Weak global growth, strong U.S. currency raise potential for

disappointing earnings

By Amrith Ramkumar

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 10, 2020).

Investors worried about the impact of the coronavirus on the

world economy might soon have to confront another challenge to

corporate profits: a strengthening dollar.

The U.S. currency has climbed steadily since the number of

coronavirus cases began surging in China last month, pushing the

WSJ Dollar Index to its highest level since early October. With

many analysts concerned that disruptions to the Chinese economy

will dent global growth, investors have been clinging to U.S.

assets, helping the S&P 500 rebound from its late-January slide

and rise last week to a fresh record.

Although major indexes and the dollar have climbed in tandem,

U.S. companies including Johnson & Johnson, Coca-Cola Co., Ford

Motor Co. and 3M Co. have mentioned the negative effects of

currency swings on earnings calls, highlighting a possible

challenge to the longstanding bull market. A stronger dollar makes

it more expensive for companies to bring home foreign sales and

makes exporters' products less competitive abroad.

Fourth-quarter profits for S&P 500 firms are on track to

stay roughly flat compared with a year earlier, extending a trend

from earlier in 2019. The combination of weak global growth and a

strong dollar raises the possibility that earnings could disappoint

again this year. Any negative impact from the dollar could amplify

the fallout from the coronavirus, which has already forced chains

from Starbucks Corp. to Nike Inc. to close stores in China

temporarily.

Some firms, including McDonald's Corp. and Yum China Holdings

Inc., which operates Pizza Hut and KFC in the country, have already

discussed the uncertain impact of the virus.

"No one knows how this outbreak will play out, and we don't know

how it will ultimately impact us," Royal Caribbean Cruises Ltd.

Chief Executive Richard Fain said on the company's earnings call

last week. The company has already canceled some cruises out of

China.

Analysts expect S&P 500 profit growth to accelerate to 10%

or higher in the last two quarters of 2020, according to FactSet, a

projection that some investors fear will now be hard to hit.

Investors will be monitoring results this week from a group

highlighted by PepsiCo Inc., Cisco Systems Inc. and Nvidia

Corp.

A rising dollar also affects emerging markets and commodities by

making investments denominated in the U.S. currency more expensive

for overseas buyers. Additionally, it becomes more costly for

developing countries to service dollar-denominated debt when the

currency climbs.

Investors have for years expected global economic growth to

weaken the dollar, only for the currency to defy those predictions.

President Trump has consistently criticized the dollar's strength

in recent years, arguing that it places the U.S. at a competitive

disadvantage. He has also cited the dollar in his criticism of the

Federal Reserve, urging the central bank to lower interest rates

further.

The currency's recent advance comes even after three Fed rate

cuts in the last half of 2019, the latest example of sturdy U.S.

growth attracting investors but potentially adding to a murky

earnings backdrop for large companies.

"Expectations might not be met, and that's a market risk," said

Lauren Goodwin, an economist and multiasset portfolio strategist at

New York Life Investments, which holds a smaller position in U.S.

stocks than the benchmark it tracks. "Markets can only defy

fundamentals for so long."

Multinational companies have already been under pressure, with

earnings from S&P 500 firms that get more than half of their

revenue outside the U.S. coming in worse than profits for more

domestically oriented companies for much of last year. Many of

those firms are now contending with the prospect of weaker Chinese

demand and a stronger dollar.

"They're facing a double whammy," said Mona Mahajan, U.S.

investment strategist at Allianz Global Investors, which has been

favoring U.S. stocks and the dollar recently.

The dollar and investments tied to U.S. growth also outpaced

other assets for much of 2019, with analysts worried about trade

tensions. As the new year started, many investors had expected the

trend to reverse following an initial trade deal and clarity on the

U.K.'s exit from the European Union.

Instead, traders are now questioning whether the world economy

can reaccelerate.

"That story is now on hold," said Emily Roland, co-chief

investment strategist at John Hancock Investment Management. "We're

maintaining our preference for the U.S. because it's the best from

an economic growth standpoint."

Still, some analysts don't see the dollar climbing out of its

recent trading range, particularly with the Fed indicating it plans

to leave rates low for now. Many are skeptical that an unforeseen

event such as the coronavirus that boosts the currency temporarily

can provide longer-term support without also threatening economic

growth in the U.S.

But for now, investors have kept buying U.S. assets. The yield

on the benchmark 10-year U.S. Treasury note, which affects

borrowing costs on everything from student debt to auto loans, fell

last week to its lowest level since early October. Yields fall as

bond prices rise.

Traders have also cited a reversal in investor positioning in

explaining the market's recent swings. Net investor bets on a

stronger U.S. currency rose in three consecutive weeks through Feb.

4, after last month hitting their lowest level since 2018,

according to the Commodity Futures Trading Commission and

Scotiabank. The reversal is another example of many betting against

the dollar, only for it to attract investors during turbulent

times.

That bearish positioning "getting beaten out of the market has

been a very consistent theme," said Ed Al-Hussainy, senior

interest-rate and currency analyst at Columbia Threadneedle

Investments. "The safe-haven narrative is absolutely critical."

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com

(END) Dow Jones Newswires

February 10, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

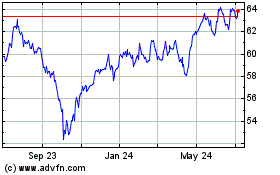

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

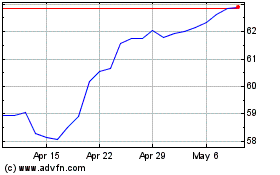

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024