IBM's Revenue Growth in Latest Period Beats Wall Street Expectations--Update

April 19 2021 - 6:50PM

Dow Jones News

By Maria Armental

International Business Machines Corp. posted higher revenue

ahead of a landmark split of the business this year that is part of

Chief Executive Arvind Krishna's plan to revive growth at the

veteran tech company.

IBM on Monday said first quarter sales rose about 1% to $17.73

billion, generating net income of $955 million. Wall Street on

average expected sales of $17.32 billion and net income of $1.28

billion, according to FactSet.

IBM still expects revenue to grow this year and anticipates $11

billion to $12 billion in adjusted free cash flow for the year.

IBM shares rose more than 3% in after-hours trading. The stock

is up about 11% in the past 12 months.

Mr. Krishna, in the top job a year, has pledged to restore

growth at IBM this year after a prolonged period of stagnation. The

company expects revenue to return to growth and projects about $11

billion to $12 billion in adjusted free cash flow for the year and

$12 billion to $13 billion in 2022.

"While it's still early in the year and a lot remains to be

done, we are confident enough to say that we are on track," Mr.

Krishna said in a conference call with analysts, adding that

customer spending patterns have strengthened.

"Strong performance this quarter in cloud, driven by increasing

client adoption of our hybrid cloud platform, and growth in

software and consulting enabled us to get off to a solid start for

the year," Mr. Krishna said in a statement, adding: "While we have

more work to do, we are confident we can achieve full-year revenue

growth and meet our adjusted free cash flow target in 2021.

The company is preparing to spin off a major part of its

information-technology services operations.

Mr. Krishna said he would focus IBM on the booming field of

cloud-computing and artificial intelligence. In the latest quarter,

total cloud revenue rose about 21% to $6.5 billion.

IBM has undertaken a number of acquisitions to bolster both

areas, including the purchase of software company Red Hat that

closed in 2019, to strengthen its efforts in the so-called

hybrid-cloud where customers mix on-site and cloud-based data

storage and processing tools. IBM last week said it had agreed to

buy for an undisclosed amount a small Italian company, called

myInvenio, that it said would advance both its AI and hybrid cloud

activities.

The company last week said that the services business it plans

to spin off by the end of this year would be called Kyndryl and be

based in New York City. It will be run by IBM veteran Martin

Schroeter,

The IT services operations that IBM is partly shedding were

central to former Chief Executive Lou Gerstner's drive in the 1990s

to transform the company from a lumbering tech giant focused on

computing hardware to a huge player in services that were booming

at the time. The spinoff announcement comes a few months after the

Armonk, N.Y., company said it was eliminating an unspecified number

of jobs.

IBM also is exploring the potential sales of Watson Health, The

Wall Street Journal previously reported.

The unit, which employs artificial intelligence to help

hospitals, insurers and drugmakers manage their data, was once a

flagship initiative for Mr. Krishna's predecessor, Ginni Rometty,

isn't currently profitable, people familiar with the matter have

said.

Mr. Krishna, on the call, said its Watson product line, which

goes beyond health, "remains critically important to us. To be

absolutely clear, Watson is the brand product name for our AI

capabilities."

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

April 19, 2021 18:35 ET (22:35 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

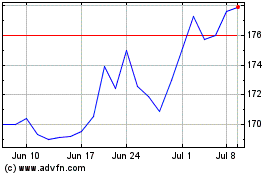

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

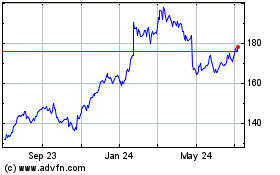

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024