HP to Cut Up to 9,000 Jobs in New CEO's Restructuring Plan

October 03 2019 - 7:28PM

Dow Jones News

By Maria Armental

Incoming HP Inc. Chief Executive Enrique Lores is moving quickly

to imprint changes on the computer hardware maker with plans to

shrink the company's ranks by as much as 16% in a restructuring

plan that also aims to revive lagging printer sales.

HP Thursday said it could eliminate 7,000 to 9,000 jobs from its

roughly 55,000 workforce over the next three years. The cuts, once

completed, should yield annual savings of about $1 billion, the

company said at its annual securities-analyst meeting. HP is

nearing the end of a three-year-old layoff plan that could

eliminate up to 5,000 jobs.

HP has been under pressure in recent quarters from a decline in

the printing-supplies business that was once its biggest

moneymaker. To help reinject growth, it plans to offer new ways to

sell its products.

Before the printer business encountered difficulties, HP had

enjoyed stronger-than-expected growth since Hewlett-Packard Co. in

2015 split the company that Bill Hewlett and Dave Packard started

in their Palo Alto, Calif., garage in 1939. The other business,

Hewlett Packard Enterprise Co., focuses on selling computer

servers, data-storage gear and other services for

corporate-technology departments and was widely seen as the company

with more promising growth prospects.

Despite a decline in industrywide PC sales since 2015, HP has

expanded its market share, even as its total shipments also

declined, according to Gartner Inc.

Mr. Lores, who has run the HP printer business since the split,

in August was named to succeed CEO Dion Weisler, who said he was

leaving the company for family health reasons.

HP historically sold printers at a discount and then made money

on ink cartridges, not unlike companies that sell razors at a

discount and make their profit on the blades. "That model made

sense when the goal was to penetrate more consumer homes and more

offices," said Mr. Lores, who is slated to take over as CEO on Nov.

1.

But users' habits have been changing. Customers have migrated to

buying their ink cartridges from other, cheaper vendors and have

become more judicious in what documents they choose to print,

hurting HP's business.

So HP is changing the sales model. It will still offer customers

the option of buying their discounted printers, but then will lock

them into buying ink from HP. It is not unlike smartphones that are

"locked" to a particular service provider. Customers also can opt

to purchase printers at a higher price that would allow them to use

third-party ink cartridges, Mr. Lores said.

HP, which is set to report fiscal fourth-quarter financial

results next month, said it would take an initial $100 million

charge in the period tied to the new restructuring plan.

The cuts, company officials said Thursday, would allow them to

redirect additional money to areas of growth and shareholder

returns through a combination of higher dividend payouts and share

repurchases.

But in the short term the restructuring will weigh on the

company's bottom line. On Thursday, company officials said they

expect to deliver $1.98 to $2.10 a share for the year that ends

Oct. 31, 2020, below the $2.18 analysts surveyed by FactSet were

forecasting.

On an adjusted basis, which would strip out the restructuring

costs and other items, company officials projected a profit of

$2.22 to $2.32 a share, compared with analysts' projected $2.24 a

share.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

October 03, 2019 19:13 ET (23:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

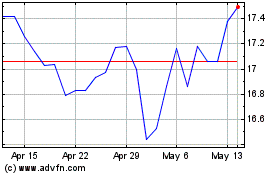

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

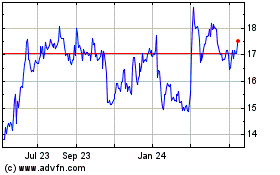

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

From Apr 2023 to Apr 2024