Brokers Bank on Your Cash, but Some Are Breaking From the Pack

August 07 2019 - 5:18PM

Dow Jones News

By Lisa Beilfuss

Fidelity Investments said it has sweetened the deal for

customers holding cash there, the latest salvo in the price war

playing out among brokerages competing for clients' assets.

The Boston-based firm, which manages about $2.8 trillion in

assets, said Wednesday that it is automatically sweeping cash in

new brokerage and retirement accounts into a money-market fund

yielding 1.91% annually. That compares to the 0.2% national average

yield on money funds and 0.09% on savings account balances,

according to S&P Global Market Intelligence.

Raking uninvested client cash from brokerage accounts into

banking products is a common practice in the brokerage and banking

world.

Cash sweeps, as they are known, are lucrative because firms

typically pay clients much less in interest than the firms earn on

the cash. Investors with relatively small cash balances in their

brokerage accounts aren't always motivated to move the money, but

those dollars add up to billions at big brokerage businesses.

Fidelity said it started automatically sweeping cash in new

accounts into the higher-yielding money-market fund in May.

Existing customers can opt to have their cash swept into the

higher-yielding fund, the company said.

Offering higher yields on cash has become a popular tactic to

attract customers. Automated advisers Betterment and Wealthfront

Inc., for example, are offering more on cash by sweeping it to

partner banks, and some banks including Goldman Sachs Group Inc.'s

Marcus has been paying relatively high interest on savings. But

Fidelity's move is notable given how the biggest brokerage firms

have been treating customers' cash.

"Many of the incumbent brokerages have been going in the other

direction, " said Devin Ryan, brokerage analyst at JMP Securities

LLC. Customers typically have to opt out of low-yielding bank

products by buying money funds or other products. "What Fidelity is

doing is removing that step," he said.

As brokerages try to make up for the revenue they are giving up

on trading fees and financial advice in order to woo customers'

assets, cash has become more crucial to their profitability. At

Charles Schwab Corp., its bank made more than half of the company's

overall revenue of $10.13 billion in 2018, up from 29% of revenue

in 2009. In recent years, Schwab began sweeping uninvested client

cash into low-yielding brokerage products.

Fidelity's move comes as investors, nervous about slowing

economic growth and trade tensions with China, are shifting more

money to havens and cash stockpiles are growing. Money-market fund

assets surged 30% in July to $3.62 trillion, the highest since

March 2009, according to Crane Data.

Everyday investors have been driving that increase into money

funds, said Pete Crane, chief executive at Crane Data, a firm that

tracks money-market and mutual-fund flows. "A big portion of that

[rise] is a quiet revolt against ultralow yields," he said. "It was

just a matter of time before cash became a battleground, too."

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

August 07, 2019 17:03 ET (21:03 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

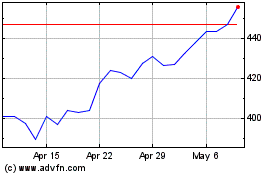

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Mar 2024 to Apr 2024

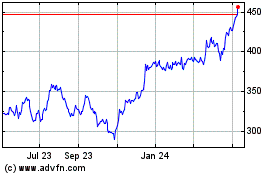

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Apr 2023 to Apr 2024