Prospectus Supplement

John Hancock Capital Series

John Hancock Investment Trust

John Hancock Investment Trust II

John Hancock Classic Value Fund

John Hancock Financial Industries Fund

John Hancock Fundamental Large Cap Core Fund (the funds)

Supplement dated October 6, 2022 to each current Prospectus, as may be

supplemented (each, a Prospectus)

On September 9, 2022, at a special meeting, the shareholders of each fund

approved the adoption of a “manager of managers” structure. Accordingly, the following supplements the section of each fund’s

Prospectus entitled “Fund details — Who’s who — Investment advisor”:

The fund relies on an order from the Securities and Exchange Commission

(SEC) permitting the advisor, subject to approval by the Board of Trustees, to appoint a subadvisor or change the terms of a subadvisory

agreement without obtaining shareholder approval. The fund, therefore, is able to change subadvisors or the fees paid to a subadvisor,

from time to time, without the expense and delays associated with obtaining shareholder approval of the change. This order does not, however,

permit the advisor to appoint a subadvisor that is an affiliate of the advisor or the fund (other than by reason of serving as a subadvisor

to the fund), or to increase the subadvisory fee of an affiliated subadvisor, without the approval of the shareholders.

You should read this supplement in conjunction with each Prospectus and

retain it for your future reference.

Manulife, Manulife Investment Management, Stylized M Design, and Manulife

Investment Management & Stylized M Design are trademarks of The Manufacturers Life Insurance Company and are used by its affiliates

under license.

Prospectus Supplement

John Hancock Investment Trust

John Hancock Fundamental Large Cap Core Fund (the fund)

Supplement dated October 6, 2022 to the current John Hancock Investment

Trust – Class NAV Prospectus, as may be supplemented (the Prospectus)

On September 9, 2022, at a special meeting, the shareholders of the fund

approved the adoption of a “manager of managers” structure. Accordingly, the following amends and restates the similar paragraph

in the section of the Prospectus entitled “Fund details — Who’s who — Investment advisor”:

Each fund relies on an order from the Securities and Exchange Commission

(SEC) permitting the advisor, subject to approval by the Board of Trustees, to appoint a subadvisor or change the terms of a subadvisory

agreement without obtaining shareholder approval. Each fund, therefore, is able to change subadvisors or the fees paid to a subadvisor,

from time to time, without the expense and delays associated with obtaining shareholder approval of the change. This order does not, however,

permit the advisor to appoint a subadvisor that is an affiliate of the advisor or the fund (other than by reason of serving as a subadvisor

to the fund), or to increase the subadvisory fee of an affiliated subadvisor, without the approval of the shareholders.

You should read this supplement in conjunction with the Prospectus and

retain it for your future reference.

Manulife, Manulife Investment Management, Stylized M Design, and Manulife

Investment Management & Stylized M Design are trademarks of The Manufacturers Life Insurance Company and are used by its affiliates

under license.

Statement of Additional Information Supplement

John Hancock Capital Series

John Hancock Investment Trust

John Hancock Fundamental Large Cap Core Fund

John Hancock Classic Value Fund (the funds)

Supplement dated October 6, 2022 to the current

statement of additional information, as may be supplemented (the SAI)

On September 9, 2022, at a special joint meeting, the shareholders of the

funds approved a proposal to amend the funds’ advisory agreement with John Hancock Investment Management LLC (the Advisor).

The following amends and replaces the narrative disclosure in the section

of each fund’s SAI entitled “Investment Management Arrangements and Other Services — Advisory Agreement — Advisor

Compensation” concerning the funds’ investment advisory agreements with the Advisor, but does not replace any information

concerning investment advisory fees payable or paid by the funds or amend any disclosure concerning the funds’ subadvisory arrangements.

Advisor Compensation. As compensation for its advisory services under

each Advisory Agreement, the Advisor receives a fee from the relevant Trust computed separately for each relevant fund. The amount of

the advisory fee is determined by applying the daily equivalent of an annual fee rate to the net assets of the fund. Each fund other than

U.S. Global Leaders Growth Fund pays the advisory fee daily. U.S. Global Leaders Growth Fund pays the advisory fee monthly in arrears.

The management fees a fund currently is obligated to pay the Advisor are as set forth in its Prospectus.

From time to time, the Advisor may reduce its fee or make other arrangements

to limit a fund’s expenses to a specified percentage of average daily net assets. The Advisor retains the right to re-impose a fee

and recover any other payments to the extent that, during the fiscal year in which such expense limitation is in place, the fund’s

annual expenses fall below this limit.

The following amends and replaces existing disclosure in the section of

each fund’s SAI entitled “Investment Management Arrangements and Other Services — Service Agreement and Accounting and

Legal Services Agreement,” but does not replace any information concerning service fees payable or paid by the funds.

Service Agreement and Accounting and Legal Services Agreement

Pursuant to (i) a Service Agreement with Capital Series (with respect to

Classic Value Fund only), Investment Trust (all series), and Investment Trust II (all series); and (ii) an Accounting and Legal Services

Agreement with Capital Series (with respect to U.S. Global Leaders Growth Fund only), the Advisor is responsible for providing, at the

expense of the applicable Trust or Trusts, certain financial, accounting and administrative services such as legal services, tax, accounting,

valuation, financial reporting and performance, compliance and service provider oversight. Pursuant to the Service Agreement, the Advisor

shall determine, subject to Board approval, the expenses to be reimbursed by each fund, including an overhead allocation. Pursuant to

the Accounting and Legal Services Agreement, such expenses shall not exceed levels that are fair and reasonable in light of the usual

and customary charges made by others for services of the same nature and quality. The payments under the Service Agreement and the Accounting

and Legal Services Agreement are not intended to provide a profit to the Advisor. Instead, the Advisor provides the services under the

Service Agreement and the Accounting and Legal Services Agreement because it also provides advisory services under the Advisory Agreement.

Pursuant to each Agreement, the reimbursement shall be calculated and paid monthly in arrears.

The Advisor is not liable for any error of judgment or mistake of law or

for any loss suffered by a fund in connection with the matters to which the Service Agreement or the Accounting and Legal Services Agreement

relates, except losses resulting from willful misfeasance, bad faith or negligence by the Advisor in the performance of its duties or

from reckless disregard by the Advisor of its obligations under either Agreement.

The Service Agreement and the Accounting and Legal Services Agreement each

had an initial term of two years, and continues thereafter so long as such continuance is specifically approved at least annually by a

majority of the Board and a majority of the Independent Trustees. The Trust, on behalf of any or all of the funds, or the Advisor may

terminate either Agreement at any time without penalty on 60 days’ written notice to the other party. Either Agreement may be amended

by mutual written agreement of the parties, without obtaining shareholder approval.

You should read this supplement in conjunction with the SAI and retain

it for your future reference.

Manulife, Manulife Investment Management, Stylized M Design, and Manulife

Investment Management & Stylized M Design are trademarks of The Manufacturers Life Insurance Company and are used by its affiliates

under license.

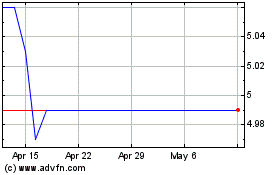

John Hancock Tax Advanta... (NYSE:HTY)

Historical Stock Chart

From Mar 2024 to Apr 2024

John Hancock Tax Advanta... (NYSE:HTY)

Historical Stock Chart

From Apr 2023 to Apr 2024