SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2019

(Commission File No. 001-32221) ,

GOL LINHAS AÉREAS INTELIGENTES S.A.

(Exact name of registrant as specified in its charter)

GOL INTELLIGENT AIRLINES INC.

(Translation of Registrant's name into English)

Praça Comandante Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of Regristrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

São Paulo, January

17

, 2019 – GOL Linhas Aéreas Inteligentes S.A. (“GOL” or the “Company”), (NYSE: GOL and B3: GOLL4)

,

Brazil's #1 airline, an

nounced tod

ay that its subsidiary, Gol Finance (formerly Gol LuxCo S.A.) (“

Gol Financ

e

”), has extended the expiration time (such time and date, as the same may be further extended, terminated or amended, the “

Expiration Time

”) of its previously announced cash tender offer (the “

Tender Offer

”) for any and all of its outstanding US$91,5

33,000 aggregate principal amount of 8.875% Senior Notes due 2022 (the “

2022 Notes

”)

(144A CUSIP No./ISIN 3

8045LAA

8/US38045LAA89 and Reg S CUSIP No./ISIN L4441PAA8/USL4441PAA86) from 5:00 p.m., New York City time, on January 16, 2019 to 5:00 p.m., New York City time, on January 31, 2019, unless further extended, terminated or amended.

Completion of the Tender Offer is subject to certain market and other conditions. Settlement of the Tender Offer is expected to occur on the third business day following the Expiration Time (as amended by this announcement), unless the Tender Offer is terminated prior to such date. Tendered 2022 Notes may be withdrawn at any time at or prior to 5:00 p.m., New York City time, on January 17, 2019. Tendered 2022 Notes may also be withdrawn any time after the 60

th

business day after commencement of the Tender Offer if for any reason the offer has not been consummated within 60 business days after commencement.

Upon the terms and subject to the conditions of the Tender Offer set forth in the Offer to Purchase, dated January 3, 2019 (the “

Offer to Purchase

”), all 2022 Notes validly tendered and not validly withdrawn or with respect to which a properly completed and duly executed Notice of Guaranteed Delivery (as described in the Offer to Purchase) is delivered at or prior to the Expiration Time (as amended by this announcement), as applicable, will be accepted for purchase.

Gol Finance reserves the absolute right to amend or terminate the Tender Offer in its sole discretion, subject to disclosure and other requirements under applicable law. In the event of termination of the Tender Offer, 2022 Notes tendered and not accepted for purchase pursuant to the Tender Offer will be promptly returned to the tendering holders. The complete terms and conditions of the Tender Offer are described in the Offer to Purchase and the related Letter of Transmittal and Notice of Guaranteed Delivery, each dated

January 3, 2019

, copies of which may be obtained from D.F. King & Co., Inc., the tender agent and information agent (the “

Tender Agent and Information Agent

”) for the Tender Offer, at

www.dfking.com/gol

, by telephone at +1 (866) 796-6898 (U.S. toll free) or +1 (212) 269-5550 (collect), in writing to 48 Wall Street, 22nd Floor, New York, New York

10005, Attention: Mei Zheng, or by email to gol@dfking.com.

Gol Finance has engaged Merrill Lynch, Pierce, Fenner & Smith Incorporated and Morgan Stanley & Co. LLC to act as the dealer managers (the “

Dealer Managers

”) in connection with the Tender Offer. Questions regarding the terms of the Tender Offer may be directed to Merrill Lynch, Pierce, Fenner & Smith Incorporated by telephone at +1 (888) 292-0070 (U.S. toll free) or +1 (646) 855-8988 (collect) and Morgan Stanley & Co. LLC by telephone at +1 (800) 624-1808 (U.S. toll free) or +1 (212) 761-1057 (collect).

|

1

|

|

Disclaimer

None of Gol Finance, GOL, the Dealer Managers, the Tender Agent and Information Agent or the trustee for the 2022 Notes, or any of their respective affiliates, is making any recommendation as to whether holders should or should not tender any 2022 Notes in response to the Tender Offer or expressing any opinion as to whether the terms of the Tender Offer are fair to any holder. Holders must make their own decision as to whether to tender any of their 2022 Notes and, if so, the principal amount of 2022 Notes to tender. Please refer to the Offer to Purchase for a description of the offer terms, conditions, disclaimers and other information applicable to the Tender Offer.

This press release is for informational purposes only and does not constitute an offer to purchase or the solicitation of an offer to sell any 2022 Notes. The Tender Offer is being made solely by means of the Offer to Purchase and the related Letter of Transmittal. The Tender Offer is not being made to holders of 2022 Notes in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction. In those jurisdictions where the securities, blue sky or other laws require any tender offer to be made by a licensed broker or dealer, the Tender Offer will be deemed to be made on behalf of Gol Finance by the Dealer Managers or one or more registered brokers or dealers licensed under the laws of such jurisdiction.

This release may contain forward-looking statements within the meaning of Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended, including those related to the Tender Offer. Forward-looking information is subject to important risks and uncertainties that could significantly affect anticipated results, and, accordingly, results may differ from those expressed in any forward-looking statements. These risks and uncertainties include, but are not limited to, general economic, political and business conditions in Brazil, South America and the Caribbean, existing and future governmental regulations, including air traffic capacity controls, and management’s expectations and estimates concerning the company’s financial performance and financing plans and programs. Additional information concerning potential factors that could affect the company’s financial results is included in GOL’s Annual Report on Form 20-F for the year ended December 31, 2017 and its current reports filed with the United States Securities and Exchange Commission. Neither GOL nor Gol Finance is under any obligation to (and expressly disclaims any obligation to) update forward-looking statements as a result of new information, future events or otherwise, except as required by law.

Investor Relations

ri@voegol.com.br

www.voegol.com.br/ir

+55 (11) 2128-4700

|

2

|

|

About GOL Linhas Aéreas Inteligentes S.A.

GOL

serves more than 30 million passengers annually. With Brazil’s largest network,

GOL

offers customers more than 700 daily flights to 69 destinations in Brazil and South America, the Caribbean and the United States.

GOLLOG

is a leading cargo transportation and logistics business serving more than 3,400 Brazilian municipalities and, through partners, more than 200 international destinations in 95 countries.

SMILES

is one of the largest coalition loyalty programs in Latin America, with over 14 million registered participants, allowing clients to accumulate miles and redeem tickets for more than 700 locations worldwide, Headquartered in São Paulo.

GOL

has a team of more than 15,000 highly skilled aviation professionals and operates a fleet of 120 Boeing 737 aircraft, with a further 133 Boeing 737 MAX on order, delivering Brazil's top on-time performance and an industry leading 18 year safety record.

GOL

has invested billions of Reais in facilities, products and services and technology to enhance the customer experience in the air and on the ground. GOL's shares are traded on the NYSE (GOL) and the B3 (GOLL4). For further information, visit

www.voegol.com.br/ir

.

|

3

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 17, 2019

|

GOL LINHAS AÉREAS INTELIGENTES S.A.

|

|

|

|

|

|

|

|

By:

|

/S/ Richard Freeman Lark Junior

|

|

|

Name: Richard Freeman Lark Junior

Title: Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

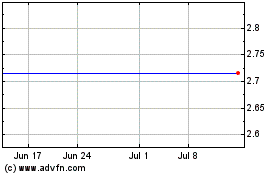

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

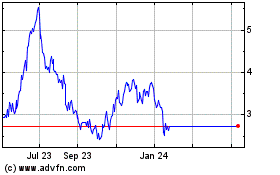

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Apr 2023 to Apr 2024