First Quarter of Fiscal 2019 Net Income up

22% on Operating Income Increase of 23% and Net Sales Increase of

15%

HEICO CORPORATION (NYSE: HEI.A) (NYSE: HEI) today reported that

net income increased 22% to a record $79.3 million, or

58 cents per diluted share, in the first quarter of fiscal

2019, up from $65.2 million, or 48 cents per diluted share, in

the first quarter of fiscal 2018.

Operating income increased 23% to $97.9 million in the first

quarter of fiscal 2019, up from $79.6 million in the first quarter

of fiscal 2018. The Company's consolidated operating margin

improved to 21.0% in the first quarter of fiscal 2019, up from

19.7% in the first quarter of fiscal 2018.

Net sales increased 15% to $466.1 million in the first quarter

of fiscal 2019, up from $404.4 million in the first quarter of

fiscal 2018.

EBITDA increased 19% to $117.7 million in the first quarter of

fiscal 2019, up from $98.9 million in the first quarter of fiscal

2018. See our reconciliation of net income attributable to HEICO to

EBITDA at the end of this press release.

Net income in the first quarter of fiscal 2019 and fiscal 2018

were both favorably impacted by 9 cents per diluted share as a

result of discrete tax benefits. In the first quarter of fiscal

2019, the benefit was $13.0 million, net of noncontrolling

interests, from stock option exercises recognized in the first

quarter of fiscal 2019 compared to the first quarter of fiscal

2018. During the first quarter of fiscal 2018, the Company

recognized an $11.9 million discrete tax benefit as a result of a

provisional one-time tax benefit stemming from the enactment of the

Tax Cuts and Jobs Act.

All applicable fiscal 2018 share and per share information

has been adjusted retrospectively to reflect a 5-for-4 stock split

effected in June 2018.

Consolidated Results

Laurans A. Mendelson, HEICO’s Chairman and CEO, commented on the

Company's first quarter results stating, "We are pleased to report

strong first quarter year-over-year increases in net sales and

operating income within both our Electronic Technologies Group and

Flight Support Group. These results principally reflect strong

double-digit organic growth within both of our operating segments

as well as the excellent performance of our well-managed fiscal

2019 and 2018 acquisitions.

Our total debt to shareholders' equity ratio was 38.0% as of

January 31, 2019, as compared to 35.4% as of October 31, 2018. Our

net debt (total debt less cash and cash equivalents) of $550.7

million as of January 31, 2019 to shareholders’ equity ratio was

34.4% as of January 31, 2019, as compared to 31.5% as of October

31, 2018. Our net debt to EBITDA ratio was 1.17x as of January 31,

2019, as compared to 1.04x as of October 31, 2018. During fiscal

2019, we successfully completed three acquisitions and we completed

six acquisitions over the past year. We have no significant debt

maturities until fiscal 2023 and plan to utilize our financial

flexibility to aggressively pursue high quality acquisitions to

accelerate growth and maximize shareholder returns.

Cash flow provided by operating activities was $49.6 million in

the first quarter of fiscal 2019 compared to $51.9 million in the

first quarter of fiscal 2018. We continue to forecast strong cash

flow from operations for fiscal 2019.

As we look ahead to the remainder of fiscal 2019, we anticipate

continued net sales growth within the Flight Support Group's

commercial aviation and defense product lines. We also anticipate

growth within the Electronic Technologies Group, principally driven

by demand for the majority of our products. During fiscal 2019, we

plan to continue our commitments to developing new products and

services, further market penetration, and an aggressive acquisition

strategy, while maintaining our financial strength and

flexibility.

Based on our current economic visibility, we are increasing our

estimated consolidated fiscal 2019 year-over-year growth in net

sales to 9% - 11% and in net income to be 11% - 13%, up from our

prior growth estimates in net sales of 8% - 10% and in net income

of approximately 10%. Additionally, we continue to anticipate our

consolidated operating margin to approximate 21.0% to 21.5% and

depreciation and amortization expense to approximate $84 million.

Further, we now anticipate cash flow from operations to approximate

$370 million, up from the prior estimate of $360 million, and

capital expenditures to approximate $43 million, down slightly from

the prior estimate of $48 million. These estimates exclude

additional acquired businesses, if any."

Flight Support Group

Eric A. Mendelson, HEICO's Co-President and President of HEICO's

Flight Support Group, commented on the Flight Support Group's first

quarter results stating, "We are pleased to report year-over-year

increases in net sales and operating income driven principally by

very strong organic growth within the majority of our product

lines.

The Flight Support Group's net sales increased 13% to $287.2

million in the first quarter of fiscal 2019, up from $254.7 million

in the first quarter of fiscal 2018. The increase reflects organic

growth of 13%. The Flight Support Group's organic growth is mainly

attributable to increased demand and new product offerings within

our aftermarket replacement parts and specialty products product

lines.

The Flight Support Group's operating income increased 15% to

$52.9 million in the first quarter of fiscal 2019, up from $45.9

million in the first quarter of fiscal 2018. The increase

principally reflects the previously mentioned net sales growth and

an improved gross profit margin mainly attributable to a more

favorable product mix within our specialty products product

line.

The Flight Support Group's operating margin increased to 18.4%

in the first quarter of fiscal 2019, up from 18.0% in the first

quarter of fiscal 2018. The increase principally reflects the

previously mentioned improved gross profit margin.

With respect to the remainder of fiscal 2019, we now estimate

full year net sales growth of approximately 7% to 9% over the prior

year, up from the prior estimate of 7% - 8%, and the full year

Flight Support Group operating margin to approximate 19.0%. These

estimates exclude acquired businesses, if any.”

Electronic Technologies Group

Victor H. Mendelson, HEICO's Co-President and President of

HEICO’s Electronic Technologies Group, commented on the Electronic

Technologies Group's first quarter results stating, "Our very

strong first quarter year-over-year growth in net sales and

operating income reflects double-digit organic growth and the

favorable impact from our profitable fiscal 2019 and 2018

acquisitions.

The Electronic Technologies Group's net sales increased 18% to

$184.4 million in the first quarter of fiscal 2019, up from $155.7

million in the first quarter of fiscal 2018. The increase reflects

organic growth of 12% and the impact from our profitable fiscal

2019 and 2018 acquisitions. The organic growth is mainly

attributable to increased demand for certain defense, aerospace,

and space products.

The Electronic Technologies Group's operating income increased

19% to $51.6 million in the first quarter of fiscal 2019, up from

$43.2 million in the first quarter of fiscal 2018. The increase

principally reflects the previously mentioned net sales growth. The

Electronic Technologies Group's operating margin improved to 28.0%

in the first quarter of fiscal 2019, up from 27.8% in the first

quarter of fiscal 2018.

With respect to the remainder of fiscal 2019, we now estimate

full year net sales growth of approximately 11% - 13% over the

prior year, up from the prior estimate of 10% - 11%, and continue

to anticipate the full year Electronic Technologies Group's

operating margin to approximate 28.0% - 29.0%. Further, we now

estimate the Electronic Technologies Group’s organic net sales

growth rate to be in the mid-single digits. These estimates exclude

additional acquired businesses, if any.”

Non-GAAP Financial Measures

To provide additional information about the Company's results,

HEICO has discussed in this press release its EBITDA (calculated as

net income attributable to HEICO adjusted for net income

attributable to noncontrolling interests, income tax expense,

interest expense and depreciation and amortization expense), its

net debt (total debt less cash and cash equivalents), its net debt

to shareholders' equity ratio (calculated as net debt divided by

shareholders' equity) and its net debt to EBITDA ratio (calculated

as net debt divided by EBITDA) which are not prepared in accordance

with accounting principles generally accepted in the United States

of America (“GAAP”). These non-GAAP measures are included to

supplement the Company’s financial information presented in

accordance with GAAP and because the Company uses such measures to

monitor and evaluate the performance of its business and believes

the presentation of these measures enhance an investors’ ability to

analyze trends in the Company’s business and to evaluate the

Company’s performance relative to other companies in its industry.

However, these non-GAAP measures have limitations and should not be

considered in isolation or as a substitute for analysis of the

Company's financial results as reported under GAAP.

These non-GAAP measures are not in accordance with, or an

alternative to, measures prepared in accordance with GAAP and may

be different from non-GAAP measures used by other companies. In

addition, these non-GAAP measures are not based on any

comprehensive set of accounting rules or principles. These measures

should only be used to evaluate the Company's results of operations

in conjunction with their corresponding GAAP measures. Pursuant to

the requirements of Regulation G of the Securities and Exchange Act

of 1934, the Company has provided a reconciliation of these

non-GAAP measures in the last table included in this press

release.

(NOTE: HEICO has two classes of common stock traded on

the NYSE. Both classes, the Class A Common Stock (HEI.A) and

the Common Stock (HEI), are virtually identical in all economic

respects. The only difference between the share classes is

the voting rights. The Class A Common Stock (HEI.A) has 1/10

vote per share and the Common Stock (HEI) has one vote per

share.)

There are currently approximately 79.6 million shares of HEICO's

Class A Common Stock (HEI.A) outstanding and 53.4 million shares of

HEICO's Common Stock (HEI) outstanding. The stock symbols for

HEICO’s two classes of common stock on most websites are HEI.A and

HEI. However, some websites change HEICO's Class A Common Stock

trading symbol (HEI.A) to HEI/A or HEIa.

As previously announced, HEICO will hold a conference call on

Wednesday, February 27, 2019 at 9:00 a.m. Eastern Standard

Time to discuss its first quarter results. Individuals wishing to

participate in the conference call should dial: U.S. and Canada

(877) 586-4323, International (706) 679-0934, wait for the

conference operator and provide the operator with the Conference ID

2678269. A digital replay will be available two hours after the

completion of the conference for 14 days. To access, dial: (404)

537-3406, and enter the Conference ID 2678269.

HEICO Corporation is engaged primarily in the design,

production, servicing and distribution of products and services to

certain niche segments of the aviation, defense, space, medical,

telecommunications and electronics industries through its

Hollywood, Florida-based Flight Support Group and its Miami,

Florida-based Electronic Technologies Group. HEICO's customers

include a majority of the world's airlines and overhaul shops, as

well as numerous defense and space contractors and military

agencies worldwide, in addition to medical, telecommunications and

electronics equipment manufacturers. For more information about

HEICO, please visit our website at http://www.heico.com.

Certain statements in this press release constitute

forward-looking statements, which are subject to risks,

uncertainties and contingencies. HEICO's actual results may differ

materially from those expressed in or implied by those

forward-looking statements as a result of factors including: lower

demand for commercial air travel or airline fleet changes or

airline purchasing decisions, which could cause lower demand for

our goods and services; product specification costs and

requirements, which could cause an increase to our costs to

complete contracts; governmental and regulatory demands, export

policies and restrictions, reductions in defense, space or homeland

security spending by U.S. and/or foreign customers or competition

from existing and new competitors, which could reduce our sales;

our ability to introduce new products and services at profitable

pricing levels, which could reduce our sales or sales growth;

product development or manufacturing difficulties, which could

increase our product development costs and delay sales; our ability

to make acquisitions and achieve operating synergies from acquired

businesses; customer credit risk; interest, foreign currency

exchange and income tax rates; economic conditions within and

outside of the aviation, defense, space, medical,

telecommunications and electronics industries, which could

negatively impact our costs and revenues; and defense spending or

budget cuts, which could reduce our defense-related revenue.

Parties receiving this material are encouraged to review all of

HEICO's filings with the Securities and Exchange Commission,

including, but not limited to filings on Form 10-K, Form 10-Q and

Form 8-K. We undertake no obligation to publicly update or revise

any forward-looking statement, whether as a result of new

information, future events or otherwise, except to the extent

required by applicable law.

HEICO CORPORATION Condensed Consolidated Statements of

Operations (Unaudited) (in thousands, except per share

data) Three Months Ended January 31,

2019

2018

Net sales $466,146 $404,410 Cost of sales 283,909 249,619 Selling,

general and administrative expenses 84,290 75,231 Operating income

97,947 79,560 Interest expense (5,489) (4,725) Other (expense)

income (332) 360 Income before income taxes and noncontrolling

interests 92,126 75,195 Income tax expense 4,100

(b)

3,500

(c)

Net income from consolidated operations 88,026 71,695 Less: Net

income attributable to noncontrolling interests 8,694 6,543 Net

income attributable to HEICO $79,332

(b)

$65,152

(c)

Net income per share attributable to HEICO shareholders: (a)

Basic $.60

(b)

$.49

(c)

Diluted $.58

(b)

$.48

(c)

Weighted average number of common shares outstanding: (a)

Basic 132,933 132,048 Diluted 136,978 136,390

Three

Months Ended January 31, 2019 2018

Operating segment information: Net sales: Flight Support Group

$287,213 $254,721 Electronic Technologies Group 184,429 155,658

Intersegment sales (5,496) (5,969) $466,146 $404,410

Operating income: Flight Support Group $52,880 $45,869 Electronic

Technologies Group 51,602 43,220 Other, primarily corporate (6,535)

(9,529) $97,947 $79,560

HEICO CORPORATION

Footnotes to Condensed Consolidated Statements of

Operations (Unaudited)

----------------------------

(a) All applicable fiscal 2018 share and per share information has

been adjusted retrospectively to reflect a 5-for-4 stock split

effected in June 2018. (b) During the first quarter of

fiscal 2019, the Company recognized a $16.6 million discrete tax

benefit from stock option exercises, which, net of noncontrolling

interests, increased net income attributable to HEICO by $15.1

million, or $.11 per basic and diluted share. During the first

quarter of fiscal 2018, the Company recognized a net benefit from

stock option exercises that increased net income attributable to

HEICO by $2.1 million, or $.02 per basic and diluted share.

(c)

During the first quarter of fiscal 2018,

the United States (U.S.) government enacted significant changes to

existing tax law resulting in the Company recording a provisional

discrete tax benefit from remeasuring its U.S. federal net deferred

tax liabilities that was partially offset by a provisional discrete

tax expense related to a one-time provisional transition tax on the

unremitted earnings of the Company's foreign subsidiaries. The net

impact of these amounts increased net income attributable to HEICO

by $11.9 million, or $.09 per basic and diluted share.

HEICO CORPORATION Condensed Consolidated Balance Sheets

(Unaudited) (in thousands) January 31,

2019 October 31, 2018 Cash and cash equivalents $57,856

$59,599 Accounts receivable, net 237,800 237,286 Contract assets

47,093 14,183 Inventories, net 406,348 401,553 Prepaid expenses and

other current assets 30,328 21,187 Total current assets 779,425

733,808 Property, plant and equipment, net 169,279 154,739 Goodwill

1,170,401 1,114,832 Intangible assets, net 529,191 506,360 Other

assets 148,718 143,657 Total assets $2,797,014 $2,653,396

Current maturities of long-term debt $865 $859 Other current

liabilities 223,250 281,570 Total current liabilities 224,115

282,429 Long-term debt, net of current maturities 607,656 531,611

Deferred income taxes 59,133 46,644 Other long-term liabilities

165,360 157,658 Total liabilities 1,056,264 1,018,342 Redeemable

noncontrolling interests 138,995 132,046 Shareholders’ equity

1,601,755 1,503,008 Total liabilities and equity $2,797,014

$2,653,396

HEICO CORPORATION Condensed Consolidated

Statements of Cash Flows (Unaudited) (in thousands)

Three Months Ended January 31, 2019

2018 Operating Activities: Net income from consolidated

operations $88,026 $71,695 Depreciation and amortization 20,037

19,024 Share-based compensation expense 2,439 2,168 Employer

contributions to HEICO Savings and Investment Plan 2,153 1,860

Increase (decrease) in accrued contingent consideration 1,862

(3,195) Deferred income tax provision (benefit) 3,798 (17,292)

Payment of contingent consideration (67) — Decrease in accounts

receivable 4,982 18,272 Decrease (increase) in contract assets

7,270 (3,809) Increase in inventories (24,284) (18,301) Decrease in

current liabilities, net (58,005) (20,581) Other 1,355 2,064 Net

cash provided by operating activities 49,566 51,905

Investing Activities: Acquisitions, net of cash acquired (101,039)

(6,126) Investments related to HEICO Leadership Compensation Plan

(8,700) (6,900) Capital expenditures (5,907) (7,577) Other 72

(2,790) Net cash used in investing activities (115,574) (23,393)

Financing Activities: Borrowings (payments) on revolving

credit facility, net 76,000 (5,000) Cash dividends paid (9,305)

(7,395) Revolving credit facility issuance costs — (4,067)

Distributions to noncontrolling interests (2,795) (1,882) Payment

of contingent consideration (283) (300) Redemptions of common stock

related to stock option exercises (150) — Proceeds from stock

option exercises 66 1,425 Other 29 (114) Net cash provided by (used

in) financing activities 63,562 (17,333) Effect of exchange

rate changes on cash 703 2,443 Net (decrease) increase in

cash and cash equivalents (1,743) 13,622 Cash and cash equivalents

at beginning of year 59,599 52,066 Cash and cash equivalents at end

of period $57,856 $65,688

HEICO CORPORATION Non-GAAP

Financial Measures (Unaudited) (in thousands)

Three Months Ended January 31, EBITDA Calculation

2019 2018 Net income attributable to

HEICO $79,332 $65,152 Plus: Depreciation and amortization 20,037

19,024 Plus: Net income attributable to noncontrolling interests

8,694 6,543 Plus: Interest expense 5,489 4,725 Plus: Income tax

expense 4,100 3,500 EBITDA (a) $117,652 $98,944

Trailing Twelve Months Ended EBITDA Calculation

January 31, 2019 October 31, 2018 Net income

attributable to HEICO $273,413 $259,233 Plus: Depreciation and

amortization 78,204 77,191 Plus: Income tax expense 71,200 70,600

Plus: Net income attributable to noncontrolling interests 28,604

26,453 Plus: Interest expense 20,665 19,901 EBITDA (a) $472,086

$453,378

Net Debt Calculation

January 31, 2019 October 31, 2018 Total debt $608,521

$532,470 Less: Cash and cash equivalents 57,856 59,599 Net debt (a)

$550,665 $472,871 Net debt $550,665 $472,871 Shareholders'

equity $1,601,755 $1,503,008 Net debt to shareholders' equity ratio

(a) 34.4% 31.5% Net debt $550,665 $472,871 EBITDA $472,086

$453,378 Net debt to EBITDA ratio (a) 1.17 1.04 (a) See the

"Non-GAAP Financial Measures" section of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190226006172/en/

Victor H. Mendelson (305) 374-1745 ext. 7590Carlos L.

Macau, Jr. (954) 987-4000 ext. 7570

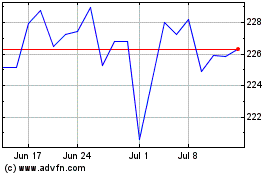

HEICO (NYSE:HEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

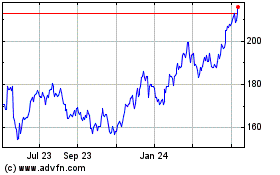

HEICO (NYSE:HEI)

Historical Stock Chart

From Apr 2023 to Apr 2024