Current Report Filing (8-k)

April 28 2020 - 6:26AM

Edgar (US Regulatory)

false 0001674335 0001674335 2020-04-27 2020-04-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): April 27, 2020

JELD-WEN HOLDING, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38000

|

|

93-1273278

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

|

|

|

|

|

2645 Silver Crescent Drive

Charlotte, North Carolina

|

|

28273

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

Registrant’s telephone number, including area code: (704) 378-5700

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock (par value $0.01 per share)

|

|

JELD

|

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2 below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01

|

Regulation FD Disclosure.

|

On April 27, 2020, JELD-WEN Holding, Inc. (the “Company”) announced that its wholly owned subsidiary, JELD-WEN, Inc., priced its previously announced offering of $250 million aggregate principal amount of senior secured notes due 2025 (the “Notes Offering”). In accordance with Regulation FD, a copy of this press release is furnished as Exhibit 99.1 to this report. This notice is not intended to and does not constitute an offer to sell nor a solicitation for an offer to purchase any securities of the Company.

The information furnished under Item 7.01 of this Current Report on Form 8-K and incorporated by reference into this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section, nor shall it be deemed incorporated by reference into any registration statement or other filing of the Securities Act of 1933, as amended or the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

Forward-Looking Statements

This report on Form 8-K contains forward-looking statements. All statements other than statements of historical fact contained in this report are forward-looking statements, including all statements regarding the Notes Offering. Forward-looking statements are generally identified by the Company’s use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “seek”, or “should”, or the negative thereof or other variations thereon or comparable terminology. Where, in any forward-looking statement, the Company expresses an expectation or belief as to future results or events, such expectation or belief is based on the current plans, expectations, assumptions, estimates, and projections of management. Although the Company believes that these statements are based on reasonable expectations, assumptions, estimates and projections, they are only predictions and involve known and unknown risks, many of which are beyond the Company’s control, that could cause actual outcomes and results to be materially different from those indicated in such statements.

The Company’s actual results could differ materially from the results contemplated by these forward-looking statements due to a number of factors, including, but not limited to, the factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 filed with the Securities and Exchange Commission.

The forward-looking statements included in this report are made as of the date hereof, and except as required by law, the Company undertakes no obligation to update, amend or clarify any forward-looking statements to reflect events, new information or circumstances occurring after the date of this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: April 27, 2020

|

|

|

|

|

|

JELD-WEN HOLDING, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ John Linker

|

|

|

|

|

|

|

|

John Linker

|

|

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

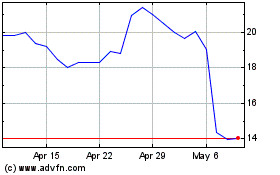

JELD WEN (NYSE:JELD)

Historical Stock Chart

From Mar 2024 to Apr 2024

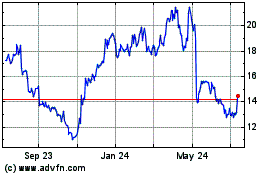

JELD WEN (NYSE:JELD)

Historical Stock Chart

From Apr 2023 to Apr 2024