Innovative Industrial Properties Announces Tax Treatment of 2019 Distributions

January 30 2020 - 7:00AM

Business Wire

Innovative Industrial Properties, Inc. (the “Company”) (NYSE:

IIPR) today announced the tax treatment of its 2019 distributions

as follows:

Security Description: Common

Stock

CUSIP: 45781V101

Ticker Symbol: IIPR

Record Date

Payable Date

Total Distribution Per

Share

Allocable to

2019

Taxable Ordinary

Dividend

Return of

Capital

Long-Term Capital

Gain

Unrecaptured

Section 1250 Gain

Section

199A

Dividend(1)

12/31/2018

01/15/2019

$0.350000

$0.149887

$0.149887

$0.000000

$0.000000

$0.000000

$0.149887

03/29/2019

04/15/2019

$0.450000

$0.450000

$0.450000

$0.000000

$0.000000

$0.000000

$0.450000

06/28/2019

07/15/2019

$0.600000

$0.600000

$0.600000

$0.000000

$0.000000

$0.000000

$0.600000

09/30/2019

10/15/2019

$0.780000

$0.780000

$0.780000

$0.000000

$0.000000

$0.000000

$0.780000

12/31/2019

01/15/2020

$1.000000

$0.510000

$0.510000

$0.000000

$0.000000

$0.000000

$0.510000

Totals

$3.180000

$2.489887

$2.489887

$0.000000

$0.000000

$0.000000

$2.489887

Security Description: 9.00%

Series A Cumulative Redeemable Preferred Stock

CUSIP: 45781V200

Ticker Symbol: IIPR PR

A

Record Date

Payable Date

Total Distribution

Per Share

Allocable to 2019

Taxable Ordinary

Dividend

Return of

Capital

Long-Term Capital

Gain

Unrecaptured Section

1250 Gain

Section

199A

Dividend(1)

03/29/2019

04/15/2019

$0.562500

$0.562500

$0.562500

$0.000000

$0.000000

$0.000000

$0.562500

06/28/2019

07/15/2019

$0.562500

$0.562500

$0.562500

$0.000000

$0.000000

$0.000000

$0.562500

09/30/2019

10/15/2019

$0.562500

$0.562500

$0.562500

$0.000000

$0.000000

$0.000000

$0.562500

12/31/2019

01/15/2020

$0.562500

$0.562500

$0.562500

$0.000000

$0.000000

$0.000000

$0.562500

Totals

$2.250000

$2.250000

$2.250000

$0.000000

$0.000000

$0.000000

$2.250000

- These amounts are a subset of, and included in, Taxable

Ordinary Dividend amounts.

The common stock distribution with a record date of December 31,

2019 will be a split-year distribution with $0.51 allocable to 2019

for federal income tax purposes and $0.49 allocable to 2020 for

federal income tax purposes.

As previously disclosed by the Company on February 11, 2019 in

its press release announcing the tax treatment of 2018 dividends,

the common stock distribution with a record date of December 31,

2018 was a split-year distribution with $0.200113 allocable to 2018

for federal income tax purposes and $0.149887 allocable to 2019 for

federal income tax purposes, and the 9.00% Series A Cumulative

Redeemable Preferred Stock distribution with a record date of

December 31, 2018 was allocable entirely to 2018 for federal income

tax purposes.

The Company did not incur any foreign taxes in 2019.

Stockholders are encouraged to consult with their personal tax

advisors as to their specific tax treatment of the Company's

distributions.

About Innovative Industrial Properties

Innovative Industrial Properties, Inc. is a self-advised

Maryland corporation focused on the acquisition, ownership and

management of specialized industrial properties leased to

experienced, state-licensed operators for their regulated

medical-use cannabis facilities. Innovative Industrial Properties,

Inc. has elected to be taxed as a real estate investment trust,

commencing with the year ended December 31, 2017. Additional

information is available at

www.innovativeindustrialproperties.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200130005216/en/

Catherine Hastings Chief Financial Officer, Chief Accounting

Officer and Treasurer Innovative Industrial Properties, Inc. (858)

997-3332

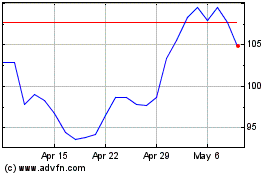

Innovative Industrial Pr... (NYSE:IIPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

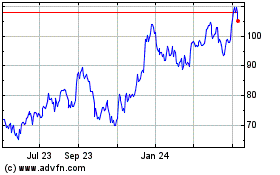

Innovative Industrial Pr... (NYSE:IIPR)

Historical Stock Chart

From Apr 2023 to Apr 2024