HCI Group, Inc. (NYSE:HCI), a holding company with

operations in homeowners insurance, reinsurance, real estate and

information technology services, reported results for the three and

nine months ended September 30, 2021.

Third Quarter 2021 - Financial ResultsIn the

third quarter of 2021, the company experienced a net loss of $4.9

million or $0.72 diluted loss per share compared with net income of

$15.4 million or $1.70 diluted earnings per share in the third

quarter of 2020. The prior year quarter included a one-time gain of

$37.0 million on an involuntary sale of real estate. Adjusted net

loss (a non-GAAP measure which excludes net unrealized gains or

losses on equity securities) for the third quarter of 2021 was a

loss of $3.5 million or $0.64 diluted loss per share compared with

income of $14.4 million or $1.60 diluted earnings per share in the

third quarter of 2020. This press release includes an explanation

of adjusted net income as well as a reconciliation to net income

and earnings per share calculated in accordance with generally

accepted accounting principles (known as “GAAP”).

Even though the company recorded a net loss in the third

quarter, book value per share increased by approximately 16% to

$30.39 per share. A contributing factor to the increase was the

conversion or exchange of a portion of the company’s convertible

notes into or for common stock. In the third quarter, holders of

the company’s convertible notes converted or exchanged $82.8

million in principal into approximately 1.36 million of the

company’s common shares. The transactions increased shareholders’

equity by approximately $81.1 million (net of related transaction

expenses). Additionally, these transactions decreased long-term

debt by $82.5 million, accounting for a significant portion of the

reduction of over 50% from the second quarter of 2021. The

company recognized debt conversion expenses of approximately $1.3

million on these transactions in the third quarter. After these

transactions, the number of common shares outstanding increased

from 8,265,640 at the end of June 30, 2021 to 9,591,079 at the end

of September 30, 2021.

Subsequent to third quarter, in the month of October the company

converted or exchanged an additional $28 million principal amount

of debt into approximately 459,000 of the company’s common

shares.

Consolidated gross written premiums of $174.3 million for the

third quarter of 2021 increased 49.6% from $116.5 million in the

third quarter of 2020. The increase was due to the continued growth

of TypTap Insurance Company, policies transitioned from Gulfstream

Property & Casualty Insurance Company and a quota share

reinsurance arrangement with United Property & Casualty

Insurance Company.

Consolidated gross premiums earned of $149.8 million for the

third quarter of 2021 increased 40.4% from $106.7 million in the

third quarter of 2020. The increase was driven by the growth in

Homeowners Choice gross premiums earned from $86.8 million to $98.3

million and the growth of TypTap gross premiums earned from $19.9

million to $51.5 million.

Premiums ceded for reinsurance for the third quarter of 2021

increased to $55.6 million from $44.2 million in the third quarter

of 2020 as a result of the growth in both TypTap and Homeowners

Choice and represented 37.1% and 41.5%, respectively, of gross

premiums earned. Premiums ceded for reinsurance included a prorated

share of an $8 million increase resulting from a periodic true-up

of total insured value attributable to the growth of the

company.

Net investment income increased to $2.5 million from $1.8

million in the third quarter of 2020. This increase was due to an

increase in income from limited partnership investments, real

estate investments and an investment in an unconsolidated joint

venture offset by a decrease in interest income from fixed-maturity

security investments.

Net realized investment gains for the third quarter of 2021

increased to $1.2 million from $0.2 million for the third quarter

of 2020. This increase was primarily due to net gains from selling

equity securities.

Net unrealized investment losses were $1.9 million in the third

quarter of 2021 compared with $1.3 million of net unrealized

investment gains for the third quarter of 2020.

Losses and loss adjustment expenses for the third quarter of

2021 were $62.7 million compared with $51.7 million in the same

period of 2020. The increase in the dollars of losses was

attributable to the company’s growing premium base, storm related

losses of $6.5 million from events in our four northeastern states,

and $6.5 million of losses from the re-estimation of losses from

Hurricane Sally and Tropical Storm Eta.

Policy acquisition and other underwriting expenses for the third

quarter of 2021 were $23.3 million compared with $14.2 million in

the same quarter of 2020. The increase relates to the growth of

TypTap and the amortization of increased costs associated with the

quota share arrangement with United.

Nine Months Ended September 30, 2021 - Financial

ResultsNet income for the nine months ended September 30,

2021 totaled $5.8 million or $0.22 diluted earnings per share

compared with $24.9 million or $3.03 diluted earnings per share for

the nine months ended September 30, 2020. The decrease in net

income was primarily due to an increase in losses and loss

adjustment expenses of $44.7 million, a one-time gain of $37.0

million on an involuntary sale of real estate included in the

company’s 2020 results, and a $30.5 million increase in policy

acquisition and other underwriting expenses, offset by an increase

in net premiums earned of $77.5 million and a $12.6 million

increase in income from our investment portfolio.

Adjusted net income (a non-GAAP measure which excludes net

unrealized gains or losses on equity securities) for the nine

months ended September 30, 2021 was $6.3 million or $0.15 diluted

earnings per share compared with $25.3 million or $3.07 diluted

earnings per share in the same period of 2020. An explanation of

this non-GAAP financial measure and reconciliations to the

applicable GAAP numbers accompany this press release.

Consolidated gross written premiums for the nine-month periods

increased 32.9% to $485.1 million in 2021 from $364.9 million in

2020. The increase was due to the continued growth of TypTap,

policies transitioned from Gulfstream and to a quota share

reinsurance arrangement with United.

Consolidated gross premiums earned for the nine months ended

September 30, 2021 increased to $420.2 million from $306.9 million

during the same nine-month period in 2020. The increase was

primarily attributable to the quota share arrangement with United

and the growth of TypTap’s business.

Premiums ceded for the nine months ended September 30, 2021 were

$145.1 million or 34.5% of gross premiums earned compared with

$109.3 million or 35.6% of gross premiums earned during the same

period in 2020. Premiums ceded for reinsurance included a prorated

share of an $8 million increase resulting from a periodic true-up

of total insured value attributable to the growth of the

company.

Net investment income for the nine months ended September 30,

2021 was $9.7 million compared with $3.2 million in the nine months

ended September 30, 2020. The $6.5 million increase was primarily

due to losses from limited partnership investments in 2020 due to

the economic effects of the COVID-19 pandemic and a net gain of

$2.8 million recognized in 2021 for a real estate investment legal

settlement.

Losses and loss adjustment expenses for the nine months ended

September 30, 2021 and 2020 were $164.3 million and $119.7 million,

respectively. The increase in the dollars of losses was

attributable to the company’s growing premium base, losses of $6.5

million from events in our four northeastern states, and $10.8

million of losses from the re-estimation of losses from Hurricane

Sally and Tropical Storm Eta.

Policy acquisition and other underwriting expenses for the nine

months ended September 30, 2021 were $69.6 million compared with

$39.0 million in the same nine-month period in 2020. The increase

relates to the growth of TypTap, and the amortization of increased

costs associated with a quota share arrangement with United.

Management Commentary“As TypTap continues to

expand, we are making important investments to maximize TypTap’s

opportunity,” said HCI Group Chairman and Chief Executive Officer

Paresh Patel. “We are confident the long-term payback on these

investments will outweigh any short-term impact.”

Conference CallHCI Group will hold a conference

call tomorrow, November 9, 2021, to discuss these financial

results. Chairman and Chief Executive Officer Paresh Patel, Chief

Operating Officer Karin Coleman and Chief Financial Officer Mark

Harmsworth will host the call starting at 8:30 a.m. Eastern

time.

Interested parties can listen to the live presentation by

dialing the listen-only number below or by clicking the webcast

link available on the Investor Information section of the company's

website at www.hcigroup.com.

Listen-only toll-free number: (888) 506-0062Listen-only

international number: (973) 528-0011 Entry Code: 775232

Please call the conference telephone number 10 minutes before

the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact Gateway Investor Relations at (949)

574-3860.

A replay of the call will be available by telephone after 8:00

p.m. Eastern time on the same day as the call and via the Investor

Information section of the HCI Group website at www.hcigroup.com

through December 9, 2021.

Toll-free replay number: (877) 481-4010International replay

number: (919) 882-2331 Replay ID: 42978

About HCI Group, Inc.HCI Group, Inc. owns

subsidiaries engaged in diverse, yet complementary business

activities, including homeowners insurance, reinsurance, real

estate and information technology services. HCI’s leading insurance

operation, TypTap Insurance Company, is a rapidly growing,

technology-driven insurance company that is expanding nationwide to

provide homeowners and flood insurance. TypTap’s operations are

powered in large part by insurance-related information technology

developed by HCI’s software subsidiary, Exzeo USA, Inc. HCI’s

largest subsidiary, Homeowners Choice Property & Casualty

Insurance Company, Inc., provides homeowners’ insurance primarily

in Florida. HCI’s real estate subsidiary, Greenleaf Capital, LLC,

owns and operates multiple properties in Florida, including office

buildings, retail centers and marinas.

The company's common shares trade on the New York Stock Exchange

under the ticker symbol "HCI" and are included in the Russell 2000

and S&P SmallCap 600 Index. HCI Group, Inc. regularly publishes

financial and other information in the Investor Information section

of the company’s website. For more information about HCI Group and

its subsidiaries, visit www.hcigroup.com.

Forward-Looking StatementsThis news release may

contain forward-looking statements made pursuant to the Private

Securities Litigation Reform Act of 1995. Words such as

"anticipate," "estimate," "expect," "intend," "plan," "confident,"

"prospects" and "project" and other similar words and expressions

are intended to signify forward-looking statements. Forward-looking

statements are not guarantees of future results and conditions, but

rather are subject to various risks and uncertainties. For example,

the estimation of reserves for losses and loss adjustment expenses

is an inherently imprecise process involving many assumptions and

considerable management judgment. Some of these risks and

uncertainties are identified in the company's filings with the

Securities and Exchange Commission. Should any risks or

uncertainties develop into actual events, these developments could

have material adverse effects on the company's business, financial

condition and results of operations. HCI Group, Inc. disclaims all

obligations to update any forward-looking statements.

Investor Relations Contact:Matt GloverGateway

Group, Inc.Tel (949) 574-3860HCI@gatewayir.com

Media Contact:Jordan SchmidtGateway Group,

Inc.Tel (949) 386-6332jordan@gatewayir.com

- Tables to

follow -

HCI GROUP, INC. AND

SUBSIDIARIES

Consolidated Balance Sheets (Dollar amounts in

thousands)

|

|

|

September 30, 2021 |

|

|

December 31, 2020 |

|

|

|

|

(Unaudited) |

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

Fixed-maturity securities, available for sale, at fair value

(amortized cost: $45,016 and $70,265, respectively and allowance

for credit losses: $0 and $588, respectively) |

|

$ |

46,053 |

|

|

$ |

71,722 |

|

| Equity securities, at fair value

(cost: $46,771 and $47,029, respectively) |

|

|

50,223 |

|

|

|

51,130 |

|

| Limited partnership

investments |

|

|

26,039 |

|

|

|

27,691 |

|

| Investment in unconsolidated

joint venture, at equity |

|

|

370 |

|

|

|

705 |

|

| Real estate investments |

|

|

73,663 |

|

|

|

74,472 |

|

|

Total investments |

|

|

196,348 |

|

|

|

225,720 |

|

| |

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

569,134 |

|

|

|

431,341 |

|

| Restricted cash |

|

|

2,400 |

|

|

|

2,400 |

|

| Accrued interest and dividends

receivable |

|

|

463 |

|

|

|

588 |

|

| Income taxes receivable |

|

|

— |

|

|

|

4,554 |

|

| Premiums receivable, net

(allowance: $3,756 and $2,053, respectively) |

|

|

43,078 |

|

|

|

68,382 |

|

| Prepaid reinsurance premiums |

|

|

47,968 |

|

|

|

36,376 |

|

| Reinsurance recoverable, net of allowance for credit

losses: |

|

|

|

|

|

|

|

Paid losses and loss adjustment expenses (allowance: $0 and $0,

respectively) |

|

|

9,658 |

|

|

|

14,127 |

|

|

Unpaid losses and loss adjustment expenses (allowance: $44 and $85,

respectively) |

|

|

39,468 |

|

|

|

71,019 |

|

| Deferred policy acquisition

costs |

|

|

47,129 |

|

|

|

43,858 |

|

| Property and equipment, net |

|

|

13,946 |

|

|

|

12,767 |

|

| Right-of-use-assets - operating

leases |

|

|

2,576 |

|

|

|

4,002 |

|

| Intangible assets, net |

|

|

10,807 |

|

|

|

3,568 |

|

| Funds held in trust for assumed

business |

|

|

79,965 |

|

|

|

— |

|

| Other assets |

|

|

13,174 |

|

|

|

22,611 |

|

| |

|

|

|

|

|

|

|

Total assets |

|

$ |

1,076,114 |

|

|

$ |

941,313 |

|

| |

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

|

| Losses and loss adjustment

expenses |

|

$ |

203,177 |

|

|

$ |

212,169 |

|

| Unearned premiums |

|

|

334,299 |

|

|

|

269,399 |

|

| Advance premiums |

|

|

19,062 |

|

|

|

11,370 |

|

| Assumed reinsurance balances

payable |

|

|

88 |

|

|

|

87 |

|

| Reinsurance payable on paid

losses and loss adjustment expenses |

|

|

4,727 |

|

|

|

— |

|

| Accrued expenses |

|

|

15,187 |

|

|

|

10,181 |

|

| Income taxes payable |

|

|

3,574 |

|

|

|

— |

|

| Deferred income taxes, net |

|

|

3,708 |

|

|

|

11,925 |

|

| Revolving credit facility |

|

|

— |

|

|

|

23,750 |

|

| Long-term debt |

|

|

78,083 |

|

|

|

156,511 |

|

| Lease liabilities - operating

leases |

|

|

2,578 |

|

|

|

4,014 |

|

| Other liabilities |

|

|

31,372 |

|

|

|

40,771 |

|

| |

|

|

|

|

|

|

|

Total liabilities |

|

|

695,855 |

|

|

|

740,177 |

|

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Redeemable noncontrolling

interest |

|

|

87,731 |

|

|

|

— |

|

| |

|

|

|

|

|

|

| Equity: |

|

|

|

|

|

|

|

Common stock, (no par value, 40,000,000 shares authorized,

9,591,079 and 7,785,617 shares issued and outstanding at September

30, 2021 and December 31, 2020, respectively) |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

39,905 |

|

|

|

— |

|

|

Retained income |

|

|

250,808 |

|

|

|

199,592 |

|

|

Accumulated other comprehensive income, net of taxes |

|

|

799 |

|

|

|

1,544 |

|

|

Total stockholders' equity |

|

|

291,512 |

|

|

|

201,136 |

|

|

Noncontrolling interests |

|

|

1,016 |

|

|

|

— |

|

|

Total equity |

|

|

292,528 |

|

|

|

201,136 |

|

| |

|

|

|

|

|

|

|

Total liabilities, redeemable noncontrolling interest, and

equity |

|

$ |

1,076,114 |

|

|

$ |

941,313 |

|

HCI GROUP, INC. AND

SUBSIDIARIESConsolidated Statements of

Income(Unaudited)(Dollar amounts

in thousands, except per share amounts)

|

|

|

Three Months Ended |

|

|

|

Nine Months Ended |

|

|

|

|

September 30, |

|

|

|

September 30, |

|

|

|

|

2021 |

|

|

2020 |

|

|

|

2021 |

|

|

2020 |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross premiums earned |

|

$ |

149,809 |

|

|

$ |

106,694 |

|

|

|

$ |

420,191 |

|

|

|

|

$ |

306,862 |

|

| Premiums ceded |

|

|

(55,577 |

) |

|

|

(44,231 |

) |

|

|

|

(145,112 |

) |

|

|

|

|

(109,304 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net premiums earned |

|

|

94,232 |

|

|

|

62,463 |

|

|

|

|

275,079 |

|

|

|

|

|

197,558 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income |

|

|

2,520 |

|

|

|

1,832 |

|

|

|

|

9,749 |

|

|

|

|

|

3,244 |

|

| Net realized investment gains

(losses) |

|

|

1,232 |

|

|

|

177 |

|

|

|

|

4,952 |

|

|

|

|

|

(632 |

) |

| Net unrealized investment

(losses) gains |

|

|

(1,869 |

) |

|

|

1,340 |

|

|

|

|

(649 |

) |

|

|

|

|

(581 |

) |

| Credit losses on investments |

|

|

— |

|

|

|

(70 |

) |

|

|

|

— |

|

|

|

|

|

(596 |

) |

| Policy fee income |

|

|

1,000 |

|

|

|

895 |

|

|

|

|

2,962 |

|

|

|

|

|

2,571 |

|

| Gain on involuntary

conversion |

|

|

— |

|

|

|

36,969 |

|

|

|

|

— |

|

|

|

|

|

36,969 |

|

| Other |

|

|

2,102 |

|

|

|

421 |

|

|

|

|

3,502 |

|

|

|

|

|

1,591 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

|

99,217 |

|

|

|

104,027 |

|

|

|

|

295,595 |

|

|

|

|

|

240,124 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Losses and loss adjustment

expenses |

|

|

62,664 |

|

|

|

51,743 |

|

|

|

|

164,332 |

|

|

|

|

|

119,664 |

|

| Policy acquisition and other

underwriting expenses |

|

|

23,340 |

|

|

|

14,210 |

|

|

|

|

69,574 |

|

|

|

|

|

39,027 |

|

| General and administrative

personnel expenses |

|

|

11,537 |

|

|

|

9,871 |

|

|

|

|

31,733 |

|

|

|

|

|

27,969 |

|

| Interest expense |

|

|

1,664 |

|

|

|

2,856 |

|

|

|

|

5,743 |

|

|

|

|

|

8,846 |

|

| Loss on repurchases of

convertible senior notes |

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

|

150 |

|

| Loss on extinguishment of

debt |

|

|

— |

|

|

|

98 |

|

|

|

|

— |

|

|

|

|

|

98 |

|

| Debt conversion expense |

|

|

1,273 |

|

|

|

— |

|

|

|

|

1,273 |

|

|

|

|

|

— |

|

| Other operating expenses |

|

|

5,243 |

|

|

|

3,713 |

|

|

|

|

14,245 |

|

|

|

|

|

10,354 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total expenses |

|

|

105,721 |

|

|

|

82,491 |

|

|

|

|

286,900 |

|

|

|

|

|

206,108 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income before income

taxes |

|

|

(6,504 |

) |

|

|

21,536 |

|

|

|

|

8,695 |

|

|

|

|

|

34,016 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax (benefit) expense |

|

|

(1,636 |

) |

|

|

6,146 |

|

|

|

|

2,888 |

|

|

|

|

|

9,143 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(4,868 |

) |

|

$ |

15,390 |

|

|

|

$ |

5,807 |

|

|

|

|

$ |

24,873 |

|

|

Net income attributable to redeemable noncontrolling interest |

|

|

(2,202 |

) |

|

|

— |

|

|

|

|

(5,175 |

) |

|

|

|

|

— |

|

|

Net loss attributable to noncontrolling interests |

|

|

833 |

|

|

|

— |

|

|

|

|

1,196 |

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income after noncontrolling interests |

|

$ |

(6,237 |

) |

|

$ |

15,390 |

|

|

|

$ |

1,828 |

|

|

|

|

$ |

24,873 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic (loss) earnings per share |

|

$ |

(0.72 |

) |

|

$ |

1.97 |

|

|

|

$ |

0.23 |

|

|

|

|

$ |

3.21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted (loss) earnings per share |

|

$ |

(0.72 |

) |

|

$ |

1.70 |

|

|

|

$ |

0.22 |

|

|

|

|

$ |

3.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends per share |

|

$ |

0.40 |

|

|

$ |

0.40 |

|

|

|

$ |

1.20 |

|

|

|

|

$ |

1.20 |

|

HCI GROUP, INC. AND

SUBSIDIARIES(Amounts in thousands, except per share

amounts)

A summary of the numerator and denominator of basic and diluted

income per common share calculated in accordance with GAAP is

presented below.

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

| GAAP |

|

September 30, 2021 |

|

|

September 30, 2021 |

|

| |

|

Loss |

|

|

Shares (a) |

|

|

Per Share |

|

|

Income |

|

|

Shares (a) |

|

|

Per Share |

|

| |

|

(Numerator) |

|

|

(Denominator) |

|

|

Amount |

|

|

(Numerator) |

|

|

(Denominator) |

|

|

Amount |

|

| Net (loss) income |

|

$ |

(4,868 |

) |

|

|

|

|

|

|

|

$ |

5,807 |

|

|

|

|

|

|

|

| Less: Net income attributable to

redeemable noncontrolling interest |

|

|

(2,202 |

) |

|

|

|

|

|

|

|

|

(5,175 |

) |

|

|

|

|

|

|

| Less: TypTap Group's net loss

attributable to non-HCI common stockholders and TypTap Group's

participating securities |

|

|

774 |

|

|

|

|

|

|

|

|

|

1,191 |

|

|

|

|

|

|

|

| Net (loss) income attributable to

HCI |

|

|

(6,296 |

) |

|

|

|

|

|

|

|

|

1,823 |

|

|

|

|

|

|

|

| Less: (Loss) income attributable

to participating securities |

|

|

537 |

|

|

|

|

|

|

|

|

|

(37 |

) |

|

|

|

|

|

|

| Basic (Loss) Earnings Per

Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income allocated to common stockholders |

|

|

(5,759 |

) |

|

|

8,023 |

|

|

$ |

(0.72 |

) |

|

|

1,786 |

|

|

|

7,676 |

|

|

$ |

0.23 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of Dilutive

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock options* |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

182 |

|

|

|

|

| Warrants* |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

234 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted (Loss) Earnings

Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income available to common

stockholders and assumed conversions |

|

$ |

(5,759 |

) |

|

|

8,023 |

|

|

$ |

(0.72 |

) |

|

$ |

1,786 |

|

|

|

8,092 |

|

|

$ |

0.22 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) Shares in

thousands. |

|

| * For the three

months ended September 30, 2021, stock options and warrants were

excluded due to anti-dilutive effect. |

|

Non-GAAP Financial Measures

Adjusted net income (loss) is a non-GAAP financial measure that

removes from net income (loss) HCI Group's portion of the effect of

unrealized gains or losses on equity securities required to be

included in results of operations in accordance with Accounting

Standards Codification 321. HCI Group believes net income without

the effect of volatility in equity prices more accurately depicts

operating results. This financial measurement is not recognized in

accordance with accounting principles generally accepted in the

United States of America ("GAAP") and should not be viewed as an

alternative to GAAP measures of performance. A reconciliation of

GAAP Net income (loss) to Non-GAAP Adjusted net income (loss) and

GAAP diluted earnings (loss) per share to non-GAAP Adjusted diluted

earnings (loss) per share is provided below.

Reconciliation of GAAP Net (Loss) Income to Non-GAAP

Adjusted Net (Loss) Income

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, 2021 |

|

September 30, 2021 |

| GAAP Net (loss) income |

|

|

|

|

$ |

(4,868 |

) |

|

|

|

|

|

|

$ |

5,807 |

|

|

|

| Net unrealized investment

losses |

|

$ |

1,869 |

|

|

|

|

|

|

|

$ |

649 |

|

|

|

|

|

|

| Less: Tax effect at

24.52182% |

|

$ |

(458 |

) |

|

|

|

|

|

|

$ |

(159 |

) |

|

|

|

|

|

| Net adjustment to Net (loss)

income |

|

|

|

|

$ |

1,411 |

|

|

|

|

|

|

|

$ |

490 |

|

|

|

| Non-GAAP Adjusted Net (loss)

income |

|

|

|

|

$ |

(3,457 |

) |

|

|

|

|

|

|

$ |

6,297 |

|

|

|

HCI GROUP, INC. AND

SUBSIDIARIES(Amounts in thousands, except per share

amounts)

A summary of the numerator and denominator of the basic and

diluted income per common share calculated with the Non-GAAP

financial measure Adjusted net income is presented below.

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

| Non-GAAP |

|

September 30, 2021 |

|

|

September 30, 2021 |

|

| |

|

Loss |

|

|

Shares (a) |

|

|

Per Share |

|

|

Income |

|

|

Shares (a) |

|

|

Per Share |

|

| |

|

(Numerator) |

|

|

(Denominator) |

|

|

Amount |

|

|

(Numerator) |

|

|

(Denominator) |

|

|

Amount |

|

| Adjusted net (loss) income

(non-GAAP) |

|

$ |

(3,457 |

) |

|

|

|

|

|

|

|

$ |

6,297 |

|

|

|

|

|

|

|

| Less: Net income attributable to

redeemable noncontrolling interest |

|

|

(2,202 |

) |

|

|

|

|

|

|

|

$ |

(5,175 |

) |

|

|

|

|

|

|

| Less: TypTap Group's net loss

attributable to non-HCI common stockholders and TypTap Group's

participating securities |

|

|

42 |

|

|

|

|

|

|

|

|

|

41 |

|

|

|

|

|

|

|

| Net (loss) income attributable to

HCI |

|

|

(5,617 |

) |

|

|

|

|

|

|

|

|

1,163 |

|

|

|

|

|

|

|

| Less: Income attributable to

participating securities |

|

|

482 |

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic (Loss) Earnings Per

Share before unrealized gains/losses on equity

securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income allocated to common stockholders |

|

|

(5,135 |

) |

|

|

8,023 |

|

|

$ |

(0.64 |

) |

|

|

1,179 |

|

|

|

7,676 |

|

|

$ |

0.15 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of Dilutive

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock options* |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

182 |

|

|

|

|

| Warrants* |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

234 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted (Loss) Earnings

Per Share before unrealized gains/losses on equity

securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income available to common

stockholders and assumed conversions |

|

$ |

(5,135 |

) |

|

$ |

8,023 |

|

|

$ |

(0.64 |

) |

|

$ |

1,179 |

|

|

$ |

8,092 |

|

|

$ |

0.15 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) Shares in

thousands. |

|

| * For the three

months ended September 30, 2021, stock options and warrants were

excluded due to anti-dilutive effect. |

|

Reconciliation of GAAP Diluted EPS to Non-GAAP Adjusted

Diluted EPS

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, 2021 |

|

September 30, 2021 |

| GAAP diluted (Loss) Earnings Per

Share |

|

|

|

|

$ |

(0.72 |

) |

|

|

|

|

|

|

$ |

0.22 |

|

|

|

| Net unrealized investment

losses |

|

$ |

0.23 |

|

|

|

|

|

|

|

$ |

0.08 |

|

|

|

|

|

|

| Less: Tax effect at

24.52182% |

|

$ |

(0.16 |

) |

|

|

|

|

|

|

$ |

(0.15 |

) |

|

|

|

|

|

| Net adjustment to GAAP diluted

EPS |

|

|

|

|

$ |

0.08 |

|

|

|

|

|

|

|

$ |

(0.07 |

) |

|

|

| Non-GAAP Adjusted diluted

EPS |

|

|

|

|

$ |

(0.64 |

) |

|

|

|

|

|

|

$ |

0.15 |

|

|

|

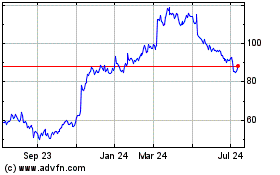

HCI (NYSE:HCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

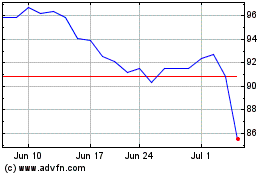

HCI (NYSE:HCI)

Historical Stock Chart

From Apr 2023 to Apr 2024