Current Report Filing (8-k)

March 03 2021 - 4:40PM

Edgar (US Regulatory)

0001478242FALSE00014782422021-03-032021-03-030001478242dei:OtherAddressMember2021-03-032021-03-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

FORM 8-K

______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 3, 2021

______________

IQVIA HOLDINGS INC.

(Exact name of registrant as specified in its charter)

______________

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-35907

|

27-1341991

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

83 Wooster Heights Road

Danbury, Connecticut 06810

and

4820 Emperor Blvd.

Durham, North Carolina 27703

(Address of principal executive offices)

Registrant’s telephone number, including area code: (203) 448-4600 and (919) 998-2000

Not Applicable

(Former name or former address, if changed since last report.)

______________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading Symbol

|

|

Name of Each Exchange on which Registered

|

|

Common Stock, par value $0.01 per share

|

|

“IQV”

|

|

New York Stock Exchange LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

☐

|

Item 1.01 Entry into a Material Definitive Agreement

Notes Offering and Notes Indenture

On March 3, 2021, IQVIA Inc. (the “Issuer”), a wholly owned subsidiary of IQVIA Holdings Inc. (the “Company”), completed the issuance and sale of €1,450,000,000 in gross proceeds of (i) €550,000,000 aggregate principal amount of its 1.750% Senior Notes due 2026 (the “2026 Notes”) and (ii) €900,000,000 aggregate principal amount of its 2.250% Senior Notes due 2029 (the “2029 Notes” and, together with the 2026 Notes, the “Notes”). The Notes were issued pursuant to an Indenture, dated March 3, 2021 (the “Indenture”), among the Issuer, U.S. Bank National Association, as trustee of the Notes, and certain subsidiaries of the Issuer as guarantors.

The net proceeds from the Notes offering will be used to redeem all of the Issuer’s outstanding 3.250% senior notes due 2025 (the “3.250% Notes”), including the payment of premiums in respect thereof and to pay fees and expenses related to the Notes offering. On February 16, 2021, the Issuer issued a conditional notice of redemption with respect to the 3.250% Notes, for a total redemption price equal to the sum of the principal amount of the 3.250% Notes, accrued and unpaid interest on the 3.250% Notes to the redemption date and the applicable redemption premium. The Issuer’s obligations with respect to the 3.250% Notes were discharged on the same day as the Issuer completed the issuance of the Notes.

The 2026 Notes are unsecured obligations of the Issuer, will mature on March 15, 2026 and will bear interest at the rate of 1.750% per year, with interest payable semi-annually on March 15 and September 15 of each year, beginning on September 15, 2021. The 2029 Notes are unsecured obligations of the Issuer, will mature on March 15, 2029 and will bear interest at the rate of 2.250% per year, with interest payable semi-annually on March 15 and September 15 of each year, beginning on September 15, 2021. Interest will accrue from March 3, 2021 for both series of the Notes.

The Issuer may redeem (i) the 2026 Notes prior to their final stated maturity, subject to a customary make-whole premium, at any time prior to March 15, 2023 (subject to a customary “equity claw” redemption right) and thereafter subject to a redemption premium declining from 0.875% to 0.000% and (ii) the 2029 Notes prior to their final stated maturity, subject to a customary make-whole premium, at any time prior to March 15, 2024 (subject to a customary “equity claw” redemption right) and thereafter subject to a redemption premium declining from 1.125% to 0.000%. The Issuer may choose to redeem the 2026 Notes and the 2029 Notes, either together or separately, on a non-ratable basis.

The foregoing description of the Notes and the Indenture is qualified in its entirety by reference to the Indenture, a copy of which is filed as Exhibit 4.1 to this Current Report on Form 8-K.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information set forth above under Item 1.01 of this Current Report on Form 8-K relating to the Notes is incorporated by reference into this Item 2.03.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

4.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 3, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IQVIA HOLDINGS INC.

|

|

|

|

|

|

|

|

By:

|

|

/s/ Eric M. Sherbet

|

|

|

|

|

Eric M. Sherbet

|

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

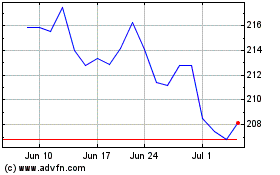

IQVIA (NYSE:IQV)

Historical Stock Chart

From Mar 2024 to Apr 2024

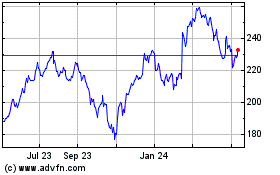

IQVIA (NYSE:IQV)

Historical Stock Chart

From Apr 2023 to Apr 2024