|

MUFG Securities Americas Inc.

|

|

|

|

|

|

Co-Managers:

|

|

BNY Mellon Capital Markets, LLC

|

|

|

|

Goldman Sachs & Co. LLC

|

|

|

|

PNC Capital Markets LLC

|

|

|

|

Santander Investment Securities Inc.

|

|

|

|

SunTrust Robinson Humphrey, Inc.

|

|

|

|

U.S. Bancorp Investments, Inc.

|

|

|

|

Wells Fargo Securities, LLC

|

|

|

|

CastleOak Securities, L.P.

|

*Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling BofA Securities, Inc. toll-free at 1-800-294-1322, Mizuho Securities USA LLC toll-free at 1-866-271-7403 or RBC Capital Markets, LLC toll-free at 1-866-375-6829.

Any disclaimer or other notice that may appear below is not applicable to this communication and should be disregarded. Such disclaimer or notice was automatically generated as a result of this communication being sent by Bloomberg or another email system.

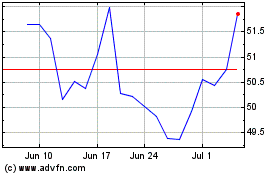

Kroger (NYSE:KR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kroger (NYSE:KR)

Historical Stock Chart

From Apr 2023 to Apr 2024