Report of Foreign Issuer (6-k)

February 08 2019 - 7:44AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

Form 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR

15d-16 UNDER THE SECURITIES

EXCHANGE ACT OF

1934

For February 8,

2019

Harmony Gold Mining Company

Limited

Randfontein

Office Park

Corner Main Reef

Road and Ward Avenue

Randfontein,

1759

South

Africa

(Address of principal executive

offices)

*-

(Indicate by

check mark whether the registrant files or will file annual reports

under cover of Form 20- F or Form 40-F.)

(Indicate by

check mark whether the registrant by furnishing the information

contained in this form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.)

Harmony Gold

Mining Company Limited

Registration

number 1950/038232/06

Incorporated in

the Republic of South Africa

ISIN:

ZAE000015228

JSE share code:

HAR

(“Harmony”

and/or “the Company”)

Operating overview and trading statement for the six months

ended

31

December 2018

Johannesburg, Friday, 8 February 2019.

Harmony Gold Mining Company Limited (“Harmony” or the

“Company”) announces an update on its operating results

and provides a trading statement relating to its interim results

for the six months ended 31 December 2018

(“H1FY19”).

Overview of H1FY19 operating performance

Harmony’s

investments in Hidden Valley and Moab Khotsong have boosted

production and contributed significantly to the group’s

operational free cash flow.

Gold production

for the group was 751 000oz for the six months ended 31 December

2018, a 34% increase compared to the six months ended 31 December

2017.

All-in sustaining

costs for the group increased by 6% to R528 265/kg for the six

months ended 31 December 2018, compared to R500 248/kg for the six

months ended 31 December 2017.

Headline and basic earnings

In terms of

paragraph 3.4(b) of the Listings Requirements of the JSE Limited

(JSE), a company listed on the JSE is required to publish a trading

statement as soon as they are satisfied that a reasonable degree of

certainty exists that the financial results for the period to be

reported upon next will differ by at least 20% from the financial

results for the previous corresponding period.

Shareholders of

Harmony are advised that a reasonable degree of certainty exists

that earnings for the six months ended 31 December 2018

(“H1FY19”) will be lower than for the corresponding six

months ended 31 December 2017 (“the previous comparable

period” or “H1FY18”) primarily due

to:

a)

an increase in amortisation

and depreciation for the Hidden Valley operation as a result of the

mine reaching commercial levels of production in June

2018;

b)

a reported translation loss

on the US$ denominated debt at 31 December 2018; and

c)

lower derivative gains

recorded in H1FY19.

Headline earnings

per share (“HEPS”) are expected to be between 7 and 29

South African cents – a decrease of approximately 87% to 97%

reported for the previous comparable period (which was 224 South

African cents). In US dollar terms, HEPS are expected to be between

1 and 3 US cents per share, which is between 83% to 97% lower than

the headline earnings of 15 US cents per share reported for the

previous comparable period.

Earnings per

share (“EPS”) are expected to decrease to between 6 and

26 South African cents per share, which is between 87% and 97%

lower than the 203 South African cents per share reported for the

previous comparable period. In US dollar terms, the earnings per

share is expected to be between 0 and 3 US cents per share, which

is between 83% and 97% lower than the earnings of 15 US cents per

share reported for the previous comparable period.

a)

Amortisation

and depreciation

A depreciation

charge (non-cash) of R915 million (US$65 million) was recorded for

Hidden Valley for the six months ended 31 December 2018 (compared

to R19 million (US$1 million) for the six months ended

31 December

2017). Hidden Valley reached commercial levels of production in

June 2018.

A translation

loss of R180 million was recognised on the US$ denominated debt as

at 31 December 2018, compared to a translation gain of

R196 million

recorded in the previous comparable period.

c)

Lower

derivative gains

Included in

H1FY19 were derivative gains of R20 million (US$1 million) compared

to R337 million (US$25 million) in H1FY18.

The financial

information on which this trading statement has been based has not

been reviewed or reported on by Harmony’s external

auditors.

Harmony will

publish its interim financial results for the six months ended 31

December 2018 on Tuesday, 12 February 2019.

For more details

contact:

Lauren

Fourie

Investor

Relations Manager

+27(0)71 607 1498

(mobile)

Marian van der

Walt

Executive:

Investor Relations

+27(0)82 888 1242

(mobile)

Johannesburg,

South Africa

8 February

2019

Sponsor:

J.P. Morgan

Equities South Africa Proprietary Limited

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused

this report to be signed on

its behalf by the undersigned, thereunto duly

authorized.

|

|

Harmony Gold Mining Company

Limited

|

|

|

|

|

|

|

|

Date:

February 8,

2019

|

By:

|

/s/

Frank Abbott

|

|

|

|

|

Name

Frank

Abbott

|

|

|

|

|

Title

Financial

Director

|

|

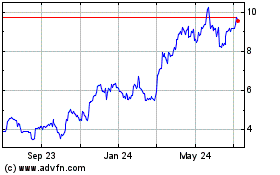

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

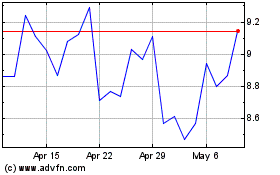

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Apr 2023 to Apr 2024