Current Report Filing (8-k)

November 21 2022 - 4:00PM

Edgar (US Regulatory)

false

0001072627

0001072627

2022-11-18

2022-11-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 18, 2022

KINGSWAY FINANCIAL SERVICES INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

(State or Other Jurisdiction of

Incorporation)

|

|

001-15204

(Commission File

Number)

|

|

85-1792291

(IRS Employer

Identification No.)

|

10 S. Riverside Plaza, Suite 1520, Chicago IL 60606

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (312) 766-2144

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

KFS

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry Into a Material Definitive Agreement.

|

On November 18, 2022, Pegasus Acquirer LLC (the “Kingsway Buyer”), a newly formed subsidiary of Kingsway Financial Services Inc. (the “Company” or “Kingsway”), entered into an Asset Purchase Agreement (the “Agreement”) with Secure Nursing Service, Inc., a California corporation (“Seller”), Rafael Gofman (“Gofman”), Ella Gofman (“Ella”), and Zhanna Weiss (“Weiss” and, collectively with Gofman and Ella, the “Shareholders” and each, individually, a “Shareholder”) pursuant to which the Kingsway Buyer agreed to purchase and assume from Seller, substantially all of the assets and certain specified liabilities of Seller (the “SNS Interests”). The acquisition was effective as of 12:01 a.m. on November 18, 2022.

Pursuant to the terms of the Agreement, as consideration for the SNS Interests, the Kingsway Buyer paid to the Seller aggregate cash consideration of approximately $10.9 million, less certain escrowed amounts for purposes of indemnification claims and working capital adjustments as described below (the “Closing Consideration”).

The Agreement contains customary representations and warranties and covenants from the Seller and Shareholders, including but not limited to representations and warranties about the Seller, Shareholders, and the Seller's business, assets, financial statements, operations, material contracts, liabilities, real property and intellectual property. The Seller and Shareholders will also be subject to customary indemnification obligations related to breaches or misrepresentations under the Agreement, failure to perform covenants contained in the Agreement and losses related to certain designated pre-closing liabilities and pre-closing taxes. A portion of the Closing Consideration equal to approximately $1.05 million was deposited into an escrow account to satisfy indemnification claims and any post-closing working capital adjustments.

The Kingsway Buyer also made customary representations and warranties and covenants, including but not limited to representations and warranties about the Buyer’s authority to enter into the transaction and ability to pay the Closing Consideration. The Kingsway Buyer will also be subject to customary indemnification obligations related to breaches or misrepresentations under the Agreement and failure to perform covenants contained in the Agreement.

Th Closing Consideration was financed with a combination of debt financing provided by Signature Bank, and cash on hand. Pegasus Acquirer Holdings LLC and Pegasus Acquirer LLC, subsidiaries of Kingsway, borrowed a total of $6.5 million, in the form of a term loan, and established a $1 million revolver (together, the “Loan”) that was undrawn at close. The Loan has a variable interest rate equal to the Prime Rate plus 0.50%, with a floor of 5.00%. The Loan requires monthly principal and interest payments and the term loan matures on November 18, 2028.

The description above is a summary and does not purport to be complete and is subject to, qualified in its entirety by, the terms of the Agreement which is filed as Exhibit 10.1 to this report and is incorporated herein by reference.

Item 8.01 Other Events.

On November 21, 2022, Kingsway issued a press release (the “Press Release”) announcing the execution of the Agreement. A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit

Number

|

Description

|

| |

|

|

10.1

|

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

* The annexes, schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. Kingsway agrees to furnish supplementally a copy of such annexes, schedules and exhibits, or any section thereof, to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

| |

KINGSWAYFINANCIAL SERVICES INC.

|

| |

|

|

|

Date: November 21, 2022

|

By:

|

/s/ Kent A. Hansen

|

| |

|

Kent A. Hansen

|

| |

|

Chief Financial Officer

|

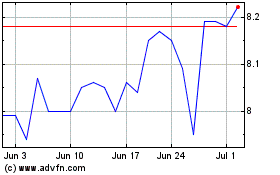

Kingsway Financial Servi... (NYSE:KFS)

Historical Stock Chart

From Mar 2024 to Apr 2024

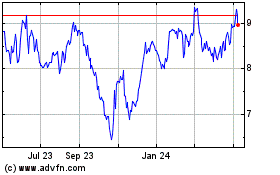

Kingsway Financial Servi... (NYSE:KFS)

Historical Stock Chart

From Apr 2023 to Apr 2024