Current Report Filing (8-k)

December 01 2020 - 7:38AM

Edgar (US Regulatory)

false000004907100000490712020-12-012020-12-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest

event reported): December 1, 2020 (December 1, 2020)

Humana Inc.

(Exact Name of Registrant as Specified in Charter)

500 W. Main Street,

Louisville, Kentucky 40202

(Address of Principal Executive Offices, and Zip Code)

(502) 580-1000

Registrant’s Telephone Number, Including Area Code

(Former Name or Former Address, if Changed Since Last

Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instruction A.2. below):

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities

Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Members of Humana Inc.’s (the “Company”) senior management team are scheduled to meet with investors at various times between

December 1, 2020 and December 31, 2020. During the meetings, the Company intends to reaffirm its guidance range of $24.70 to $24.95 in diluted earnings per common share (“EPS”), or a range of $18.50 to $18.75 in adjusted earnings per common share

(“Adjusted EPS”), in each case for the year ending December 31, 2020 (“FY 2020”). FY 2020 EPS guidance reflects fourth quarter 2020 losses of approximately $2.55 EPS, or approximately $2.40 in Adjusted EPS. This guidance is consistent with the guidance

issued in Humana’s press release dated November 3, 2020. The date and time of presentations to investors are available via the Investor Relations calendar of events on Humana’s website at humana.com.

The Company has included Adjusted EPS in this current report, a financial measure that is not in accordance with Generally

Accepted Accounting Principles (“GAAP”). Management believes that this measure, when presented in conjunction with the comparable measure of GAAP EPS, is useful to both management and its investors in analyzing the Company’s ongoing business and

operating performance. Consequently, management uses Adjusted EPS as an indicator of the Company’s business performance, as well as for operational planning and decision making purposes. Adjusted EPS should be considered in addition to, but not as a

substitute for, or superior to, GAAP EPS. A reconciliation of GAAP EPS to Adjusted EPS follows:

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: December 1, 2020

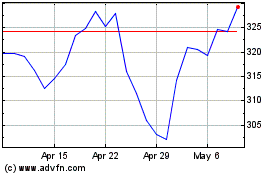

Humana (NYSE:HUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

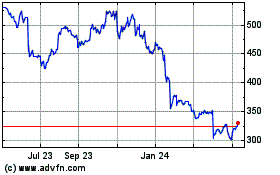

Humana (NYSE:HUM)

Historical Stock Chart

From Apr 2023 to Apr 2024