IBM Strengthens Hybrid Cloud With Red Hat Acquisition

July 12 2019 - 6:14PM

Dow Jones News

By Angus Loten

International Business Machines Corp.'s $34 billion deal to buy

Red Hat Inc., which closed this week, boosts its standing in the

hybrid cloud market.

Companies use the hybrid cloud to manage software and other

systems across different cloud services and their own data

centers.

The acquisition announced in October also gives IBM some

traction in its effort to gain ground on cloud-market front-runners

Amazon.com Inc. and Microsoft Corp., information-technology

executives and industry analysts said.

Red Hat's open-source software enables IT managers to modernize

older applications and run them both in data centers and across

various cloud providers, among other features.

Despite early predictions that cloud services would take over

every company's IT needs, in-house data centers show no sign of

fading. Research and advisory firm Gartner Inc. this week said

global spending on data-center systems will hit $208 billion by

2020, up 2.8% from 2019.

"Hybrid and multi-cloud is a top-of-mind issue for CIOs across

many organizations," said Chirag Dekate, senior director and

analyst for artificial-intelligence infrastructure and emerging

technologies at Gartner.

Businesses on average use four cloud vendors for software, three

for platforms and two for infrastructure, according to a survey

last year of 550 corporate IT decision makers by data and marketing

company International Data Group Inc. Most of these companies had

shifted only about half of their IT systems and software to the

cloud, continuing to use in-house data centers, IDG found.

IBM's Red Hat deal "speaks to how essential it's become for

organizations deploying a hybrid cloud strategy to coordinate

multiple clouds in use," said Paul Gaynor, a senior technology

analyst at PricewaterhouseCoopers LLP.

Connecting separate cloud services is crucial for letting

organizations put their data to work, he said, enabling them to

sort, group and analyze it quickly and securely.

The deal also puts IBM in a better position to close the gap

with cloud market leaders Amazon and Microsoft, though "it's still

going to be an uphill battle," said Mark Sami, vice president of

delivery management at SPR, an IT-services company.

The two companies were cited as the preferred vendors in over

half of the IT spending intentions of roughly 800 CIOs and other

high-level corporate decision makers in a survey this year by

market-research firm ETR.

Through its acquisition of Red Hat, IBM is likely to benefit as

more businesses are drawn to hybrid cloud strategies that offer

improved flexibility and security in managing workloads -- boosting

IBM's standing in the cloud market, said Tim Beerman, chief

technology officer of IT-services firm Ensono.

Some industry watchers worry about Red Hat's ability to continue

innovating in the open-source space under IBM, though the tech

giant has said it would let Red Hat operate independently.

Write to Angus Loten at angus.loten@wsj.com

(END) Dow Jones Newswires

July 12, 2019 17:59 ET (21:59 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

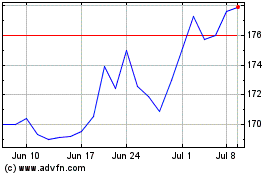

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

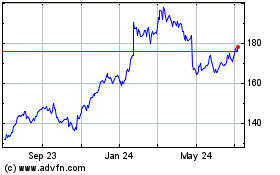

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024