Current Report Filing (8-k)

January 31 2023 - 6:10AM

Edgar (US Regulatory)

false000169001200016900122023-01-302023-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 30, 2023 |

InPoint Commercial Real Estate Income, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

001-40833 |

32-0506267 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2901 Butterfield Road |

|

Oak Brook, Illinois |

|

60523 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (800) 826-8228 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

6.75% Series A Cumulative Redeemable Preferred Stock, par value $0.001 per share |

|

ICR PR A |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: Certain statements in this Current Report on Form 8-K constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Words such as “may,” “could,” “should,” “expect,” “intend,” “plan,” “goal,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “variables,” “potential,” “continue,” “expand,” “maintain,” “create,” “strategies,” “likely,” “will,” “would” and variations of these terms and similar expressions indicate forward-looking statements. These forward-looking statements reflect the intent, belief or current expectations of our management based on their knowledge and understanding of the business and industry, the economy and other future conditions. These statements are not factual or guarantees of future performance, and we caution stockholders not to place undue reliance on them. Actual results may differ materially from those expressed or forecasted in forward-looking statements due to a variety of risks, uncertainties and other factors, including but not limited to risks related to blind pool offerings, best efforts offerings, use of short-term financing, borrower defaults, changing interest rates, the effects of the COVID-19 pandemic, particularly on hospitality and retail properties, including our hotel, and on related mortgage loans and securities, and other risks detailed in the Risk Factors section in our most recent Annual Report on Form 10-K and in subsequent filings on Form 10-Q as filed with the Securities and Exchange Commission and made available on our website. Forward-looking statements reflect our management’s view only as of the date they are made and may ultimately prove to be incorrect. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results except as required by applicable law. We intend for these forward-looking statements to be covered by the applicable safe harbor provisions created by Section 27A of the Securities Act and Section 21E of the Exchange Act.

Item 8.01 Other Events.

Distribution to Stockholders of Record as of January 31, 2023

On January 30, 2023, the Board of Directors of InPoint Commercial Real Estate Income, Inc. (the "Company") has authorized a distribution for each class of its common stock in the amount per share set forth below.

|

|

|

|

|

|

|

|

|

|

|

|

|

January 31, 2023 Record Date |

|

|

|

Gross

Distribution |

|

|

Stockholder

Servicing Fee |

|

|

Net

Distribution |

|

Class A Common Stock |

|

$ |

0.1042 |

|

|

N/A |

|

|

$ |

0.1042 |

|

Class D Common Stock |

|

$ |

0.1042 |

|

|

$ |

0.0042 |

|

|

$ |

0.1000 |

|

Class I Common Stock |

|

$ |

0.1042 |

|

|

N/A |

|

|

$ |

0.1042 |

|

Class P Common Stock |

|

$ |

0.1042 |

|

|

N/A |

|

|

$ |

0.1042 |

|

Class T Common Stock |

|

$ |

0.1042 |

|

|

$ |

0.0142 |

|

|

$ |

0.0900 |

|

The net distributions for each class of common stock (which represent the gross distribution less any stockholder servicing fees for the applicable class of common stock) are payable to stockholders of record as of close of business January 31, 2023 and will be paid on or about February 17, 2023. These distributions will be paid in cash or reinvested in shares of the Company's common stock for stockholders participating in the Company's distribution reinvestment plan.

Suspension of Share Repurchase Plan, Primary Offering, and Distribution Reinvestment Plan

In light of the pace of fundraising in the Company’s current public offering and the amount of monthly redemption requests pursuant to the Company’s share repurchase plan (the “SRP”), which are currently in excess of such fundraising, on January 30, 2023, the Company’s board of directors (the “Board”) unanimously approved, effective immediately, the suspension of the operation of the SRP. In connection with such suspension, the Board has also unanimously approved the suspension of the sale of shares in the primary portion of the public offering (the “Primary Offering”), effective immediately, and the suspension of the sale of shares pursuant to the Company’s amended and restated distribution reinvestment plan (the “DRP”), effective as of February 10, 2023. The Primary Offering, the SRP, and the DRP shall each remain suspended unless and until such time as the Board approves their resumption. In connection with the foregoing, the Board has decided to evaluate strategic alternatives available to the Company.

Termination of Series A Preferred Repurchase Program

The Board previously authorized and approved a share repurchase program (the “Series A Preferred Repurchase Program”) pursuant to which the Company was permitted to repurchase up to the lesser of 1,000,000 shares or $15,000,000 of the outstanding shares of the Company’s 6.75% Series A Cumulative Redeemable Preferred Stock through December 31, 2022 (later extended through December 31, 2023). On January 30, 2023, the Board unanimously approved the termination of the Series A Preferred Repurchase Program.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

INPOINT COMMERCIAL REAL ESTATE INCOME, INC. |

|

|

|

|

Date: |

January 30, 2023 |

By: |

/s/ Mitchell A. Sabshon |

|

|

|

Mitchell A. Sabshon

Chief Executive Officer |

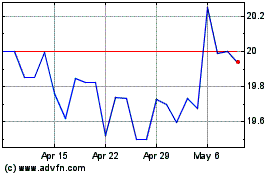

InPoint Commercial Real ... (NYSE:ICR-A)

Historical Stock Chart

From Mar 2024 to Apr 2024

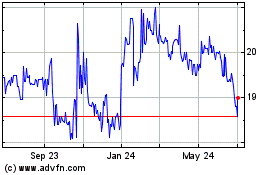

InPoint Commercial Real ... (NYSE:ICR-A)

Historical Stock Chart

From Apr 2023 to Apr 2024