Current Report Filing (8-k)

January 17 2023 - 7:15AM

Edgar (US Regulatory)

false 0000096223 0000096223 2023-01-13 2023-01-13 0000096223 us-gaap:CommonStockMember 2023-01-13 2023-01-13 0000096223 jef:Four850SeniorNotesDue2027Member 2023-01-13 2023-01-13 0000096223 jef:Two750SeniorNotesDue2032Member 2023-01-13 2023-01-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 13, 2023

Jefferies Financial Group Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| New York |

|

001-05721 |

|

13-2615557 |

| (State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(IRS. Employer Identification No.) |

|

|

|

| 520 Madison Ave., New York, New York |

|

10022 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 212-460-1900

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2, below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, Par Value $1.00 Per Share |

|

JEF |

|

New York Stock Exchange |

| 4.850% Senior Notes Due 2027 |

|

JEF 27A |

|

New York Stock Exchange |

| 2.750% Senior Notes Due 2032 |

|

JEF 32A |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement |

Completion of Spin-Off of Vitesse from Jefferies

On January 13, 2023 (the “Distribution Date”), Jefferies Financial Group Inc. (“Jefferies” or the “Company”) completed the previously announced legal and structural separation and distribution to its shareholders of all of the outstanding shares of Vitesse Energy, Inc. (“Vitesse”) held by Jefferies (the “Spin-Off”). The distribution was made in the amount of one share of Vitesse common stock for every 8.49668 Jefferies common shares (the “Distribution”) owned by the Company’s shareholders as of the close of business on December 27, 2022, the record date of the Distribution.

On January 13, 2023, in connection with the Spin-Off, the Company entered into several agreements with Vitesse and other related parties that set forth the principal actions taken or to be taken in connection with the Spin-Off and that govern the relationship of the parties following the Spin-Off, including a Separation and Distribution Agreement and a Tax Matters Agreement.

Summaries of the material terms and conditions of each of the foregoing agreements can be found in the section entitled “Certain Relationships and Related Party Transactions—Agreements Related to the Spin-Off” of Vitesse’s information statement, dated January 6, 2023 (the “Information Statement”), which was included as Exhibit 99.1 to the Company’s Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on January 9, 2023 and which summaries are incorporated by reference herein. The summaries of the Separation and Distribution Agreement and Tax Matters Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of such Separation and Distribution Agreement and Tax Matters Agreement, which are attached hereto as Exhibits 2.1 and 10.1, respectively, and are incorporated by reference herein.

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

Vitesse Energy, Inc. Transitional Equity Award Adjustment Plan

The Vitesse Energy, Inc. Transitional Equity Award Adjustment Plan (the “Transitional Plan”) became effective on the Distribution Date. The Transitional Plan will generally provide for the treatment of those Jefferies outstanding compensatory equity awards that are to be adjusted into equity incentive awards denominated both in shares of Vitesse common stock and in Jefferies common shares in connection with the Spin-Off. The Transitional Plan provides for the issuance of up to 2,182,299 shares of Vitesse common stock, subject to adjustments as provided by the Transitional Plan. A summary of the material terms of the Transitional Plan can be found in the Information Statement under the section entitled “Certain Relationships and Related Party Matters—Agreements Related to the Spin-Off—Transitional Equity Award Adjustment Plan,” which summary is incorporated by reference herein. The summary of the Transitional Plan does not purport to be complete and is qualified in its entirety by reference to the full text of the Transitional Plan, which is attached hereto as Exhibit 10.2 and is incorporated by reference herein.

On January 17, 2023, the Company and Vitesse issued a joint press release announcing the completion of the Spin-Off. A copy of the joint press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

| Item 9.01 |

Financial Statements and Exhibits |

(d)

|

|

|

| Exhibit Number |

|

Description |

|

|

| 2.1 |

|

Separation and Distribution Agreement, dated as of January 13, 2023, by and among Jefferies Financial Group Inc., Vitesse Energy Finance LLC, Vitesse Energy, Inc., and the other signatories listed therein* |

|

|

| 10.1 |

|

Tax Matters Agreement, dated as of January 13, 2023, between Jefferies Financial Group Inc. and Vitesse Energy, Inc. |

|

|

| 10.2 |

|

Vitesse Energy, Inc. Transitional Equity Award Adjustment Plan*† |

|

|

| 99.1 |

|

Joint Press Release issued by Jefferies Financial Group Inc. and Vitesse Energy, Inc. on January 17, 2023 |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| * |

Certain schedules and similar attachments have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company undertakes to furnish supplemental copies of any of the omitted schedules upon request by the SEC. |

| † |

Compensatory plan or arrangement. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: January 17, 2023 |

|

|

|

JEFFERIES FINANCIAL GROUP INC. |

|

|

|

|

|

|

|

|

|

|

/s/ Michael J. Sharp |

|

|

|

|

|

|

Michael J. Sharp |

|

|

|

|

|

|

Executive Vice President and General Counsel |

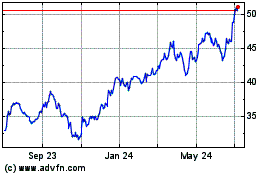

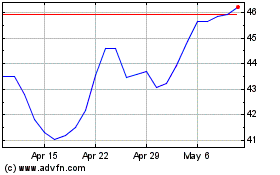

Jefferies Financial (NYSE:JEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jefferies Financial (NYSE:JEF)

Historical Stock Chart

From Apr 2023 to Apr 2024