Hess Midstream to Acquire Hess Infrastructure for $6.2 Billion

October 04 2019 - 8:26AM

Dow Jones News

By Dave Sebastian

Hess Midstream Partners LP (HESM) said it would acquire Hess

Infrastructure Partners in a move aimed at simplifying its

structure.

The deal includes Hess Infrastructure's water-services business,

its 80% interest in Hess Midstream's oil and gas midstream assets

and outstanding economic partner interest and incentive

distribution rights in Hess Midstream. The companies value the cash

and stock deal at $6.2 billion.

Hess Infrastructure is a midstream energy joint venture between

Hess Corp. (HES) and the infrastructure private-equity firm Global

Infrastructure Partners.

Hess Corp. and Global Infrastructure will each own 47% of the

combined midstream company. The companies will also each receive

$275 million in cash.

The deal "simplifies the ownership structure of Hess Midstream,

provides transparency on the value of Hess' midstream interests,

and positions Hess Midstream for sustainable growth and value

creation," Hess Corp. Chief Executive John Hess said.

Hess Midstream said it would assume about $1.15 billion of

existing Hess Infrastructure debt and would issue about 230 million

Hess Midstream units.

The combined entity's organizational structure would be

converted into an "Up-C," in which payments in incentive

distribution rights to sponsors are eliminated, Hess Midstream

said.

Hess Midstream said the transaction would boost distributable

cash flow per unit in 2020 by 6% and more than 15% in 2021 and

2022.

Hess Midstream said it expects its 2020 net income to be between

$440 million and $480 million, and for adjusted earnings before

interest, taxes, depreciation and amortization of $710 million to

$750 million.

Hess Midstream said it expects the deal to close in the fourth

quarter.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

October 04, 2019 08:11 ET (12:11 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

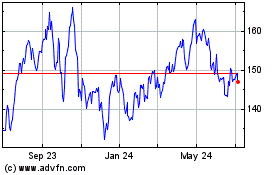

Hess (NYSE:HES)

Historical Stock Chart

From Mar 2024 to Apr 2024

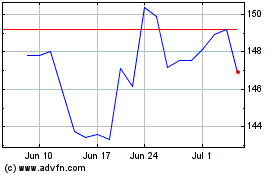

Hess (NYSE:HES)

Historical Stock Chart

From Apr 2023 to Apr 2024