Current Report Filing (8-k)

December 23 2022 - 1:15PM

Edgar (US Regulatory)

0001072627

false

0001072627

2022-12-22

2022-12-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): December 22, 2022

KINGSWAY

FINANCIAL SERVICES INC.

(Exact

Name of Registrant as Specified in Its Charter)

| Delaware |

|

001-15204 |

|

85-1792291 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

10

S. Riverside Plaza, Suite 1520, Chicago, IL 60606

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

Telephone Number, Including Area Code: (312)766-2138

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.01 per share |

|

KFS |

|

New

York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01

Entry into a Material Definitive Agreement.

On

December 22, 2022, TRT Leaseco, LLC (“Kingsway Seller”), an indirect subsidiary of Kingsway Financial Services Inc. (the

“Company”), entered into a Purchase and Sale Agreement (the “Agreement”) with BNSF Dayton LLC (“Purchaser”),

pursuant to which Kingsway Seller agreed to sell to the Purchaser certain real property (the “Property”) in Liberty County,

Texas that is currently operated as a railyard.

Kingsway

Seller is also the landlord under an existing railway lease over the Property. An affiliate of the Purchaser is the current tenant under

the existing railway lease. Under the terms of the Agreement, at the closing, Kingsway Seller will assign, and the Purchaser will assume,

the rights and obligations of the landlord under the existing railway lease.

The

purchase price to be paid by the Purchaser at the closing consists of $44,500,000.00 in cash plus the assumption of the unpaid principal

balance as of the closing of certain existing loans encumbering the Property (the “Existing Loans”), estimated to be $171,192,344.00.

Also at the closing, Seller and its affiliates will be released of any indemnity or guaranty obligations relating to the Existing Loans.

Commencing

upon the execution of the Agreement and ending on December 23, 2022, the Purchaser is entitled to terminate the Agreement for any reason

or no reason, at its sole discretion. To the extent the Purchaser does not exercise its termination right during such period, this right

will be waived and the closing of the transaction will be expected to occur on or before the close of business on December 30, 2022.

The

description of the Agreement, above, does not purport to be complete, and is subject to, and qualified in its entirety by, the terms

of the Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

| * | The

annexes, schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. Kingsway agrees to furnish supplementally

a copy of such annexes, schedules and exhibits, or any section thereof, to the SEC upon request. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

KINGSWAY

FINANCIAL SERVICES INC. |

| |

|

|

| Date:

December 23, 2022 |

By: |

/s/

Kent A. Hansen |

| |

Name: |

Kent

A. Hansen |

| |

Title: |

Chief

Financial Officer |

2

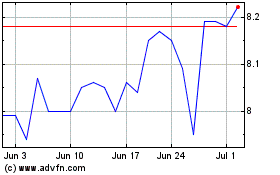

Kingsway Financial Servi... (NYSE:KFS)

Historical Stock Chart

From Mar 2024 to Apr 2024

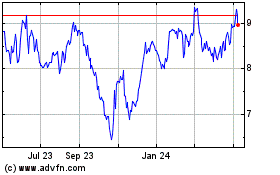

Kingsway Financial Servi... (NYSE:KFS)

Historical Stock Chart

From Apr 2023 to Apr 2024