Hess Corporation to Receive Cash and Equity from Sale of Hess Infrastructure Partners LP to Hess Midstream Partners LP

October 04 2019 - 7:09AM

Business Wire

Hess Corporation (NYSE: HES) will receive approximately $275

million in cash and approximately 115 million newly issued units in

Hess Midstream Partners LP (NYSE: HESM) as part of a proposed

transaction announced today by HESM.

Under the terms of the proposed transaction, HESM will acquire

Hess Infrastructure Partners LP (HIP), a 50/50 joint venture

between Hess Corporation and Global Infrastructure Partners,

including HIP’s 80% interest in HESM’s oil and gas midstream

assets, HIP’s water services business and the outstanding economic

general partner interest and incentive distribution rights in HESM.

In addition, HESM’s organizational structure will convert from a

master limited partnership (MLP) into an “Up-C” structure in which

HESM’s public unitholders will receive newly issued securities in a

new public entity to be named “Hess Midstream LP” (“Hess

Midstream”). Upon completion of the transaction, Hess Corporation

will own approximately 134 million HESM units, or 47 percent of

Hess Midstream on a consolidated basis, valued at approximately

$2.6 billion based on the closing price per HESM common unit on

Oct. 2, 2019.

Hess Corporation Chief Executive Officer John Hess said: “This

transaction is compelling for all parties involved and was

unanimously approved by each company’s board of directors. It

simplifies the ownership structure of Hess Midstream, provides

transparency on the value of Hess’ midstream interests, and

positions Hess Midstream for sustainable growth and value creation

as a large-scale, publicly traded midstream company accessible to a

broad range of investors.”

“Hess Midstream will continue to play an important role in

supporting Hess’ production growth in the Bakken, where we have a

premier acreage position and a 15 year inventory of high return

drilling locations. In turn, Hess’ production growth in the Bakken

along with third parties are expected to drive Hess Midstream’s

industry leading earnings growth through 2021,” Hess said. “Cash

proceeds from the transaction will be used to fund our world class

investment opportunities in Guyana and the Bakken.”

Hess Corporation will continue to provide operational services

to Hess Midstream and maintain the same commercial contracts with

Hess Midstream as under the current MLP structure. The transaction,

which is non-taxable to Hess Corporation, is expected to close in

the fourth quarter of 2019, subject to customary closing conditions

and regulatory approvals. Morgan Stanley & Co. LLC acted as

financial advisor to Hess Corporation on this transaction.

About Hess Corporation

Hess Corporation is a leading global independent energy company

engaged in the exploration and production of crude oil and natural

gas. More information on Hess Corporation is available at

www.hess.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of federal securities laws regarding Hess Corporation,

HESM and Hess Midstream. These forward-looking statements relate

to, among other things, the proposed transaction among HESM, HIP

and Hess Midstream and includes expectations with respect to the

benefits of the proposed transaction to Hess Corporation and use of

proceeds therefrom. You can identify forward-looking statements by

words such as “anticipate,” “believe,” “could,” “design,”

“estimate,” “expect,” “forecast,” “goal,” “guidance,” “imply,”

“intend,” “may,” “objective,” “opportunity,” “outlook,” “plan,”

“position,” “potential,” “predict,” “project,” “prospective,”

“pursue,” “seek,” “should,” “strategy,” “target,” “would,” “will”

or other similar expressions that convey the uncertainty of future

events or outcomes. While Hess Corporation believes that the

assumptions concerning future events are reasonable, such

forward-looking statements are not guarantees of future performance

and are subject to risks, uncertainties and other factors, some of

which are beyond Hess Corporation’s control and are difficult to

predict. Factors that could cause actual results to differ

materially from those implied in the forward-looking statements

include the following: the ability to consummate the proposed

transaction among HESM, HIP and Hess Midstream on the proposed

terms and timeline; the ability to satisfy various conditions to

closing of the proposed transaction, and any conditions imposed on

the combined entity in connection with the consummation of the

proposed transaction; and the risk that anticipated benefits of the

proposed transaction may not be fully realized or may take longer

to realize than expected. When considering these forward-looking

statements, you should keep in mind the risk factors and other

cautionary statements in Hess Corporation's Annual Report on Form

10-K for the year ended December 31, 2018, and those set forth from

time to time in Hess Corporation's and HESM's filings with the

Securities and Exchange Commission (the "SEC"). Hess Corporation

undertakes no obligation and does not intend to update these

forward-looking statements to reflect events or circumstances

occurring after this press release except as required by applicable

law. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release.

No Offer or Solicitation

This press release is for informational purposes only and shall

not constitute an offer to sell or the solicitation of an offer to

buy any securities or a solicitation of any proxy, vote or approval

with respect to the proposed transaction or otherwise, nor shall

there be any sale of securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such

jurisdiction.

Additional Information

In connection with the proposed transaction, a registration

statement on Form S-4 (the "Registration Statement") will be filed

with the SEC by Hess Midstream. INVESTORS AND SECURITY HOLDERS ARE

ENCOURAGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER

RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROSPECTUS

THAT WILL BE PART OF THE REGISTRATION STATEMENT, WHEN THEY BECOME

AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE PROPOSED TRANSACTION. Investors and security holders will be

able to obtain the documents free of charge at the SEC’s website,

www.sec.gov, from HESM at its website, www.hessmidstream.com, or by

contacting HESM’s Investor Relations at (212) 536-8244.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191004005214/en/

Investors: Jay Wilson (212)

536-8940

Media: Lorrie Hecker (212)

536-8250 or Jamie Tully Sard Verbinnen & Co. (312) 895-4700

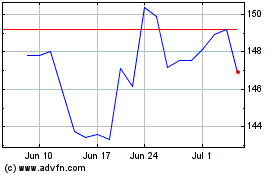

Hess (NYSE:HES)

Historical Stock Chart

From Mar 2024 to Apr 2024

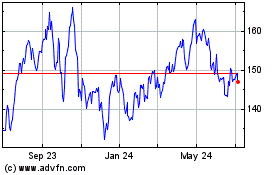

Hess (NYSE:HES)

Historical Stock Chart

From Apr 2023 to Apr 2024