Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

January 17 2023 - 4:16PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-264540

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

SUPPLEMENT NO. 3 DATED JANUARY 17, 2023 TO THE

PROSPECTUS DATED NOVEMBER 2, 2022

This prospectus supplement no. 3 (this “Supplement”) is part of and should be read in conjunction with the base prospectus of InPoint Commercial Real Estate Income, Inc. dated November 2, 2022, prospectus supplement no. 1 dated November 15, 2022 and prospectus supplement no. 2 dated December 15, 2022 (collectively the “prospectus”). Unless otherwise defined herein, capitalized terms used in this Supplement shall have the same meanings as in the prospectus.

The purposes of this Supplement are as follows:

•to disclose the transaction price as of February 1, 2023, the first business day of the month, for each class of our common stock being offered and sold in this offering; and

•to disclose our NAV per share as of December 31, 2022.

Transaction Prices

The transaction price for each share class of our common stock for subscriptions to be accepted as of February 1, 2023, the first business day of the month, and for distribution reinvestments is as follows:

|

|

|

|

|

|

|

Transaction

Price (per share) |

|

Class A |

|

$ |

19.5252 |

|

Class T |

|

$ |

19.5743 |

|

Class S |

|

$ |

19.4829 |

|

Class D |

|

$ |

19.5159 |

|

Class I |

|

$ |

19.5218 |

|

As of December 31, 2022, we had not sold any Class S shares. The February 1, 2023 transaction price for our Class S shares is based on our aggregate NAV for all share classes as of December 31, 2022. The purchase price of our common stock for each share class equals the transaction price of such class, plus applicable upfront selling commissions and dealer manager fees. A detailed calculation of the NAV per share is set forth below. No transactions or events have occurred since December 31, 2022 that would have a material impact on our NAV per share.

December 31, 2022 NAV per Share

We calculate NAV per share in accordance with the valuation guidelines that have been approved by our board of directors. Our NAV per share, which is updated as of the last calendar day of each month, is posted on our website at www.inland-investments.com/inpoint. Please refer to “Net Asset Value Calculation and Valuation Guidelines” in the prospectus, as supplemented, for how our NAV is determined. The Advisor is ultimately responsible for determining our NAV. The valuation of our commercial real estate loan portfolio is reviewed by our independent valuation advisor. We have included a breakdown of the components of total net asset value attributable to common stock and NAV per share for December 31, 2022.

Our total net asset value attributable to common stock presented in the following table includes the NAV of our Class A, Class T, Class S, Class D, and Class I common stock being sold in this offering, as well as our Class P common stock, which is not being sold in this offering. As of December 31, 2022, we had not sold any Class S shares. The following table provides a breakdown of the major components of our total net asset value attributable to common stock as of December 31, 2022 ($ and shares in thousands, except per share data):

|

|

|

|

|

Components of NAV |

|

December 31, 2022 |

|

Commercial mortgage loans |

|

$ |

845,866 |

|

Real estate owned, net |

|

|

19,000 |

|

Cash and cash equivalents and restricted cash |

|

|

29,408 |

|

Other assets |

|

|

8,298 |

|

Repurchase agreements - commercial mortgage loans |

|

|

(488,086 |

) |

Credit facility payable |

|

|

(18,380 |

) |

Loan participations sold |

|

|

(99,420 |

) |

Reserve for negative impact of COVID on real estate owned (1) |

|

|

(1,874 |

) |

Due to related parties |

|

|

(2,197 |

) |

Distributions payable |

|

|

(1,047 |

) |

Interest payable |

|

|

(1,499 |

) |

Accrued stockholder servicing fees (2) |

|

|

(160 |

) |

Other liabilities |

|

|

(7,199 |

) |

Preferred stock |

|

|

(86,069 |

) |

Net asset value attributable to common stock |

|

$ |

196,641 |

|

Number of outstanding shares |

|

|

10,093 |

|

Aggregate NAV per share |

|

$ |

19.4829 |

|

(1)As of December 31, 2020, we established as a component of the NAV calculation a $2,250 reserve for the estimated negative impact of COVID-19 during 2021 on real estate owned (“REO”). We increased this reserve by an additional $1,000 and $1,366 as of December 31, 2021 and December 31, 2022, respectively. Management assesses the balance of the reserve periodically in light of future income projections. The estimated total income for 2023 assumes that the REO would generate net losses in certain months in 2023. Net income generated by the REO is typically not added to the reserve balance unless management believes the reserve balance would not be sufficient to cover expected future losses on REO. During December 2022, the REO generated a net loss of $288.

(2)Stockholder servicing fees only apply to Class T, Class S, and Class D shares. For purposes of NAV, we recognize the stockholder servicing fee as a reduction of NAV on a monthly basis as such fee is paid. Under accounting principles generally accepted in the United States of America (“GAAP”), we accrue the full cost of the stockholder servicing fee as an offering cost at the time we sell Class T, Class S, and Class D shares. As of December 31, 2022, we have accrued under GAAP $641 of stockholder servicing fees payable to the Dealer Manager related to the Class T and Class D shares sold. As of December 31, 2022, we have not sold any Class S shares and, therefore, we have not accrued any stockholder servicing fees payable to the Dealer Manager related to Class S shares. The Dealer Manager does not retain any of these fees, all of which are retained by, or reallowed (paid) to, participating broker-dealers and servicing broker-dealers for ongoing stockholder services performed by such broker-dealers.

The following table provides a breakdown of our total net asset value attributable to common stock and NAV per share by share class as of December 31, 2022 ($ and shares in thousands, except per share data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAV Per Share |

|

Class P |

|

|

Class A |

|

|

Class T |

|

|

Class S |

|

|

Class D |

|

|

Class I |

|

|

Total |

|

Net asset value attributable to common stock |

|

$ |

166,741 |

|

|

$ |

14,511 |

|

|

$ |

5,605 |

|

|

$ |

— |

|

|

$ |

935 |

|

|

$ |

8,837 |

|

|

$ |

196,641 |

|

Number of outstanding shares |

|

|

8,563 |

|

|

|

743 |

|

|

|

286 |

|

|

|

— |

|

|

|

48 |

|

|

|

453 |

|

|

|

10,093 |

|

NAV per share as of December 31, 2022 |

|

$ |

19.4728 |

|

|

$ |

19.5252 |

|

|

$ |

19.5743 |

|

|

$ |

— |

|

|

$ |

19.5159 |

|

|

$ |

19.5218 |

|

|

$ |

19.4829 |

|

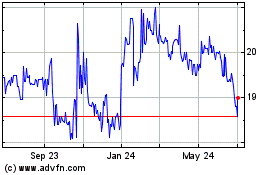

InPoint Commercial Real ... (NYSE:ICR-A)

Historical Stock Chart

From Mar 2024 to Apr 2024

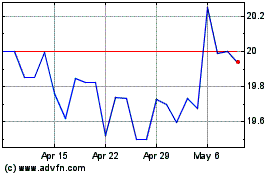

InPoint Commercial Real ... (NYSE:ICR-A)

Historical Stock Chart

From Apr 2023 to Apr 2024