Online Push Hurts Kroger's Margins -- WSJ

December 07 2018 - 3:02AM

Dow Jones News

By Heather Haddon

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 7, 2018).

Kroger Co.'s profit margin is getting pinched as the grocer

ramps up investments to compete in the cutthroat U.S. grocery

market.

The Cincinnati company is working to expand beyond its

traditional business of selling groceries in stores to compete with

Amazon.com Inc. and others. Kroger has struck six deals this year

to boost sales online and elsewhere, such as in Kroger-branded

locations in select Walgreens Boots Alliance Inc. pharmacies.

"It will allow us to grow and grow over time," Kroger chief

executive Rodney McMullen said of its partnerships in an interview

on Thursday.

Digital sales grew more than 60% in Kroger's latest quarter as

the company added more online-order pickup locations and as

customers ordered its newly acquired Home Chef meal kits, the

company said.

But investors are watching how Kroger's efforts pressure

profits. The nation's largest supermarket chain by stores and sales

on Thursday reported a net profit of $317 million, or 39 cents a

share, compared with $397 million, or 44 cents a share, a year ago.

Overall sales declined slightly to $27.7 billion in the

third-quarter ending in November.

Kroger's shares were up 2% Thursday.

The company posted same-store sales of 1.6% for the quarter,

excluding fuel, on par with analyst expectations.

Kroger started selling a new line of clothing this year, and

struck a deal with the hedge fund owners of the defunct Toys "R" Us

brand to carry branded toys and other merchandise.

The company is trying to transform its business while also

keeping its prices competitive with rivals such as Walmart Inc.

Executives said that they sacrificed profit to drive down prices

this year, and that they are marketing more of their own low-priced

store-brand products.

Kroger is also aiming to earn more from sales outside its core

business, including pitching shopping data and promotions to

suppliers. The company said its marketing business grew during the

quarter as well.

The strategy has some skeptics. "These profit streams remain

largely unproven," UBS wrote in a recent note about Kroger to

investors.

Kroger executives said higher transportation costs and

investment ate into margins in the third quarter. Executives said

they would pay for their investments by driving down the cost of

goods and being more efficient.

Kroger's reported adjusted earnings of $394 million, or 48 cents

per diluted share, when accounting for its investment in the Ocado

Group PLC online grocery firm. The British company's shares have

doubled in value this year, with a partnership agreement struck

with Kroger this year contributing to much of the lift.

The company lowered its net earnings guidance for the year to

$3.80 to $3.95 per diluted share from $3.88 to $4.03 previously. It

maintained its adjusted operating profits of $2.00 to $2.15 for the

year.

Write to Heather Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

December 07, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

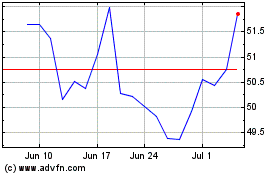

Kroger (NYSE:KR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kroger (NYSE:KR)

Historical Stock Chart

From Apr 2023 to Apr 2024