IBM Shares Are an Anomaly in a Hot Tech Sector

January 22 2021 - 2:21PM

Dow Jones News

By Akane Otani

International Business Machines Corp.'s stock is falling.

Again.

The tech company, whose shares have declined steadily since

peaking in 2013, slid 11% Friday after reporting a drop in sales

for every quarter of 2020.

The stock move puts IBM's performance among Dow components in a

familiar spot: at the bottom.

IBM was the single biggest drag on the blue-chip index between

its climb from 20000 in January 2017 to 30000 last November,

according to a Dow Jones Market Data analysis. Although the stock

market rose to numerous records over that time, IBM shares fell,

shaving 367 points off the Dow.

The trend has persisted since then, with IBM ranking among the

worst-performing Dow components since the 30000 milestone.

If IBM were a different company -- say, an oil producer,

regional bank or airline -- its underperformance might not be as

surprising. But its business lies squarely in technology. That

makes its fall from the biggest U.S. company in the 1980s to

yearslong underdog all the more of an anomaly in an era when

investors have handsomely rewarded technology stocks of all stripes

-- from industry-dominating companies like Apple Inc., Amazon.com

Inc. and Microsoft Corp. to newer public-market entrants like

exercise bike maker Peloton Interactive Inc. and Etsy Inc., the

online retailer selling everything from macramé plant hangers to

kitschy birthday cards.

For context, IBM has a market capitalization of about $119

billion, according to FactSet. That is a fraction of Apple's $2.3

trillion and Amazon and Microsoft's $1.7 trillion.

The simple answer for IBM's stock performance? It hasn't

delivered the growth expected of technology companies. Although IBM

snapped a 22-quarter streak of falling sales in January 2018,

briefly reviving some investors' hopes for a successful turnaround,

it has largely failed to post strong results since then, trailing

behind rivals like Amazon and Microsoft in the cloud computing

business.

Chief Executive Arvind Krishna has said he is confident IBM's

renewed focus on artificial intelligence and hybrid cloud platform

will allow it to return to revenue growth in 2021. Between that and

encouraging increased risk-taking among employees, IBM "will look

different at the end of the year," he said.

But Friday's stock slide shows investors are skeptical.

So while the run-up in technology shares has been nothing short

of eye-catching, Big Blue's woes show that investors are far from

indiscriminate buyers.

There's a cautionary tale in it all, one analyst said.

"We're in this weird time where some of these tech names and

their moats seem totally impenetrable," said Ross Mayfield, an

investment strategy analyst at Baird. "But as entrenched as we

think the FAANG names are, all you have to do is take a look at IBM

to know that can change."

Write to Akane Otani at akane.otani@wsj.com

(END) Dow Jones Newswires

January 22, 2021 14:06 ET (19:06 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

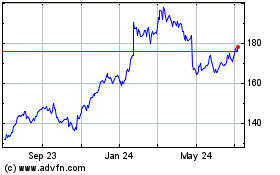

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

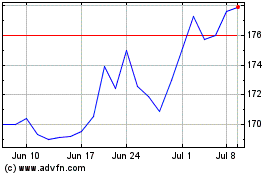

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024