Current Report Filing (8-k)

March 16 2023 - 4:44PM

Edgar (US Regulatory)

false000169001200016900122023-03-162023-03-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 16, 2023 |

InPoint Commercial Real Estate Income, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

001-40833 |

32-0506267 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2901 Butterfield Road |

|

Oak Brook, Illinois |

|

60523 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (800) 826-8228 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

6.75% Series A Cumulative Redeemable Preferred Stock, par value $0.001 per share |

|

ICR PR A |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 8.01 Other Events.

Determination of February 28, 2023 NAV per Share

InPoint Commercial Real Estate Income, Inc. (the “Company,” “we,” “our”) calculates net asset value (“NAV”) per share in accordance with the valuation guidelines that have been approved by its board of directors (the “Board”). Our NAV per share, which is updated as of the last calendar day of each month, is posted on our website at www.inland-investments.com/inpoint. The “Net Asset Value Calculation and Valuation Guidelines” section of our prospectus for our public offering (SEC Registration No. 333-264540), as supplemented, contains details regarding how our NAV is determined. Inland InPoint Advisor, LLC, our Advisor, is ultimately responsible for determining our NAV. We have included a breakdown of the components of total net asset value attributable to common stock and NAV per share for February 28, 2023.

Our total net asset value attributable to all classes of our common stock in the aggregate is presented in the following table. As of February 28, 2023, we had not sold any Class S shares of common stock in our public offering. As previously announced, on January 30, 2023, our Board unanimously approved the suspension of the sale of shares in the primary portion of our public offering and through our amended and restate distribution reinvestment plan. The following table provides a breakdown of the major components of our total net asset value attributable to common stock as of February 28, 2023 ($ and shares in thousands, except per share data):

|

|

|

|

|

Components of NAV |

|

February 28, 2023 |

|

Commercial mortgage loans (1) |

|

$ |

818,312 |

|

Real estate owned, net |

|

|

19,000 |

|

Cash and cash equivalents and restricted cash |

|

|

24,012 |

|

Other assets |

|

|

7,438 |

|

Repurchase agreements - commercial mortgage loans |

|

|

(481,609 |

) |

Credit facility payable |

|

|

(18,380 |

) |

Loan participations sold |

|

|

(78,196 |

) |

Reserve for expected future losses on real estate owned (2) |

|

|

(1,311 |

) |

Due to related parties |

|

|

(2,226 |

) |

Distributions payable |

|

|

(1,050 |

) |

Interest payable |

|

|

(1,008 |

) |

Accrued stockholder servicing fees (3) |

|

|

(168 |

) |

Other liabilities |

|

|

(4,675 |

) |

Preferred stock |

|

|

(87,085 |

) |

Net asset value attributable to common stock |

|

$ |

193,054 |

|

Number of outstanding shares |

|

|

10,114 |

|

Aggregate NAV per share |

|

$ |

19.0878 |

|

(1)As of January 1, 2023, we adopted Accounting Standards Update 2016-13, “Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”), which changes how entities measure credit losses for financial assets measured at amortized cost under generally accepted accounting principles. Under this guidance, there is a measure of expected credit losses of financial assets (in this case, commercial mortgage loans) when the assets on a collective (pool) basis share similar risk characteristics, including but not limited to, internal risk ratings and expected credit loss patterns. In the process of adoption during Q1 2023, information pertaining to the value of a loan’s underlying collateral came to our attention that caused us to record a specific reserve of $3,628 on that loan. Per the NAV policy approved by our board of directors, the reserve for expected credit losses for the assets recorded on a collective (pool) basis are not included in our calculation of the NAV. The specific reserve on the loan with potential impairment is included in the February 28, 2023 NAV calculation. This adjustment had not been reflected in our December 31, 2022 NAV and January 31, 2023 NAV calculations reported in prospectus supplement no. 3 to our base prospectus dated November 2, 2022 (supplement filed with the SEC on January 17, 2023 in Form 424B3) and our Form 8-K filed on February 15, 2023, respectively.

(2)As of December 31, 2020, we established as a component of the NAV calculation a $2,250 reserve for the estimated negative impact of COVID-19 during 2021 on real estate owned (“REO”). We increased this reserve by an additional $1,000 and $1,366 as of December 31, 2021 and December 31, 2022, respectively. Management assesses the balance of the reserve periodically in light of future income projections. The estimated total income for 2023 assumes that the REO would generate net losses in certain months in 2023. Net income generated by the REO is typically not offset by an increase to the amount reserved for losses unless management believes the reserve balance would not be sufficient to cover expected future losses on REO. During February 2023, the REO generated a net loss of $157.

(3)Stockholder servicing fees only apply to Class T, Class S, and Class D shares. For purposes of NAV, we recognize the stockholder servicing fee as a reduction of NAV on a monthly basis as such fee is paid. Under accounting principles

generally accepted in the United States of America (“GAAP”), we accrue the full cost of the stockholder servicing fee as an offering cost at the time we sell Class T, Class S, and Class D shares. As of February 28, 2023, we have accrued under GAAP $645 of stockholder servicing fees payable to Inland Securities Corporation (the “Dealer Manager”) related to the Class T and Class D shares sold. As of February 28, 2023, we have not sold any Class S shares and, therefore, we have not accrued any stockholder servicing fees payable to the Dealer Manager related to Class S shares. The Dealer Manager does not retain any of these fees, all of which are retained by, or reallowed (paid) to, participating broker-dealers and servicing broker-dealers for ongoing stockholder services performed by such broker-dealers.

The following table provides our total NAV attributable to common stock and NAV for each class of common stock in each case as of February 28, 2023 ($ and shares in thousands, except per share data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAV Per Share |

|

Class P |

|

|

Class A |

|

|

Class T |

|

|

Class S |

|

|

Class D |

|

|

Class I |

|

|

Total |

|

Net asset value attributable to common stock |

|

$ |

163,346 |

|

|

$ |

14,268 |

|

|

$ |

5,569 |

|

|

$ |

— |

|

|

$ |

918 |

|

|

$ |

8,940 |

|

|

$ |

193,054 |

|

Number of outstanding shares |

|

|

8,563 |

|

|

|

746 |

|

|

|

290 |

|

|

|

— |

|

|

|

48 |

|

|

|

467 |

|

|

|

10,114 |

|

NAV per share as of February 28, 2023 |

|

$ |

19.0763 |

|

|

$ |

19.1283 |

|

|

$ |

19.1792 |

|

|

$ |

— |

|

|

$ |

19.1195 |

|

|

$ |

19.1253 |

|

|

$ |

19.0878 |

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

INPOINT COMMERCIAL REAL ESTATE INCOME, INC. |

|

|

|

|

Date: |

March 16, 2023 |

By: |

/s/ Catherine L. Lynch |

|

|

|

Catherine L. Lynch

Chief Financial Officer |

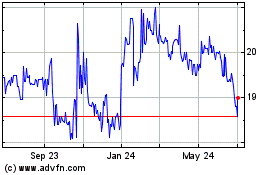

InPoint Commercial Real ... (NYSE:ICR-A)

Historical Stock Chart

From Mar 2024 to Apr 2024

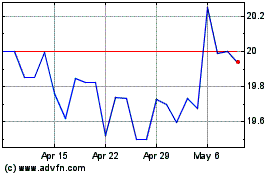

InPoint Commercial Real ... (NYSE:ICR-A)

Historical Stock Chart

From Apr 2023 to Apr 2024