By Annie Gasparro

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 14, 2020).

Kraft Heinz Co. and other big food makers are ramping up

advertising after years of cost cutting, recognizing a need to

rekindle enthusiasm for their condiments, candies and snacks.

Kraft Heinz, which reported lower fourth-quarter sales on

Thursday, said additional spending was necessary to bolster its

strongest products as shoppers have drifted toward lower-price

store brands and newer niche products.

"You need to nurture brands, take care of them, to keep them

meaningful after 150 years," Chief Executive Miguel Patricio said

in an interview.

Shares in Kraft Heinz fell 7.6% to $27.77 after the maker of

Oscar Mayer meats and Jell-O desserts reported $6.54 billion in

quarterly sales, short of analyst expectations and down 5.1% from a

year earlier.

Other food makers are also boosting marketing after years

focused on cost cuts that accelerated profits but crimped sales

growth. Hershey Co., Kellogg Co., Unilever SA and Oreo-maker

Mondelez International Inc. are all spending more on advertisements

and in-store promotions.

"That's how we connect with consumers and keep our brands

relevant," Hershey CEO Michele Buck said in an interview.

Hershey's advertising expenses in North America rose 5% in the

fourth quarter, and the chocolatier ran a commercial for its new

Reese's Take 5 bar during this year's Super Bowl.

Kellogg also bought ads during the Super Bowl for Pringles and

Pop-Tarts, snack brands the company is counting on to help make up

for tepid cereal sales.

"That's the big leagues," Steve Cahillane, Kellogg's chief

executive, said of paying a lofty price for the impact of a Super

Bowl commercial. He said it is worth taking a temporary hit to

profit if it fosters long-term sales potential. TV broadcaster Fox

Corp. charged as much as $5.6 million for 30 seconds of advertising

time during this year's National Football League championship

game.

Mondelez increased ad spending for the first time in five years

in 2019, to $1.21 billion from $1.17 billion the year before, and

it plans to spend more again this year.

Some companies say they are paying for new marketing with cuts

elsewhere. Unilever, maker of Hellmann's mayonnaise and Breyers ice

cream, increased marketing spending by roughly $75 million last

year. Chief Executive Alan Jope said the funds came from savings

generated through zero-based budgeting, a method of aggressive

cost-management popularized by 3G Capital, a Brazilian firm

invested in Kraft Heinz and other consumer-goods companies.

At Kraft Heinz, 3G stripped out nearly $2 billion in annual

spending after the 2015 merger of Kraft Foods and H.J. Heinz. But

the company has fallen short of its sales goals. Last year it also

reduced the value of some of its best-known brands by a combined

$17 billion.

Mr. Patricio, who took over after the biggest of the

write-downs, is now investing again, leading to lower margins for

key brands including Oscar Mayer deli meat and Philadelphia cream

cheese.

Kraft Heinz on Thursday lowered the value of its Maxwell House

brand by $213 million. The coffee has fared poorly amid the rise in

high-end, trendy coffee and new flavors. Kraft Heinz also lost

market share in cheese and cold cuts in the quarter, while

condiment sales remained strong.

Mr. Patricio, who took over last June, said Kraft Heinz would

continue to spend more on marketing for big brands that drive

profitability. He didn't name those brands. Analysts expect Heinz

condiments, Philadelphia cream cheese and Planters nuts to be among

the brands drawing increased investments.

Last year, Kraft Heinz embarked on its first global ad campaign

to mark Heinz's 150th anniversary. The company collaborated with

singer Ed Sheeran -- who has a tattoo of the Heinz logo on his arm

-- to sell a limited-edition ketchup dubbed "Edchup."

This year, Kraft Heinz is increasing spending on television ads

and other consumer-oriented marketing by 30% while cutting

less-visible expenses like agency fees. Mr. Patricio said he aims

to make the company's supply chain more efficient and reduce the

complexity of its sprawling operations to fund new investments.

"We could put the savings on the bottom line, but that's not

what we want to do. We want to invest in our brands," he said.

For the fourth quarter, Kraft Heinz posted a 2.2% drop in

comparable sales globally, including a 2.7% decline in the U.S.,

its biggest market. The sales metric excludes the effect of

currency fluctuations, mergers and divestitures.

The company's profit for the period was $182 million, or 15

cents a share, compared with a loss of $12.57 billion a year

earlier. Excluding certain items affecting comparability, its

adjusted profit of 72 cents a share beat analyst estimates by four

cents.

Micah Maidenberg

contributed to this article.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

February 14, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

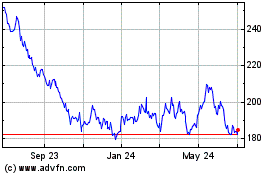

Hershey (NYSE:HSY)

Historical Stock Chart

From Mar 2024 to Apr 2024

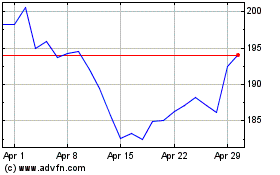

Hershey (NYSE:HSY)

Historical Stock Chart

From Apr 2023 to Apr 2024