Coca-Cola Sales Slide as Pandemic Progresses -- Update

April 21 2020 - 9:49AM

Dow Jones News

By Jennifer Maloney

Coca-Cola Co. said its global sales volume has fallen 25% since

the beginning of April amid pandemic lockdowns, and cautioned that

consumer spending won't immediately bounce back as countries begin

to reopen.

"We may be at the end of the big global lockdown, but we are

still a long way from the new normal," Chief Executive James

Quincey said on a call with analysts Tuesday.

In China, where Coke's plants are running and employees have

returned to company offices in Shanghai, there are still limits on

crowd sizes, and consumption is down from last year, Mr. Quincey

said. And other places such as Tokyo are implementing a second

round of restrictions, he noted.

About half of Coca-Cola's business is generated by

away-from-home retail channels -- the restaurants, bars, movie

theaters and sports stadiums that have been shut world-wide. The

company has also seen a decline in on-the-go drinks typically sold

in convenience stores, Mr. Quincey said.

As economies enter a phase of graduated reopenings, consumers

will continue to lean heavily on e-commerce because of "the specter

of the virus over us," Mr. Quincey said. He said he also expects to

see "a very profound theme of affordability," as shoppers brace for

an economic downturn. The company expects the sharpest impact on

its sales in the second quarter of this year.

Coke has cut marketing and capital spending and has put some

employees on paid furlough through June. Executives said they are

focusing on supplying grocery stores with core brands to help them

simplify their supply chains. And the beverage giant is canceling

smaller projects in its R&D pipeline to focus resources on

developing products that could scale more easily, Mr. Quincey

said.

The soda giant, whose brands include Dasani water, Costa coffee

and Powerade, reported lower revenue for the March-ended quarter,

with sales down 1% to $8.6 billion. The Atlanta company said

organic revenue, which excludes the effect of currency swings,

acquisition and divestitures, was flat.

For the quarter, Coca-Cola reported earnings of $2.76 billion,

compared with $1.68 billion in the comparable quarter last year.

Adjusted earnings were 51 cents a share, ahead of the 44 cents

analysts had expected.

Unit-case volume for its sparkling soft drinks, which include

its namesake soda, Diet Coke, Fanta and Sprite, fell 2% for the

quarter, led by a decline in Asia Pacific, particularly China.

--Dave Sebastian contributed to this article.

Write to Jennifer Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

April 21, 2020 09:34 ET (13:34 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

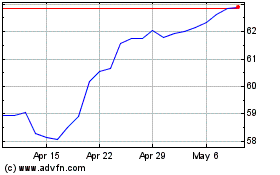

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

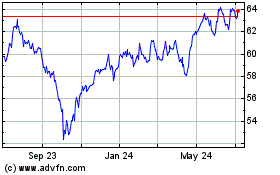

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024