Bankrupt Hertz Sets Up Another Round of Executive Bonuses

August 28 2020 - 4:45PM

Dow Jones News

By Peg Brickley

Hertz Global Holdings Inc. wants to hand out a further $14.6

million in bonuses to executives, months after the car-rental

company shelled out $16.2 million in extra pay meant to keep

executives from leaving as the Covid-19 pandemic upended the travel

industry.

Hertz filed for chapter 11 protection in May, its business

shredded by pandemic-related restrictions.

Before filing for bankruptcy, Hertz laid off thousands of

employees and handed out retention bonuses to key leaders. The move

was part of a trend in corporate bankruptcy, where distressed

companies hand out retention bonuses, or "stay pay," just before

they file for bankruptcy protection. Retention payments are almost

impossible for top executives to get after a company files for

bankruptcy.

Chief Financial Officer Jamere Jackson resigned this month and

forfeited his retention bonus.

Hertz is sealing much of the information about which employees

are in line for the latest round of bonuses.

The judge overseeing Hertz's bankruptcy would need to sign off

on the new round of pay enhancements, which the company detailed in

court papers filed Thursday. They are styled as "incentive"

bonuses, which are supposed to drive performance.

If it succeeds, Hertz's second bonus round could drive Chief

Executive Paul Stone's extra pay to $2 million in less than a year,

as he leads a company that has no clear path to survival. Mr. Stone

took the job and a $700,000 "retention bonus" in May. Assuming the

CEO is the executive in line for the highest incentive award, $1.26

million, Mr. Stone could have a lucrative first year on the job.

His annual base salary is $1 million.

Hundreds of key employees could be paid under the incentive

plans, including senior management. For executives further down the

ladder, bonuses are in the range of $10,000 to $15,000, court

papers say.

Fifteen years ago, Congress responded to public outrage over

bonuses for top executives of companies that went bankrupt and

wiped out thousands of jobs. "Retention" bonuses were banned,

unless an executive could show he or she had a better job offer and

would leave.

To get around the ban on stay pay, bankruptcy lawyers began

crafting incentive programs, selling judges on the idea that the

law didn't prevent companies from rewarding executives for hitting

performance targets.

These have been routinely approved, often over the protests of

federal bankruptcy watchdogs who argued they were merely disguised

retention bonuses and shouldn't have been allowed.

So far this year, various companies filing for bankruptcy amid

the coronavirus pandemic have paid out bonuses. The CEOs of Hertz,

GNC Holdings Inc., Ascena Retail Group Inc., Tailored Brands Inc.,

J.C. Penney Co., Neiman Marcus Group Ltd. and other companies have

received such pay shortly before their employers filed for

bankruptcy.

Such moves were rare until recently.

"I think there was some reluctance to pay pre-bankruptcy

retention bonuses as unseemly, but once the line was crossed, the

behavior became somewhat normalized," said Adam Levitin, a

Georgetown University law professor.

There was no need to seek a bankruptcy judge's permission,

because the judge has no jurisdiction until a petition is

filed.

Hertz's pre-bankruptcy retention bonuses could be subject to

clawback actions by junior creditors.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

August 28, 2020 16:30 ET (20:30 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

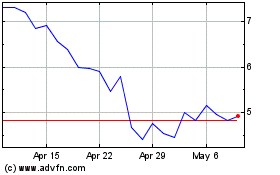

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

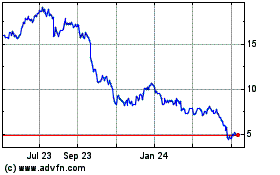

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Apr 2023 to Apr 2024