Statement of Ownership (sc 13g)

February 13 2020 - 12:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No.1)*

JELD-WEN Holding, Inc.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

47580P103

(CUSIP Number)

December 31, 2019

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to

designate the rule pursuant to which this Schedule is filed:

☐ Rule 13d-1(b)

☐ Rule 13d-1(c)

☒ Rule 13d-1(d)

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

|

The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF REPORTING PERSONS

Onex Corporation

|

|

2

|

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Ontario,

Canada

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

0

|

|

|

6

|

|

SHARED VOTING POWER

32,101,820 (1)

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

32,101,820 (1)

|

|

|

|

|

|

|

|

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

32,101,820 (1)

|

|

10

|

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐

|

|

11

|

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (9)

31.9% (2)

|

|

12

|

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS)

CO

|

|

(2)

|

Based on 100,590,747 shares of common stock outstanding as of November 4, 2019.

|

2

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF REPORTING PERSONS

Gerald W. Schwartz

|

|

2

|

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Canada

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

0

|

|

|

6

|

|

SHARED VOTING POWER

32,883,094 (1)

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

32,883,094

(1)

|

|

|

|

|

|

|

|

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

32,883,094 (1)

|

|

10

|

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐

|

|

11

|

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (9)

32.7% (2)

|

|

12

|

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS)

IN

|

|

(2)

|

Based on 100,590,747 shares of common stock outstanding as of November 4, 2019.

|

3

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF REPORTING PERSONS

Onex Partners III LP

|

|

2

|

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

0

|

|

|

6

|

|

SHARED VOTING POWER

20,302,027 (1)

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

20,302,027

(1)

|

|

|

|

|

|

|

|

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

20,302,027 (1)

|

|

10

|

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐

|

|

11

|

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (9)

20.2% (2)

|

|

12

|

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS)

PN

|

|

(2)

|

Based on 100,590,747 shares of common stock outstanding as of November 4, 2019.

|

4

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF REPORTING PERSONS

Onex BP Co-Invest LP

|

|

2

|

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

0

|

|

|

6

|

|

SHARED VOTING POWER

2,744,219 (1)

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

2,744,219

(1)

|

|

|

|

|

|

|

|

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,744,219 (1)

|

|

10

|

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐

|

|

11

|

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (9)

2.7% (2)

|

|

12

|

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS)

PN

|

|

(2)

|

Based on 100,590,747 shares of common stock outstanding as of November 4, 2019.

|

5

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF REPORTING PERSONS

Onex Partners III GP LP

|

|

2

|

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

0

|

|

|

6

|

|

SHARED VOTING POWER

23,907,545 (1)

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

23,907,545

(1)

|

|

|

|

|

|

|

|

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

23,907,545 (1)

|

|

10

|

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐

|

|

11

|

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (9)

23.8% (2)

|

|

12

|

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS)

PN

|

|

(4)

|

Based on 100,590,747 shares of common stock outstanding as of November 4, 2019.

|

6

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF REPORTING PERSONS

Onex US Principals LP

|

|

2

|

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

0

|

|

|

6

|

|

SHARED VOTING POWER

272,060 (1)

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

272,060

(1)

|

|

|

|

|

|

|

|

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

272,060 (1)

|

|

10

|

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐

|

|

11

|

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (9)

0.3% (2)

|

|

12

|

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS)

PN

|

|

(2)

|

Based on 100,590,747 shares of common stock outstanding as of November 4, 2019.

|

7

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF REPORTING PERSONS

Onex Partners III PV LP

|

|

2

|

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

0

|

|

|

6

|

|

SHARED VOTING POWER

258,883 (1)

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

258,883

(1)

|

|

|

|

|

|

|

|

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

258,883 (1)

|

|

10

|

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐

|

|

11

|

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (9)

0.3% (2)

|

|

12

|

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS)

PN

|

|

(2)

|

Based on 100,590,747 shares of common stock outstanding as of November 4, 2019.

|

8

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF REPORTING PERSONS

BP EI LLC

|

|

2

|

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

0

|

|

|

6

|

|

SHARED VOTING POWER

335,900 (1)

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

335,900

(1)

|

|

|

|

|

|

|

|

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

335,900 (1)

|

|

10

|

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐

|

|

11

|

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (9)

0.3% (2)

|

|

12

|

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS)

OO (Limited Liability Company)

|

|

(4)

|

Based on 100,590,747 shares of common stock outstanding as of November 4, 2019.

|

9

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF REPORTING PERSONS

Onex Partners III Select LP

|

|

2

|

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

0

|

|

|

6

|

|

SHARED VOTING POWER

65,364 (1)

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

65,364 (1)

|

|

|

|

|

|

|

|

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

65,364 (1)

|

|

10

|

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐

|

|

11

|

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (9)

0.1% (2)

|

|

12

|

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS)

PN

|

|

(2)

|

Based on 100,590,747 shares of common stock outstanding as of November 4, 2019.

|

10

|

|

|

|

|

|

|

|

|

1

|

|

NAMES OF REPORTING PERSONS

New PCo II Investments Ltd.

|

|

2

|

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Ontario,

Canada

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

5

|

|

SOLE VOTING POWER

0

|

|

|

6

|

|

SHARED VOTING POWER

781,274 (1)

|

|

|

7

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

8

|

|

SHARED DISPOSITIVE POWER

781,274

(1)

|

|

|

|

|

|

|

|

|

|

9

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

781,274 (1)

|

|

10

|

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐

|

|

11

|

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (9)

0.8% (2)

|

|

12

|

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS)

OO (Limited Liability Company)

|

|

(2)

|

Based on 100,590,747 shares of common stock outstanding as of November 4, 2019.

|

11

This Amendment No. 1 to Schedule 13G relates to Common Stock, par value $0.01 per share, of JELD-WEN Holding, Inc. (the “Issuer”), amends and supplements the Schedule 13G previously filed by Onex Corporation and other reporting persons with the Securities and Exchange Commission on

February 14, 2018 (as so amended, the “Schedule 13G”), and is being filed to reflect that Onex American Holdings II LLC has changed its name to Onex Private Equity Holdings LLC.

The Schedule 13G is hereby amended as follows:

Item 4 is hereby amended and restated in its entirety as follows:

The information required by Items 4(a)-4(c) is set forth in Rows 5-11 of the

cover page for each of the Reporting Persons and is incorporated herein by reference for each of the Reporting Persons. As of the date of this report, each of the Reporting Persons beneficially owned the number and percentage of issued and

outstanding shares of common stock of JELD-WEN Holding, Inc. (the “Company”) listed opposite its or his name:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reporting Person:

|

|

Number of

Shares Held

of Record:

|

|

|

Number of

Shares

Beneficially

Owned:

|

|

|

Percent

of

Class:

|

|

|

Sole

Power

to

Vote

or to

Direct

the

Vote:

|

|

|

Shared

Power to

Vote or to

Direct the

Vote:

|

|

|

Sole Power

to

Dispose or

to

Direct the

Disposition

of:

|

|

|

Shared

Power

to Dispose or

to Direct the

Disposition

of:

|

|

|

Onex Corporation(1)

|

|

|

7,586,315

|

|

|

|

32,101,820

|

|

|

|

31.9

|

%

|

|

|

0

|

|

|

|

32,101,820

|

|

|

|

0

|

|

|

|

32,101,820

|

|

|

Gerald W. Schwartz(1)(2)

|

|

|

0

|

|

|

|

32,883,094

|

|

|

|

32.7

|

%

|

|

|

0

|

|

|

|

32,883,094

|

|

|

|

0

|

|

|

|

32,883,094

|

|

|

Onex Partners III LP

|

|

|

20,302,027

|

|

|

|

20,302,027

|

|

|

|

20.2

|

%

|

|

|

0

|

|

|

|

20,302,027

|

|

|

|

0

|

|

|

|

20,302,027

|

|

|

Onex Partners III GP LP(3)

|

|

|

537,052

|

|

|

|

23,907,545

|

|

|

|

23.8

|

%

|

|

|

0

|

|

|

|

23,907,545

|

|

|

|

0

|

|

|

|

23,907,545

|

|

|

Onex US Principals LP

|

|

|

272,060

|

|

|

|

272,060

|

|

|

|

0.3

|

%

|

|

|

0

|

|

|

|

272,060

|

|

|

|

0

|

|

|

|

272,060

|

|

|

Onex Partners III PV LP

|

|

|

258,883

|

|

|

|

258,883

|

|

|

|

0.3

|

%

|

|

|

0

|

|

|

|

258,883

|

|

|

|

0

|

|

|

|

258,883

|

|

|

Onex Partners III Select LP

|

|

|

65,364

|

|

|

|

65,364

|

|

|

|

0.1

|

%

|

|

|

0

|

|

|

|

65,364

|

|

|

|

0

|

|

|

|

65,364

|

|

|

Onex BP Co-Invest LP

|

|

|

2,744,219

|

|

|

|

2,744,219

|

|

|

|

2.7

|

%

|

|

|

0

|

|

|

|

2,744,219

|

|

|

|

0

|

|

|

|

2,744,219

|

|

|

BP EI LLC

|

|

|

335,900

|

|

|

|

335,900

|

|

|

|

0.3

|

%

|

|

|

0

|

|

|

|

335,900

|

|

|

|

0

|

|

|

|

335,900

|

|

|

New PCo II Investments Ltd.

|

|

|

781,274

|

|

|

|

781,274

|

|

|

|

0.8

|

%

|

|

|

0

|

|

|

|

781,274

|

|

|

|

0

|

|

|

|

781,274

|

|

|

(1)

|

Onex Corporation, a corporation whose subordinated voting shares are traded on the Toronto Stock Exchange,

and/or Mr. Gerald W. Schwartz, may be deemed to beneficially own the common stock held by (a) Onex Partners III LP, through Onex Corporation’s indirect ownership or control of Onex Partners Manager GP ULC, the general partner of

Onex Partners Manager LP, the agent of Onex Partners III GP LP, the general partner of Onex Partners III LP, (b) Onex BP Co-Invest LP, through Onex Corporation’s indirect ownership or control of Onex

Partners Manager GP ULC, the general partner of Onex Partners Manager LP, the agent of Onex Partners III GP LP, the general partner of Onex BP Co-Invest LP, (c) Onex Partners III GP LP, through Onex

Corporation’s ownership of all of the equity of Onex Partners GP Inc., the general partner of Onex Partners III GP LP, (d) Onex US Principals LP, through Onex Corporation’s indirect ownership or control of Onex American Holdings GP

LLC, the general partner of Onex US Principals LP, (e) Onex Partners III PV LP, through Onex Corporation’s indirect ownership or control of Onex Partners Manager GP ULC, the general partner of Onex Partners Manager LP, the agent of Onex

Partners III GP LP, the general partner of Onex Partners III PV LP, (f) BP EI LLC, through Onex Corporation’s ownership of all of the equity of Onex Private Equity Holdings LLC, which owns all of the equity of BP EI LLC, and (g) Onex

Partners III Select LP, through Onex Corporation’s indirect ownership or control of Onex Partners Manager GP ULC, the general partner of Onex Partners Manager LP, the agent of Onex Partners III GP LP, the general partner of Onex Partners III

Select LP. Mr. Gerald W. Schwartz, the Chairman, President and Chief Executive Officer of Onex Corporation, indirectly owns shares representing a majority of the voting rights of the shares of Onex Corporation and as such may be deemed to

beneficially own all of the common stock beneficially owned by Onex Corporation. Mr. Schwartz disclaims such beneficial ownership.

|

|

(2)

|

Mr. Gerald W. Schwartz may be deemed to beneficially own the common stock held by New PCo II

Investments Ltd., through Mr. Schwartz’s indirect ownership or control of 1597257 Ontario Inc., which owns all of the equity of New PCo II Investments Ltd.

|

|

(3)

|

Onex Partners III GP LP may be deemed to beneficially own the shares held of record by Onex Partners III LP.,

Onex BP Co-Invest LP, Onex Partners III GP LP, Onex Partners III PV LP, and Onex Partners III Select LP as described in note (1) above. Onex Partners III GP LP disclaims such beneficial ownership (except

with respect to the shares held of record by such entity).

|

12

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Date: February 13, 2020

|

|

|

|

|

|

|

ONEX CORPORATION

|

|

|

|

|

By:

|

|

/s/ David Copeland

|

|

|

|

Name:

|

|

David Copeland

|

|

|

|

Title:

|

|

Managing Director - Tax

|

|

|

|

ONEX PARTNERS III GP LP

|

|

By: Onex Partners GP Inc., its General Partner

|

|

|

|

|

By:

|

|

/s/ Joshua Hausman

|

|

|

|

Name:

|

|

Joshua Hausman

|

|

|

|

Title:

|

|

Vice President

|

|

|

|

ONEX PARTNERS III LP

|

|

By: Onex Partners III GP LP, its General Partner

|

|

By: Onex Partners Manager LP, its Agent

|

|

By: Onex Partners Manager GP ULC, its General Partner

|

|

|

|

|

By:

|

|

/s/ Joshua Hausman

|

|

|

|

Name:

|

|

Joshua Hausman

|

|

|

|

Title:

|

|

Managing Director

|

|

|

|

ONEX US PRINCIPALS LP

|

|

By: Onex American Holdings GP LLC, its General Partner

|

|

|

|

|

By:

|

|

/s/ Joshua Hausman

|

|

|

|

Name:

|

|

Joshua Hausman

|

|

|

|

Title:

|

|

Director

|

|

|

|

ONEX PARTNERS III PV LP

|

|

By: Onex Partners III GP LP, its General Partner

|

|

By: Onex Partners Manager LP, its Agent

|

|

By: Onex Partners Manager GP ULC, its General Partner

|

|

|

|

|

By:

|

|

/s/ Joshua Hausman

|

|

|

|

Name:

|

|

Joshua Hausman

|

|

|

|

Title:

|

|

Managing Director

|

13

|

|

|

|

|

|

|

|

|

ONEX BP CO-INVEST LP

|

|

By: Onex Partners III GP LP, its General Partner

|

|

By: Onex Partners Manager LP, its Agent

|

|

By: Onex Partners Manager GP ULC, its General Partner

|

|

|

|

|

By:

|

|

/s/ Joshua Hausman

|

|

|

|

Name:

|

|

Joshua Hausman

|

|

|

|

Title:

|

|

Managing Director

|

|

|

|

ONEX PARTNERS III SELECT LP

|

|

By: Onex Partners III GP LP, its General Partner

|

|

By: Onex Partners Manager LP, its Agent

|

|

By: Onex Partners Manager GP ULC, its General Partner

|

|

|

|

|

By:

|

|

/s/ Joshua Hausman

|

|

|

|

Name:

|

|

Joshua Hausman

|

|

|

|

Title:

|

|

Managing Director

|

|

|

|

BP EI LLC

|

|

|

|

|

By:

|

|

/s/ Joshua Hausman

|

|

|

|

Name:

|

|

Joshua Hausman

|

|

|

|

Title:

|

|

Managing Director

|

|

|

|

NEW PCO II INVESTMENTS LTD.

|

|

|

|

|

By:

|

|

/s/ Michelle Iskander

|

|

|

|

Name:

|

|

Michelle Iskander

|

|

|

|

Title:

|

|

Secretary

|

|

|

|

GERALD W. SCHWARTZ

|

|

|

|

|

By:

|

|

/s/ Andrea E. Daly

|

|

|

|

Name:

|

|

Andrea E. Daly

|

|

|

|

Title:

|

|

Attorney-in-fact for Gerald W. Schwartz, pursuant to a power of attorney incorporated herein by reference from the Schedule 13G/A with respect to Fly

Leasing Limited filed by Mr. Schwartz and other reporting persons on April 3, 2017.

|

14

INDEX TO EXHIBITS

|

|

|

|

|

Exhibit No.

|

|

Exhibit

|

|

|

|

|

99.1

|

|

Joint Filing Agreement

|

15

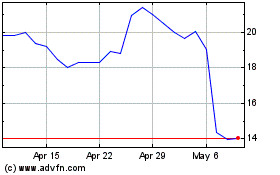

JELD WEN (NYSE:JELD)

Historical Stock Chart

From Mar 2024 to Apr 2024

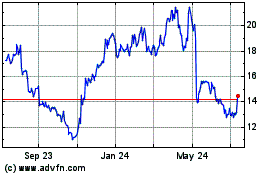

JELD WEN (NYSE:JELD)

Historical Stock Chart

From Apr 2023 to Apr 2024