Innovative Industrial Properties, Inc. (IIP), the first and only

real estate company on the New York Stock Exchange (NYSE: IIPR)

focused on the regulated U.S. cannabis industry, announced today

that it closed on the acquisition of a property in Wimauma,

Florida, which comprises approximately 373,000 square feet of

industrial and greenhouse space, from an affiliate of Parallel, a

leading multi-state cannabis company with operations in Florida,

Massachusetts, Nevada and Texas. Parallel is the corporate parent

company to Surterra Wellness, a market leader and one of the

original licensed vertical operators in Florida, with a rapidly

growing footprint that includes 39 retail dispensaries across the

state and multiple industrial-scale cultivation, production and

research facilities.

The purchase price for the property was $35.3 million (excluding

transaction costs). Concurrent with the closing of the purchase,

IIP entered into a long-term, triple-net lease agreement for the

property with a subsidiary of Parallel, which intends to continue

to operate the property as a regulated medical cannabis cultivation

and processing facility. Parallel is expected to complete

additional tenant improvements for the property, for which IIP has

agreed to provide reimbursement of up to $8.2 million. Assuming

full reimbursement for the tenant improvements, IIP’s total

investment in the property will be $43.5 million.

As the pioneering real estate investment trust (REIT) for the

medical-use cannabis industry, IIP partners with experienced

medical-use cannabis operators and serves as a source of capital by

acquiring and leasing back their real estate assets, in addition to

offering other creative real estate-based capital solutions.

“We are thrilled to execute this transaction with Parallel, and

look forward to supporting Parallel as their long-term real estate

capital partner in Florida and elsewhere,” said Paul Smithers,

President and Chief Executive Officer of IIP. “Parallel has a

tremendous footprint in Florida with its 39 operating dispensary

locations, and we expect the Wimauma facility to be a critical

catalyst to Parallel’s continued growth and expansion of operations

to meet the tremendous patient need for high quality medical

cannabis products throughout Florida.”

Parallel is one of the largest privately-held multi-state

cannabis operators in the U.S., with leading positions in several

of the largest and fastest-growing markets, including Florida,

Massachusetts, Nevada and Texas. Parallel’s operations include 42

retail dispensaries, a robust portfolio of proprietary consumer

brands and innovative products, and state-of-the-art cultivation,

production and research facilities. Parallel has over 1,700

employees nationwide, and has raised more than $300 million in

capital to date. Parallel’s highly accomplished management team is

led by Chairman and CEO William “Beau” Wrigley, Jr., who previously

served as the Chairman and CEO of global gum and confectionery

leader the Wm. Wrigley Jr. Company, which was acquired by Mars,

Inc. in 2008 for $23 billion.

“We are thrilled to partner with IIP on this transaction, which

enables Parallel to unlock previously untapped sources of growth

capital from our real estate holdings to help drive our continued

expansion in Florida as well as in other markets,” said Beau

Wrigley, Jr., Chairman and CEO of Parallel. “As the premier real

estate capital provider for the cannabis space, IIP is best

positioned to support Parallel’s continued growth to enable us to

continue to meet our customers’ needs by delivering a wide variety

of consistent, high-quality cannabis products.”

Florida represents one of the largest and one of the fastest

growing medical-use cannabis markets in the United States.

Floridians overwhelmingly supported the passage of the medical-use

cannabis program in 2016 with 71% voter approval. Qualifying

medical conditions for the program include, among others, cancer,

epilepsy, PTSD, HIV/AIDS and multiple sclerosis. According to the

Florida Office of Medical Marijuana Use (OMMU), as of March 6,

2020, there were over 320,000 qualified patients and over 2,500

qualified physicians in the medical-use cannabis program.

As of March 11, 2020, IIP owned 53 properties located in

Arizona, California, Colorado, Florida, Illinois, Maryland,

Massachusetts, Michigan, Minnesota, New York, Nevada, North Dakota,

Ohio, Pennsylvania and Virginia, totaling approximately 3.8 million

rentable square feet (including approximately 1.1 million rentable

square feet under development/redevelopment), which were 99.1%

leased (based on square footage) with a weighted-average remaining

lease term of approximately 15.9 years. As of March 11, 2020, IIP

had invested approximately $611.0 million in the aggregate

(excluding transaction costs) and had committed an additional

approximately $168.6 million to reimburse certain tenants and

sellers for completion of construction and tenant improvements at

IIP’s properties. IIP’s average current yield on invested capital

is approximately 13.2% for these 53 properties, calculated as (a)

the sum of the current base rents, supplemental rent (with respect

to the lease with a tenant at one of IIP’s New York properties) and

property management fees (after the expiration of applicable base

rent abatement or deferral periods), divided by (b) IIP’s aggregate

investment in these properties (excluding transaction costs and

including aggregate potential development/redevelopment funding and

tenant reimbursements of approximately $168.6 million). These

statistics do not include up to approximately $15.9 million that

may be funded in the future pursuant to IIP’s lease with a tenant

at one of IIP’s Illinois properties, or the approximately $35.7

million that may be funded in the future pursuant to IIP’s lease

with a tenant at one of IIP’s Massachusetts properties, as the

tenants at those properties may not elect to have IIP disburse

those funds to them and pay IIP the corresponding base rent on

those funds. These statistics also treat IIP’s Los Angeles,

California property as not leased, due to the tenant’s ongoing

default in its obligation to pay rent at that location.

About Innovative Industrial Properties

Innovative Industrial Properties, Inc. is a self-advised

Maryland corporation focused on the acquisition, ownership and

management of specialized industrial properties leased to

experienced, state-licensed operators for their regulated

medical-use cannabis facilities. Innovative Industrial Properties,

Inc. has elected to be taxed as a real estate investment trust,

commencing with the year ended December 31, 2017. Additional

information is available at

www.innovativeindustrialproperties.com.

About Parallel

Parallel (formerly Surterra Wellness) is a leading global

company that is pioneering human well-being and improving quality

of life for humanity through the benefits of cannabinoids. Parallel

is one of the fastest growing cannabis companies in the world with

vertical operations in Florida, Texas, Nevada, and Massachusetts, a

developing international footprint in the European Union (EU),

South America and Asia, a global retail brand, Goodblend, and a

diverse portfolio of high quality, proprietary consumer brands,

including Surterra Wellness, Coral Reefer, Endless Summer, and

Float. Parallel’s business also includes Massachusetts’ New England

Treatment Access (NETA), a leading vertical cannabis operation with

regional retail dispensaries and consumer brands; Molecular

Infusions (Mi), a cannabis based biopharmaceutical company; and

Nevada’s The Apothecary Shoppe, a vertical cannabis dispensary.

Parallel’s integrated footprint includes 42 retail dispensaries

across the United States (US), including 39 in Florida, cultivation

and manufacturing operations across the platform, R&D

facilities in Massachusetts, Florida, and Budapest, Hungary, and an

exclusive partnership with global biotechnology company Intrexon to

drive its science and technology-led innovation. Parallel follows

rigorous operational and business practices to ensure the quality,

safety, consistency and efficacy of its products, and is building a

business based on strong values to be the gold standard for the

industry. For more information: www.liveParallel.com.

Innovative Industrial Properties

Forward-Looking Statements

This press release contains statements that IIP believes to be

“forward-looking statements” within the meaning of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

All statements other than historical facts, including, without

limitation, statements regarding the lease of the Florida property,

Parallel and the Florida regulated cannabis market, are

forward-looking statements. When used in this press release, words

such as we “expect,” “intend,” “plan,” “estimate,” “anticipate,”

“believe” or “should” or the negative thereof or similar

terminology are generally intended to identify forward-looking

statements. Such forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ

materially from those expressed in, or implied by, such statements.

Investors should not place undue reliance upon forward-looking

statements. IIP disclaims any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200311005750/en/

IIP Contact: Catherine Hastings Chief Financial Officer, Chief

Accounting Officer and Treasurer Innovative Industrial Properties,

Inc. (858) 997-3332

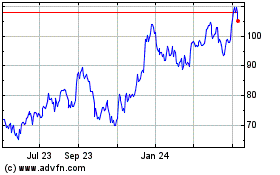

Innovative Industrial Pr... (NYSE:IIPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

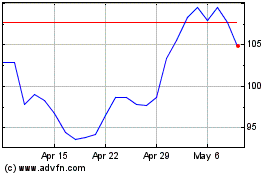

Innovative Industrial Pr... (NYSE:IIPR)

Historical Stock Chart

From Apr 2023 to Apr 2024