Hostess Brands Buying Wafer Maker for $320 Million -- Update

December 02 2019 - 5:33PM

Dow Jones News

By Micah Maidenberg

The maker of Twinkies wants to expand its portfolio with a new

bet on wafers, cookies and sugar-free treats.

Hostess Brands Inc. on Monday said it struck a deal to buy

Voortman Cookies Ltd. for about $320 million in cash from Swander

Pace Capital, a private-equity firm that acquired a majority stake

in the baker in 2015.

Founded in 1951, Voortman makes cookies but is known for being

the leader among companies that produce creme-filled wafers and

sugar-free cookies, according to Hostess. Voortman's wafers come in

a range of flavors, from lemon to chocolate hazelnut to pumpkin

spice, and are made with and without sugar.

American consumers have expressed concerns about sugar amid

changing dietary preferences, with 38% saying in a Pew Research

Center survey last year that they had limited their intake of the

ingredient.

Still, Mondelez International Inc. has seen gains due in part to

its Oreo cookies. Hershey Co. said in October that North American

retail-level sales were up in a 12-week period compared with the

year earlier.

Ontario, Canada-based Voortman's products will help diversify

Hostess's lineup of products, which include classic sweet-baked

goods like Twinkies, Ding Dongs and Zingers, company executives

said. Its offerings have grown about 5% over the past three years

on a compound basis, more than double the 1.8% growth rate for the

broader cookie category, according to Hostess.

"They are by far the leader in sugar-free cookies and they are

by far the leader within the wafer platform. So they have a very

nice niche," Hostess Chief Executive Andrew Callahan said on a

conference call.

Hostess expects the deal to be completed in early January and is

targeting $15 million in annualized cost savings in procurement,

operations and other tasks.

It also expects the acquisition to boost adjusted earnings

before interest, taxes, depreciation and amortization by at least

$40 million by 2022.

Colin Kellaher contributed to this article.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

December 02, 2019 17:18 ET (22:18 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

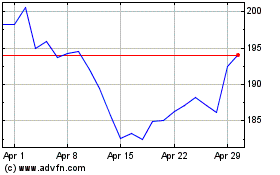

Hershey (NYSE:HSY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hershey (NYSE:HSY)

Historical Stock Chart

From Apr 2023 to Apr 2024