Current Report Filing (8-k)

May 21 2020 - 4:15PM

Edgar (US Regulatory)

Hewlett Packard Enterprise Company0001645590false00016455902020-05-192020-05-21

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

|

|

|

|

|

|

|

|

|

|

|

FORM

|

8-K

|

|

|

|

|

|

|

|

CURRENT REPORT

|

|

|

|

|

|

|

|

|

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

|

|

|

|

May 19, 2020

|

|

|

|

|

Date of Report (Date of Earliest Event Reported)

|

|

|

|

|

|

|

|

|

|

HEWLETT PACKARD ENTERPRISE COMPANY

|

|

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-37483

|

|

47-3298624

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6280 AMERICA CENTER DRIVE,

|

SAN JOSE,

|

CA

|

95002

|

|

|

(Address of principal executive offices)

|

|

|

(Zip code)

|

|

|

|

|

|

|

|

|

|

(650)

|

687-5817

|

|

(Registrant’s telephone number, including area code)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, par value $0.01 per share

|

|

HPE

|

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

☐

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

|

|

|

|

|

|

|

Item 2.02

|

Results of Operations and Financial Condition.

|

|

|

|

|

The information contained in this Item 2.02 and in the accompanying Exhibit 99.1 shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

|

|

|

|

|

On May 21, 2020, Hewlett Packard Enterprise Company (“HPE”) issued a press release relating to segment results for its fiscal quarter ended April 30, 2020. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

|

|

|

|

|

|

|

|

Item 2.05

|

Costs Associated with Exit or Disposal Activities.

|

|

|

|

On May 19, 2020, the Board of Directors of HPE (the "Board") approved a cost optimization and prioritization plan (the “plan”) in order to focus HPE’s investments and realign the workforce to areas of growth and measures to simplify and evolve its product portfolio strategy, go-to-market configurations, supply chain structures, digital customer support model and marketing experiences, and real estate strategies. HPE expects that the plan will be implemented through fiscal 2022 and estimates it will include gross savings as a result of changes to the company’s workforce, real estate model and business process improvements of at least $1 billion, with the plan expected to deliver annualized net run-rate savings of at least $800 million by FY22-end, in both cases relative to HPE’s fiscal year 2019 exit.

In order to achieve this level of cost savings, HPE estimates cash funding payments between $1 billion to $1.3 billion over the next three years.

|

|

|

|

|

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

|

|

|

In response to the impact and uncertainty caused by the coronavirus (COVID-19) pandemic, on May 19, 2020, the Board also approved certain base salary adjustments for the period beginning on July 1, 2020 through the remainder of fiscal 2020, as follows: the base salaries of the Chief Executive Officer, and of each executive officer at the Executive Vice President level, will be reduced by 25%, and the base salary of each executive officer at the Senior Vice President level will be reduced by 20%. The Board also agreed to reduce by 25% the portion of the annual $100,000 cash retainer to which each director is entitled for the period beginning on July 1, 2020 through the remainder of fiscal 2020.

|

|

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

(d) Exhibits.

|

|

|

|

|

Exhibit Number

|

Description

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HEWLETT PACKARD ENTERPRISE COMPANY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE: May 21, 2020

|

By:

|

/s/ RISHI VARMA

|

|

|

|

|

Name:

|

Rishi Varma

|

|

|

|

|

Title:

|

Senior Vice President, General Counsel

and Assistant Secretary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

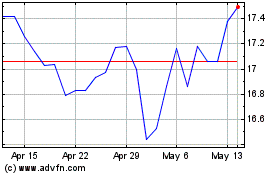

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

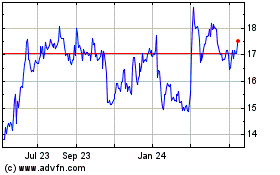

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

From Apr 2023 to Apr 2024