U.S. Stocks Mixed Ahead of Fed Decision

December 11 2019 - 12:43PM

Dow Jones News

By Avantika Chilkoti and Karen Langley

U.S. stocks were mixed Wednesday as investors await the latest

policy decision from the Federal Reserve and fresh cues on the

strength of the world's largest economy.

The S&P 500 gained 0.1%, and the Nasdaq Composite added

0.2%. The Dow Jones Industrial Average, meanwhile, slipped 0.1%,

weighed down by declines in the shares of Boeing and Home

Depot.

Investors are braced for a busy few days as the U.S. and

European central banks hold policy meetings that will provide fresh

assessments of key economic indicators, as well as a general

election in the U.K. that could prove to be a turning point for

Brexit.

The Fed will conclude Wednesday a two-day meeting, where policy

makers are widely expected to hold the federal-funds rate

unchanged. The Fed cut interest rates at its past three meetings,

but Chairman Jerome Powell has indicated both that there is a very

high bar for the Fed to raise rates and that the economic outlook

would need to weaken materially to consider lowering them

further.

"I do think we're finally at the point where maybe monetary

policy will become less of what we need to watch, and instead it

will be more focused on the company fundamentals and the

fundamentals of the economy, " said Ron Temple, head of U.S. equity

at Lazard Asset Management.

Meanwhile, fresh data Wednesday showed consumer prices rose

moderately in November, indicating inflation has remained in check

despite historically low unemployment and the trade conflict with

China. The inflation numbers aren't likely to sway the Fed's

interest-rate decision.

Investors were also continuing to parse headlines for

indications on the progress of the U.S.-China trade talks, after

the The Wall Street Journal reported Tuesday that negotiators from

both sides were preparing to delay fresh U.S. tariffs on Chinese

imports due to go into effect on Dec. 15.

Some analysts remain concerned that existing tariffs imposed on

Chinese imports are already starting to hurt the U.S. economy.

"It's going to come home to roost for the one element of the

U.S. economy that has always, always, always pulled the economy out

of any slump and that's the U.S. consumer," said Matt Cairns, a

rates strategist at Rabobank.

Shares of Boeing fell 1.2% as the House held a hearing on the

737 MAX jet. The Wall Street Journal reported U.S. regulators

allowed the 737 MAX to keep flying after its first fatal crash last

fall even though their analysis indicated it could become one of

the most accident-prone airliners in decades without design

changes.

Home Depot dropped 2% after forecasting fiscal 2020 same-store

sales below Wall Street expectations. Shares of Children's Place

declined 22% after the retailer's third-quarter sales missed

analysts' estimates and it reduced its revenue forecast. GameStop

declined 18% after the videogame retailer cut its financial

guidance following worse-than-expected quarterly results.

The yield on the benchmark 10-year Treasury was 1.816%, down

from 1.833% Tuesday.

In Europe, the U.K.'s FTSE 250 equity index slipped 0.6% ahead

of a general election scheduled for Thursday that will help

determine the course of the U.K.'s withdrawal from the European

Union.

Some opinion polls show Prime Minister Boris Johnson's lead

narrowing, and a new, closely watched YouGov poll couldn't rule out

a hung Parliament. It showed that Mr. Johnson's Conservative Party

is set to win a majority of 28 seats, down from a 68-seat majority

forecast in a survey last month.

The state-backed oil major Saudi Arabian Oil Co., which was

among the most closely watched stocks, gained 10% by the close of

trading in Riyadh. That was the upper limit for the stock, which

made its debut after the world's largest initial public

offering.

Write to Avantika Chilkoti at Avantika.Chilkoti@wsj.com and

Karen Langley at karen.langley@wsj.com

(END) Dow Jones Newswires

December 11, 2019 12:28 ET (17:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

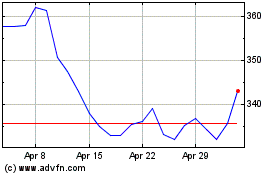

Home Depot (NYSE:HD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Home Depot (NYSE:HD)

Historical Stock Chart

From Apr 2023 to Apr 2024