HCI Group, Inc. (NYSE:HCI), an

InsurTech company with operations in insurance, software

development and real estate, reported results for the quarter ended

March 31, 2021.

First Quarter 2021 - Financial ResultsNet

income for the first quarter of 2021 totaled $6.1 million or $0.75

diluted earnings per share compared with $0.5 million or $0.07

diluted earnings per share in the first quarter of 2020. Adjusted

net income (a non-GAAP measure which excludes net unrealized gains

or losses on equity securities) for the quarter was $6.4 million or

$0.77 diluted earnings per share compared with $4.2 million or

$0.54 diluted earnings per share in the first quarter of 2020. This

press release includes an explanation of adjusted net income as

well as a reconciliation to net income and earnings per share

calculated in accordance with generally accepted accounting

principles (known as “GAAP”).

Consolidated gross written premiums of $125.8 million for the

first quarter of 2021 were up 64.4% from $76.5 million in the first

quarter of 2020. This increase was due to the growth of Homeowners

Choice gross written premiums from $58.1 million to $81.0 million

and the growth of TypTap Insurance Company gross written premiums

from $18.4 million to $44.9 million.

Consolidated gross premiums earned of $130.9 million for the

first quarter of 2021 were up 41.8% from $92.4 million in the first

quarter of 2020. The increase was driven by the growth in

Homeowners Choice gross premiums earned from $75.8 million to

$102.1 million and the growth of TypTap gross premiums earned from

$16.6 million to $28.8 million.

Premiums ceded for reinsurance for the first quarter of 2021

increased to $43.1 million from $30.7 million in the first quarter

of 2020 and represented 32.9% and 33.3%, respectively, of gross

premiums earned.

Net investment income was $4.6 million, compared with a net

investment loss of $0.2 million in the first quarter of 2020. This

increase was due to an increase in limited partnership income as

well as a lawsuit settlement in the real estate division.

Net realized investment gains were $1.1 million compared with a

net realized investment losses of $2.2 million in the first quarter

of 2020.

Net unrealized investment losses were $0.3 million in the first

quarter of 2021 compared with net unrealized losses of $4.8 million

in 2020.

Losses and loss adjustment expenses were $45.8 million compared

with $28.1 million in the same period in 2020. The increase was

driven primarily by the growth in gross premiums earned.

Policy acquisition and other underwriting expenses were $23.1

million compared with $11.8 million in the same quarter of 2020.

The increase relates to the growth in gross premiums earned.

Interest expense decreased to $2.1 million in the first quarter

of 2021 compared with $3.0 in the first quarter of 2020 due to the

early adoption of a new accounting standard requiring the reversal

of discounts previously recorded to account for the cash conversion

feature of the Company’s convertible debt instrument. As a result,

interest expense no longer includes amounts representing the

amortization of the discount.

The effective tax rate for the first quarter was 32.2% versus a

rate of 16.7% for the first quarter of 2020. The increase in the

effective tax rate was primarily due to the derecognition of

deferred tax assets attributable to unvested restricted stock that

was cancelled in the quarter offset by a decrease in the

non-deductibility of certain executive compensation.

First Quarter 2021 – Other EventsDuring the

first quarter of 2021, the Company repaid the $23.75 million

outstanding balance of its revolving credit facility, leaving the

full $65 million line of credit available to the Company as of

March 31, 2021.

Long-term debt increased to $160.5 million in the first quarter

of 2021 compared with $156.5 million at December 31, 2020. The $4

million increase did not result from new indebtedness but was

caused by the early adoption of a new accounting standard that

allows the reversal of the discount previously recorded to account

for the cash conversion feature of the Company’s 4.25% convertible

senior notes.

During the first quarter of 2021, the Company’s subsidiary,

TypTap Insurance Group, Inc., completed a capital investment

transaction with a fund associated with Centerbridge Partners L.P.

As a result of this transaction, the Company recorded $85.9 million

of redeemable noncontrolling interest on the balance sheet

reflecting the cash increase of $100 million from the initial

proceeds received from Centerbridge less $6.3 million of issuance

costs and $8.6 million of fair value assigned to the warrants to

purchase HCI stock that were granted as part of the

transaction.

During the quarter, the number of common shares outstanding

increased from 7,785,617 to 8,289,682. The increase is attributable

to 100,000 shares issued to United Property & Casualty

Insurance Company in connection with a renewal rights agreement as

well as a net increase in the number of restricted common shares of

404,065.

Total equity increased to $217.6 million in the first quarter of

2021 compared with $201.1 million at December 31, 2020. The $16.5

million increase was primarily due to the $8.6 million of fair

value assigned to the issued warrants and $5.4 million for HCI

common stock issued to United Property & Casualty Insurance

Company. Book value per common share (including noncontrolling

interest) increased to $26.25 at March 31, 2021 compared with

$25.83 at December 31, 2020.

Management Commentary “We are reaping the

benefits of decisions we made in previous periods,” said HCI Group

Chairman and Chief Executive Officer Paresh Patel. “We expect to

report more benefits as 2021 progresses.”

Conference CallHCI Group will hold a conference

call later today, May 6, 2021, to discuss these financial results.

Chairman and Chief Executive Officer Paresh Patel, Chief Operating

Officer Karin Coleman and Chief Financial Officer Mark Harmsworth

will host the call starting at 4:45 p.m. Eastern time. A

question-and-answer session will follow management's

presentation.

Interested parties can listen to the live presentation by

dialing the listen-only number below or by clicking the webcast

link available on the Investor Information section of the

company's website at www.hcigroup.com.

Listen-only toll-free number: (877) 545-0320Listen-only

international number: (973) 528-0016 Entry Code: 606423

Please call the conference telephone number 10 minutes before

the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact Gateway Investor Relations at (949)

574-3860.

A replay of the call will be available by telephone after 8:00

p.m. Eastern time on the same day as the call and via the Investor

Information section of the HCI Group website at www.hcigroup.com

through June 6, 2021.

Toll-free replay number: (877) 481-4010International replay

number: (919) 882-2331 Replay ID: 40734

About HCI Group, Inc.HCI Group, Inc. is an

InsurTech company with operations in insurance, software

development and real estate. HCI’s leading insurance operation,

TypTap Insurance Company, is a rapidly growing, technology-driven

insurance company that is expanding nationwide to provide

homeowners and flood insurance. TypTap’s operations are powered in

large part by insurance-related information technology developed by

HCI’s software subsidiary, Exzeo USA, Inc. HCI’s largest

subsidiary, Homeowners Choice Property & Casualty Insurance

Company, Inc., provides homeowners’ insurance primarily in Florida.

HCI’s real estate subsidiary, Greenleaf Capital, LLC, owns and

operates multiple properties in Florida, including office

buildings, retail centers and marinas.

The company's common shares trade on the New York Stock Exchange

under the ticker symbol "HCI" and are included in the Russell 2000

and S&P SmallCap 600 Index. HCI Group, Inc. regularly publishes

financial and other information in the Investor Information section

of the company’s website. For more information about HCI Group and

its subsidiaries, visit www.hcigroup.com.

Forward-Looking Statements

This news release may contain forward-looking statements made

pursuant to the Private Securities Litigation Reform Act of 1995.

Words such as "anticipate," "estimate," "expect," "intend," "plan,"

"confident," "prospects" and "project" and other similar words and

expressions are intended to signify forward-looking statements.

Forward-looking statements are not guarantees of future results and

conditions, but rather are subject to various risks and

uncertainties. For example, the estimation of reserves for losses

and loss adjustment expenses is an inherently imprecise process

involving many assumptions and considerable management judgment.

Some of these risks and uncertainties are identified in the

company's filings with the Securities and Exchange Commission.

Should any risks or uncertainties develop into actual events, these

developments could have material adverse effects on the company's

business, financial condition and results of operations. HCI Group,

Inc. disclaims all obligations to update any forward-looking

statements.

Company Contact:Rachel Swansiger, Esq.Investor

RelationsHCI Group, Inc.Tel (813)

405-3206rswansiger@hcigroup.com

Investor Relations Contact:Matt GloverGateway

Investor RelationsTel (949) 574-3860HCI@gatewayir.com

Media Contact:Jordan SchmidtGateway Investor

RelationsTel (949) 386-6332jordan@gatewayir.com

- Tables to follow -

HCI GROUP, INC. AND

SUBSIDIARIESConsolidated Balance

SheetsDollar amounts in thousands)

|

|

|

March 31, 2021 |

|

|

December 31, 2020 |

|

| |

|

(Unaudited) |

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

| Fixed-maturity securities,

available for sale, at fair value (amortized cost: $58,921 and

$70,265, respectively) (allowance for credit losses: $579 and $588,

respectively) |

|

$ |

60,202 |

|

|

$ |

71,722 |

|

| Equity securities, at fair value

(cost: $45,968 and $47,029, respectively) |

|

|

49,800 |

|

|

|

51,130 |

|

| Limited partnership

investments |

|

|

26,726 |

|

|

|

27,691 |

|

| Investment in unconsolidated

joint venture, at equity |

|

|

680 |

|

|

|

705 |

|

| Real estate investments |

|

|

74,015 |

|

|

|

74,472 |

|

|

Total investments |

|

|

211,423 |

|

|

|

225,720 |

|

| |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

553,397 |

|

|

|

431,341 |

|

| Restricted cash |

|

|

2,400 |

|

|

|

2,400 |

|

| Accrued interest and dividends

receivable |

|

|

595 |

|

|

|

588 |

|

| Income taxes receivable |

|

|

481 |

|

|

|

4,554 |

|

| Premiums receivable, net |

|

|

29,459 |

|

|

|

68,382 |

|

| Prepaid reinsurance premiums |

|

|

14,974 |

|

|

|

36,376 |

|

| Reinsurance recoverable, net

of allowance for credit losses: |

|

|

|

|

|

|

|

|

|

Paid losses and loss adjustment expenses (allowance: $0 and $0,

respectively) |

|

|

10,652 |

|

|

|

14,127 |

|

|

Unpaid losses and loss adjustment expenses (allowance: $73 and $85,

respectively) |

|

|

61,070 |

|

|

|

71,019 |

|

| Deferred policy acquisition

costs |

|

|

40,466 |

|

|

|

43,858 |

|

| Property and equipment, net |

|

|

13,026 |

|

|

|

12,767 |

|

| Right-of-use-assets - operating

leases |

|

|

3,571 |

|

|

|

4,002 |

|

| Intangible assets, net |

|

|

11,255 |

|

|

|

3,568 |

|

| Other assets |

|

|

63,784 |

|

|

|

22,611 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

1,016,553 |

|

|

$ |

941,313 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

|

|

|

| Losses and loss adjustment

expenses |

|

$ |

205,773 |

|

|

$ |

212,169 |

|

| Unearned premiums |

|

|

264,305 |

|

|

|

269,399 |

|

| Advance premiums |

|

|

24,291 |

|

|

|

11,370 |

|

| Assumed reinsurance balances

payable |

|

|

88 |

|

|

|

87 |

|

| Reinsurance payable on paid

losses and loss adjustment expenses |

|

|

2,317 |

|

|

|

— |

|

| Accrued expenses |

|

|

14,404 |

|

|

|

10,181 |

|

| Deferred income taxes, net |

|

|

10,052 |

|

|

|

11,925 |

|

| Revolving credit facility |

|

|

— |

|

|

|

23,750 |

|

| Long-term debt |

|

|

160,539 |

|

|

|

156,511 |

|

| Lease liabilities - operating

leases |

|

|

3,579 |

|

|

|

4,014 |

|

| Other liabilities |

|

|

27,705 |

|

|

|

40,771 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

713,053 |

|

|

|

740,177 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Redeemable noncontrolling

interest |

|

|

85,892 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

| Equity: |

|

|

|

|

|

|

|

|

|

Common stock, (no par value, 40,000,000 shares authorized,

8,289,682 and 7,785,617 shares issued and outstanding at March

31, 2021 and December 31, 2020, respectively) |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

— |

|

|

|

— |

|

|

Retained income |

|

|

216,086 |

|

|

|

199,592 |

|

|

Accumulated other comprehensive income, net of taxes |

|

|

1,405 |

|

|

|

1,544 |

|

|

Total stockholders’ equity |

|

|

217,491 |

|

|

|

201,136 |

|

|

Noncontrolling interests |

|

|

117 |

|

|

|

— |

|

|

Total equity |

|

|

217,608 |

|

|

|

201,136 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities, redeemable noncontrolling interest, and

equity |

|

$ |

1,016,553 |

|

|

$ |

941,313 |

|

HCI GROUP, INC. AND

SUBSIDIARIESConsolidated Statements of

Income(Unaudited)(Dollar amounts

in thousands, except per share amounts)

| |

|

Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2021 |

|

|

2020 |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross premiums earned |

|

$ |

130,942 |

|

|

$ |

92,365 |

|

| Premiums ceded |

|

|

(43,099 |

) |

|

|

(30,719 |

) |

| |

|

|

|

|

|

|

|

|

| Net premiums earned |

|

|

87,843 |

|

|

|

61,646 |

|

| |

|

|

|

|

|

|

|

|

| Net investment income (loss) |

|

|

4,594 |

|

|

|

(192 |

) |

| Net realized investment gains

(losses) |

|

|

1,113 |

|

|

|

(2,244 |

) |

| Net unrealized investment

losses |

|

|

(269 |

) |

|

|

(4,805 |

) |

| Credit losses on investments |

|

|

— |

|

|

|

(439 |

) |

| Policy fee income |

|

|

970 |

|

|

|

829 |

|

| Other |

|

|

623 |

|

|

|

585 |

|

| |

|

|

|

|

|

|

|

|

|

Total revenue |

|

|

94,874 |

|

|

|

55,380 |

|

| |

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Losses and loss adjustment

expenses |

|

|

45,751 |

|

|

|

28,078 |

|

| Policy acquisition and other

underwriting expenses |

|

|

23,065 |

|

|

|

11,826 |

|

| General and administrative

personnel expenses |

|

|

9,650 |

|

|

|

8,367 |

|

| Interest expense |

|

|

2,079 |

|

|

|

2,970 |

|

| Other operating expenses |

|

|

4,227 |

|

|

|

3,482 |

|

| |

|

|

|

|

|

|

|

|

|

Total expenses |

|

|

84,772 |

|

|

|

54,723 |

|

| |

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

10,102 |

|

|

|

657 |

|

| |

|

|

|

|

|

|

|

|

| Income tax expense |

|

|

3,257 |

|

|

|

110 |

|

| |

|

|

|

|

|

|

|

|

|

Net income |

|

|

6,845 |

|

|

|

547 |

|

|

Net income attributable to redeemable noncontrolling interest |

|

|

(794 |

) |

|

|

— |

|

|

Net loss attributable to noncontrolling interests |

|

|

97 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to HCI |

|

$ |

6,148 |

|

|

$ |

547 |

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share |

|

$ |

0.82 |

|

|

$ |

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

$ |

0.75 |

|

|

$ |

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends per share |

|

$ |

0.40 |

|

|

$ |

0.40 |

|

HCI GROUP, INC. AND

SUBSIDIARIES(Amounts in thousands, except per share

amounts)

A summary of the numerator and denominator of basic and diluted

income per common share calculated in accordance with GAAP is

presented below.

| |

|

Three Months Ended |

|

|

Three Months Ended |

|

| GAAP |

|

March 31, 2021 |

|

|

March 31, 2020 |

|

| |

|

Income |

|

|

Shares (a) |

|

|

Per Share |

|

|

Income |

|

|

Shares (a) |

|

|

Per Share |

|

| |

|

(Numerator) |

|

|

(Denominator) |

|

|

Amount |

|

|

(Numerator) |

|

|

(Denominator) |

|

|

Amount |

|

|

Net income attributable to HCI |

|

$ |

6,148 |

|

|

|

|

|

|

|

|

|

|

$ |

547 |

|

|

|

|

|

|

|

|

|

| Less: Income attributable to

participating securities |

|

|

(18 |

) |

|

|

|

|

|

|

|

|

|

|

(13 |

) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic Earnings Per

Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income allocated to common

stockholders |

|

|

6,130 |

|

|

|

7,474 |

|

|

$ |

0.82 |

|

|

|

534 |

|

|

|

7,369 |

|

|

$ |

0.07 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of Dilutive

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock options |

|

|

— |

|

|

|

96 |

|

|

|

|

|

|

|

— |

|

|

|

9 |

|

|

|

|

|

| Convertible senior notes (b) |

|

|

1,312 |

|

|

|

2,288 |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

| Warrants |

|

|

— |

|

|

|

72 |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted Earnings Per

Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income available to common

stockholders and assumed conversions |

|

$ |

7,442 |

|

|

|

9,930 |

|

|

$ |

0.75 |

|

|

$ |

534 |

|

|

|

7,378 |

|

|

$ |

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) Shares in

thousands. |

|

| (b) For the three

months ended March 31, 2020, convertible senior notes were excluded

due to their anti-dilutive effect. |

|

Non-GAAP Financial Measures

Adjusted net income is a Non-GAAP financial measure that removes

from net income the effect of unrealized gains or losses on equity

securities required to be included in results of operations in

accordance with Accounting Standards Codification 321. HCI Group

believes net income without the effect of volatility in equity

prices more accurately depicts operating results. This financial

measurement is not recognized in accordance with accounting

principles generally accepted in the United States of America

("GAAP") and should not be viewed as an alternative to GAAP

measures of performance. A reconciliation of GAAP net income to

Non-GAAP Adjusted net income and GAAP diluted earnings per share to

Non-GAAP Adjusted diluted earnings per share is provided below.

Reconciliation of GAAP Net Income to Non-GAAP Adjusted

Net Income

| |

|

Three Months Ended |

|

Three Months Ended |

| |

|

March 31, 2021 |

|

March 31, 2020 |

|

GAAP Net income attributable to HCI |

|

|

|

|

|

$ |

6,148 |

|

|

|

|

|

|

|

|

$ |

547 |

|

|

|

| Net unrealized investment losses

(gains) |

|

$ |

269 |

|

|

|

|

|

|

|

|

$ |

4,805 |

|

|

|

|

|

|

|

| Less: Tax effect at

24.52182% |

|

$ |

(66 |

) |

|

|

|

|

|

|

|

$ |

(1,178 |

) |

|

|

|

|

|

|

| Net adjustment to Net income |

|

|

|

|

|

$ |

203 |

|

|

|

|

|

|

|

|

$ |

3,627 |

|

|

|

| Non-GAAP Adjusted Net income |

|

|

|

|

|

$ |

6,351 |

|

|

|

|

|

|

|

|

$ |

4,174 |

|

|

|

HCI GROUP, INC. AND

SUBSIDIARIES(Amounts in thousands, except per share

amounts)

A summary of the numerator and denominator of the basic and

diluted income per common share calculated with the Non-GAAP

financial measure Adjusted net income is presented below.

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

| Non-GAAP |

|

March 31, 2021 |

|

|

March 31, 2020 |

|

| |

|

Income |

|

|

Shares (a) |

|

|

Per Share |

|

|

Income |

|

|

Shares (a) |

|

|

Per Share |

|

| |

|

(Numerator) |

|

|

(Denominator) |

|

|

Amount |

|

|

(Numerator) |

|

|

(Denominator) |

|

|

Amount |

|

|

Adjusted net income attributable to HCI (non-GAAP) |

|

$ |

6,351 |

|

|

|

|

|

|

|

|

|

|

$ |

4,174 |

|

|

|

|

|

|

|

|

|

| Less: Income attributable to

participating securities |

|

|

(31 |

) |

|

|

|

|

|

|

|

|

|

|

(200 |

) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic Earnings Per Share

before unrealized gains/losses on equity

securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income allocated to common

stockholders |

|

|

6,320 |

|

|

|

7,474 |

|

|

$ |

0.85 |

|

|

|

3,974 |

|

|

|

7,369 |

|

|

$ |

0.54 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of Dilutive

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock options |

|

|

— |

|

|

|

96 |

|

|

|

|

|

|

|

— |

|

|

|

9 |

|

|

|

|

|

| Convertible senior notes (b) |

|

|

1,312 |

|

|

|

2,288 |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

| Warrants |

|

|

— |

|

|

|

72 |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted Earnings Per

Share before unrealized gains/losses on

equity securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income available to common

stockholders and assumed conversions |

|

$ |

7,632 |

|

|

|

9,930 |

|

|

$ |

0.77 |

|

|

$ |

3,974 |

|

|

|

7,378 |

|

|

$ |

0.54 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) Shares in

thousands. |

|

| (b) For the three

months ended March 31, 2020, convertible senior notes were excluded

due to their anti-dilutive effect. |

|

Reconciliation of GAAP Diluted EPS to Non-GAAP Adjusted

Diluted EPS

|

|

|

Three Months Ended |

|

Three Months Ended |

|

|

|

March 31, 2021 |

|

March 31, 2020 |

|

GAAP diluted Earnings Per Share |

|

|

|

|

|

$ |

0.75 |

|

|

|

|

|

|

|

|

$ |

0.07 |

|

|

|

| Net unrealized investment losses

(gains) |

|

$ |

0.03 |

|

|

|

|

|

|

|

|

$ |

0.65 |

|

|

|

|

|

|

|

| Less: Tax effect at

24.52182% |

|

$ |

(0.01 |

) |

|

|

|

|

|

|

|

$ |

(0.18 |

) |

|

|

|

|

|

|

| Net adjustment to GAAP diluted

EPS |

|

|

|

|

|

$ |

0.02 |

|

|

|

|

|

|

|

|

$ |

0.47 |

|

|

|

| Non-GAAP Adjusted diluted

EPS |

|

|

|

|

|

$ |

0.77 |

|

|

|

|

|

|

|

|

$ |

0.54 |

|

|

|

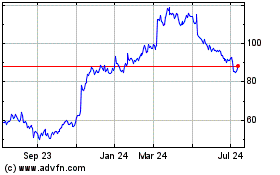

HCI (NYSE:HCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

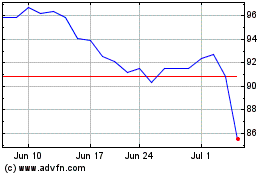

HCI (NYSE:HCI)

Historical Stock Chart

From Apr 2023 to Apr 2024