Filed pursuant to Rule 424(b)(3)

Registration No. 333-259040

Prospectus Supplement No. 2

(To Prospectus dated April 29, 2022)

HIPPO HOLDINGS INC.

This prospectus supplement updates, amends, and supplements the prospectus dated April 29, 2022, as previously amended (the “Prospectus”), which forms a part of our Registration Statement on Form S-1 (Registration No. 333-259040). Capitalized terms used in this prospectus supplement and not otherwise defined herein have the meanings specified in the Prospectus.

This prospectus supplement is being filed to update, amend, and supplement the information included in the Prospectus with the information contained in our Current Reports on Form 8-K (the “Current Reports”), filed with the SEC on June 6, 2022 and June 8, 2022. Accordingly, we have attached the Current Reports to this prospectus supplement.

This prospectus supplement is not complete without the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus, which is to be delivered with this prospectus supplement, and is qualified by reference thereto, except to the extent that the information in this prospectus supplement updates or supersedes the information contained in the Prospectus. Please keep this prospectus supplement with your Prospectus for future reference.

Hippo Holdings Inc.’s common stock and warrants are listed on the New York Stock Exchange under the symbols “HIPO” and “HIPO.WS.” On June 6, 2022, the closing price of our common stock was $1.36 and the closing price of our warrants was $0.25.

We are an “emerging growth company” under federal securities laws and are subject to reduced public company reporting requirements. Investing in our securities involves certain risks. See “Risk Factors” beginning on page 8 of the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is June 8, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 6, 2022

Hippo Holdings Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39711 | | 32-0662604 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

150 Forest Avenue

Palo Alto, California 94301

650 294-8463

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.0001 par value per share | | HIPO | | New York Stock Exchange |

| Warrants to purchase common stock | | HIPO.WS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 3, 2022, the board of directors (the “Board”) of Hippo Holdings Inc. (the “Company”) appointed Richard McCathron as the Company’s Chief Executive Officer, to succeed Assaf Wand upon Mr. Wand’s appointment as the Company’s Executive Chairman of the Board, each effective as of June 6, 2022 (the “Effective Date”). Mr. McCathron has served as the Company’s President since 2017. Prior to joining the Company, Mr. McCathron held senior executive positions at various insurance companies including First Connect Insurance as its President and Chief Executive Officer from October 2012 to February 2017, Home Value Protection, Inc. as its Chief Revenue Officer from April 2011 to March 2012, Superior Access Insurance Services as its President and Chief Executive Officer from June 2007 to October 2010, and Mercury Insurance Group as its Regional Vice President from April 2004 to June 2007. Mr. McCathron is both a Chartered Property and Casualty Underwriter and a Certified Insurance Counselor and sits on the board of directors of Spinnaker Insurance Company and First Connect Insurance Services LLC. He is an advisor for several other insurtech companies and holds a B.S. in Finance from Oregon State University. The compensation of Mr. McCathron has not changed. In light of his role change, Mr. Wand’s annual salary was reduced from $600,000 to $250,000.

Item 7.01 - Regulation FD Disclosure

On June 6, 2022, the Company issued a press release announcing the appointment of Mr. McCathron as Chief Executive Officer, and the appointment of Mr. Wand as Executive Chairman of the Board. The full text of the press release is furnished as Exhibit 99.1 to this Form 8-K and is incorporated by reference in this Item 7.01.

The information in this Item 7.01 of this Form 8-K and Exhibit 99.1 is being furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | |

| Exhibit Number | Exhibit Title or Description |

| 99.1 | Press Release dated June 6, 2022 |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 6, 2022

| | | | | | | | |

| HIPPO HOLDINGS, INC. |

| |

| By: | | /s/ STEWART ELLIS |

| | Stewart Ellis |

| | Chief Financial Officer |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 8, 2022

Hippo Holdings Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39711 | | 32-0662604 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

150 Forest Avenue

Palo Alto, California 94301

650 294-8463

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.0001 par value per share | | HIPO | | New York Stock Exchange |

| Warrants to purchase common stock | | HIPO.WS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07. Submission of Matters to a Vote of Security Holders.

On June 8, 2022, Hippo Holdings Inc. (the “Company”) held its Annual Meeting of Stockholders (the “Annual Meeting”). The proposals considered at the Annual Meeting are described in detail in the Company’s 2022 definitive proxy statement filed with the U.S. Securities and Exchange Commission on April 19, 2022. Present at the Annual Meeting in person, by remote communication or by proxy were holders of 319,805,316 shares of the Company’s common stock, representing a majority in voting power of the Company’s issued and outstanding shares entitled to vote as of April 14, 2022, the record date for the Annual Meeting, and constituting a quorum under the Company’s Bylaws. The following proposals were voted upon and the final results with respect to each such proposal are set forth below:

1.Election of Directors

The stockholders elected the three persons named below as directors of the Company, each to serve until the Annual Meeting of Stockholders to be held in 2025 and until each such director’s respective successor is duly elected and qualified or until each such director’s earlier death, resignation, disqualification or removal. The results of such vote were:

| | | | | | | | | | | | | | | | | | | | |

| | FOR | | WITHHELD | | BROKER NON-VOTES |

| Eric Feder | | 217,073,124 | | 22,987,123 | | 79,745,069 |

Sam Landman | | 217,063,186 | | 22,997,061 | | 79,745,069 |

Noah Knauf | | 217,081,176 | | 22,979,072 | | 79,745,068 |

2.Ratification of Appointment of Independent Registered Public Accounting Firm

The stockholders ratified the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. The results of such vote were:

| | | | | | | | | | | | | | | | | | | | |

| FOR | | AGAINST | | ABSTAIN | | BROKER NON-VOTES |

| 314,978,594 | | 4,737,558 | | 89,164 | | 0 |

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | |

| Exhibit Number | Exhibit Title or Description |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 8, 2022

| | | | | | | | |

| HIPPO HOLDINGS, INC. |

| |

| By: | | /s/ STEWART ELLIS |

| | Stewart Ellis |

| | Chief Financial Officer |

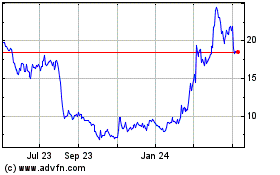

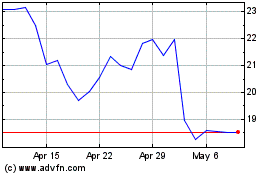

Hippo (NYSE:HIPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hippo (NYSE:HIPO)

Historical Stock Chart

From Apr 2023 to Apr 2024