Current Report Filing (8-k)

November 14 2022 - 8:04AM

Edgar (US Regulatory)

false 0001777946 0001777946 2022-11-14 2022-11-14 0001777946 irnt:CommonStockParValue0.0001PerShare2Member 2022-11-14 2022-11-14 0001777946 irnt:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf11.50PerShare1Member 2022-11-14 2022-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 14, 2022

IronNet, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-39125 |

|

83-4599446 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

7900 Tysons One Place, Suite 400

McLean, VA 22102

(Address of principal executive offices, including zip code)

(443) 300-6761

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

IRNT |

|

The New York Stock Exchange |

| Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share |

|

IRNT.WS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On November 14, 2022, IronNet, Inc. (the “Company”) expects to file a registration statement on Form S-3 under the Securities Act of 1933, as amended, to register up to $25,750,000 of the Company’s common stock, par value $0.0001 per share (the “Registration Statement”).

In connection with the expected filing of the Registration Statement and the expected incorporation by reference of the Company’s financial statements (and the related report of the Company’s independent registered public accounting firm) as part of the Registration Statement by reference to the Company’s Annual Report on Form 10-K for the year ended January 31, 2022 (the “Form 10-K”), the Company is refiling as (i) Exhibit 99.1 hereto Part II, Item 8, Financial Statements and Supplementary Data, which includes its consolidated financial statements that were previously included in the Form 10-K and the related report of the Company’s independent registered public accounting firm and (ii) Exhibit 99.2 hereto Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations included in the Form 10-K. The financial information filed as Exhibits 99.1 and 99.2 hereto is identical to that included in the Form 10-K other than (i) an update to “Liquidity and Capital Resources” in Part II, Item 7 and (ii) an update to “Liquidity” in Note 1 to the consolidated financial statements in Part II, Item 8. The updates reflect the change in our assessment that was made at the time of the filing of our Quarterly Report on Form 10-Q for the quarter ended July 31, 2022 (the “Form 10-Q”) as to whether substantial doubt exists about our ability to continue as a going concern. The report of the Company’s independent registered public accounting firm included in Exhibit 99.1 hereto likewise includes an explanatory paragraph relating to the Company’s ability to continue as a going concern. Other than as described in the preceding sentences, Exhibits 99.1 and 99.2 do not revise, modify, update or otherwise affect the Form 10-K.

This Form 8-K is being filed only for the purposes described above, and all other information in the Form 10-K remains unchanged. In order to preserve the nature and character of the disclosures set forth in the Form 10-K, the items included in Exhibits 99.1 and 99.2 of this Form 8-K have been updated solely for the matters described above. No attempt has been made in this Form 8-K to reflect other events or occurrences after the date of the filing of the Form 10-K on May 2, 2022, and it should not be read to modify or update other disclosures as presented in the Form 10-K. As a result, this Form 8-K should be read in conjunction with the Form 10-K and the Company’s filings made with the SEC subsequent to the filing of the Form 10-K. References in the attached exhibits to the Form 10-K or parts thereof refer to the Form 10-K for the year ended January 31, 2022, filed on May 2, 2022.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

IRONNET, INC. |

|

|

|

|

| |

|

|

|

By: |

|

/s/ Cameron Pforr |

| Date: November 14, 2022 |

|

|

|

|

|

Cameron Pforr |

|

|

|

|

|

|

Chief Financial Officer |

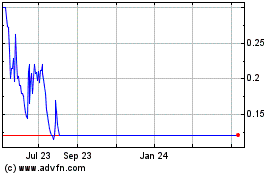

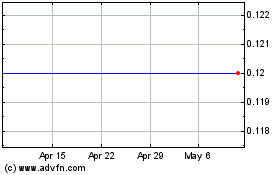

IronNet (NYSE:IRNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

IronNet (NYSE:IRNT)

Historical Stock Chart

From Apr 2023 to Apr 2024