Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

|

|

Filed by the Registrant ý

|

Filed by a Party other than the Registrant o

|

Check the appropriate box:

|

o

|

|

Preliminary Proxy Statement

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

ý

|

|

Definitive Proxy Statement

|

o

|

|

Definitive Additional Materials

|

o

|

|

Soliciting Material under §240.14a-12

|

|

|

|

|

|

|

|

GENERAC HOLDINGS INC.

|

(Name of Registrant as Specified In Its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

ý

|

|

No fee required.

|

o

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

o

|

|

Fee paid previously with preliminary materials.

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Table of Contents

April 29, 2020

|

|

|

|

|

|

Notice of Annual

Meeting of Stockholders

|

To the Stockholders of our Company:

You are cordially invited to attend the 2020 Annual Meeting of Stockholders where we will be voting on the below matters.

Items of Business

-

•

-

To elect the three nominees named herein as Class II directors;

-

•

-

To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the

year ending December 31, 2020;

-

•

-

To vote on an advisory, non-binding "say-on-pay" resolution to approve the compensation of our executive officers; and

-

•

-

To consider any other matters that may properly come before the meeting or any adjournments or postponements of the meeting.

|

|

|

|

|

DATE AND TIME:

Thursday, June 18, 2020

9:00 a.m. CT

|

|

Instructions regarding all methods of voting are contained on any Notice of Internet Availability of Proxy Materials or proxy card provided. If your shares are held in the name of a bank, broker, fiduciary or custodian, follow the voting

instructions you receive from your record holder.

Your vote is important. Whether or not you intend to be

present at the meeting, to assure that your shares are represented at the meeting, please vote promptly using one of the methods mentioned below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WHERE:

|

|

Internet

|

|

Telephone

|

|

Mail

|

|

In Person

|

|

Generac Power Systems, Inc.

S45 W29290 Hwy. 59

Waukesha, Wisconsin

53189

ADMISSION:

Holders of record of

our common stock at

|

|

Visit the internet website indicated on the Notice of Internet Availability or any proxy card you receive and follow the on-screen instructions.

|

|

Use the toll-free telephone number shown on the Notice of Internet Availability or any proxy card you receive.

|

|

If you request a paper proxy card by telephone or internet, you may elect to vote by mail. If you elect to do so, you should date, sign and promptly return your proxy card by mail in the postage prepaid

envelope which accompanied that proxy card.

|

|

You can deliver a completed proxy card at the meeting or vote in person.

|

|

the close of business

on April 20, 2020 are

entitled to notice of,

|

|

Thank you for your continued support of and interest in the Company.

|

|

|

|

|

|

|

|

and to vote at, the

annual meeting.

|

|

|

|

By Order of the Board of Directors,

Raj Kanuru

Executive Vice President, General

Counsel, and Secretary

|

Table of Contents

TABLE OF CONTENTS

Important notice:

The Board of Directors (the "Board of Directors" or

"Board") of Generac Holdings Inc. ("Generac,"

"we," "us," "our," or the

"Company") is soliciting your proxy to be voted at the Annual Meeting of Stockholders to be held on Thursday, June 18, 2020.

Instead

of mailing a printed copy of our proxy materials to each stockholder, we furnish proxy materials to our stockholders over the internet by mailing a Notice of Internet Availability of Proxy

Materials ("Notice of Internet Availability"). In view of the impact of COVID-19, and updated Guidance issued by the SEC on April 7, 2020 concerning Delays in Printing and Mailing of Full Set

of Proxy Materials, we are mailing only a Notice of Internet Availability to all shareholders. The Notice of Internet Availability includes information on where to view all proxy materials online, as

well as voting instructions. If you would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet

Availability. The Notice of Internet Availability was first mailed on or about April 29, 2020 to all stockholders of record as of the record date for the annual meeting, which was the close of

business on April 20, 2020.

|

|

|

|

|

|

|

|

|

|

|

2020

Proxy

Statement

|

Table of Contents

Summary

Information

Our Corporate Strategy

Generac By The Numbers

|

|

|

|

|

|

|

|

|

1

|

|

2020

Proxy

Statement

|

Table of Contents

SUMMARY INFORMATION

|

|

|

|

|

|

|

Proposals at the Meeting

|

|

Our Board Recommends

a vote "FOR" each of the

following:

|

|

Proposal 1: Election of Directors

|

|

|

|

|

Marcia J. Avedon

Bennett J. Morgan

Dominick P. Zarcone

|

|

Pages 4-12

|

|

|

|

|

|

|

|

|

Proposal 2:

|

|

|

|

|

To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2020;

|

|

Page 54

|

|

|

|

|

|

|

|

|

Proposal 3:

|

|

|

|

|

To vote on an advisory, non-binding "say-on-pay" resolution to approve the compensation of our executive officers

|

|

Page 55

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

|

|

2020

Proxy

Statement

|

Table of Contents

SUMMARY INFORMATION

Our 2019 Business Highlights

We achieved a number of significant milestones in 2019 that we believe are important to the execution of our strategy.

Key Components and Design of the Executive Compensation Program

* A full discussion of our use of non-U.S. generally accepted accounting principles measures to provide a baseline for evaluating and comparing our

operating results, and a reconciliation of Adjusted EBITDA to net income can be found in Item 6 of the Company's Annual Report on Form 10-K for the fiscal year ended December 31,

2019.

|

|

|

|

|

|

|

|

|

3

|

|

2020

Proxy

Statement

|

Table of Contents

Proposal 1 — Election of Class II Directors

|

|

|

|

|

|

|

|

|

|

The nominees for election as Class II Directors at the 2020 annual meeting are described below. The Board, upon the recommendation of the Nominating and Corporate Governance Committee of the Board of Directors, has nominated each of the

candidates for election. If elected, each of the nominees is expected to serve for a three-year term expiring at the annual meeting of stockholders of the Company in 2023 and until their respective successors have been elected and qualified.

The Board of Directors recommends a vote FOR the Company's nominees for Class II

Directors.

|

|

|

|

|

Our

Third Amended and Restated Certificate of Incorporation provides that our Board of Directors is divided into three classes, with each class serving a consecutive three-year term. The term of the

current Class II Directors will expire on the date of the 2020 annual meeting, subject to the election and qualification of their respective successors. The Board of Directors expects that each

of the nominees will be available for election as a director. However, if by reason of an unexpected occurrence, one or more of the nominees is not available for election, the persons named in the

form of proxy have advised that they will vote for such substitute nominees as the Board of Directors may nominate.

In

selecting director candidates, the Nominating and Corporate Governance Committee considers whether the candidates possess the required skill sets and fulfill the qualification requirements of

directors approved by the Board of Directors, including integrity, objectivity, sound judgment, leadership, and diversity in all aspects of that term, including differences of perspective,

professional experience, education, skills, and other individual qualities, such as gender, race, and ethnicity.

The

following table provides the composition of each of our committees:

-

"C"

-

=

Chairperson

-

"L"

-

=

Lead Director

|

|

|

|

|

|

|

|

|

4

|

|

2020

Proxy

Statement

|

Table of Contents

PROPOSAL 1 – ELECTION OF CLASS II DIRECTORS

Our

directors and nominees bring a broad range of skills, experiences, and perspectives to our board. The below tables and graphics summarize the skills and experiences that bring value to our

company.

|

|

|

|

|

|

|

|

|

5

|

|

2020

Proxy

Statement

|

Table of Contents

PROPOSAL 1 – ELECTION OF CLASS II DIRECTORS

The

following biographies describe the business experience of each director. Following the biographical information for each director below, we have listed qualifications that, in addition to those

discussed above, the Board of Directors considered in determining whether to recommend the director be nominated for reelection.

Nominees for Election

Class II Directors

MARCIA J. AVEDON, PH.D.

|

|

|

|

|

|

|

|

|

Age: 58

Director Since: 2019

|

|

EXPERIENCE & QUALIFICATIONS

•

2020-Current: Executive Vice President, Chief Human Resources, Marketing, & Communications

Officer for Trane Technologies, a climate control innovation company focusing on heating and cooling in buildings, homes, and transportation (previously Ingersoll Rand, plc)

•

2007-2020: Senior Vice President of Human Resources, Communications, and Corporate Affairs for Ingersoll Rand, leading global human resources, public affairs, corporate social responsibility, communications, and strategic

marketing

•

2002-2006: Chief Human Resources Officer at Merck, a global pharmaceutical company

•

1995-2002: Held increasingly responsible leadership positions in Human Resources and Communications for Honeywell International, a global diversified company

•

Prior to 1995: Held positions in Human Resources at Anheuser-Busch Companies and as a consultant with Booz, Allen & Hamilton

Other Board Service

•

Former Director of GCP

Applied Technologies, a global manufacturer of construction products

•

Former Director of Lincoln

National Corporation

Ms. Avedon has over 30 years of experience leading organizational transformation, talent and succession management, culture change, corporate

social responsibility and communications. Ms. Avedon earned a bachelor's degree in Psychology from the University of North Carolina at Wilmington, and a Master's and Ph.D. in Industrial and Organizational Psychology from George Washington

University.

|

|

|

|

|

|

|

|

|

|

6

|

|

2020

Proxy

Statement

|

Table of Contents

PROPOSAL 1 – ELECTION OF CLASS II DIRECTORS

BENNETT J. MORGAN

|

|

|

|

|

|

|

|

|

Age: 56

Director Since: 2013

Lead Director Since: 2018

|

|

EXPERIENCE & QUALIFICATIONS

•

2005-2016: President and Chief Operating Officer, Polaris Industries Inc., a manufacturer of

power sports vehicles ("Polaris")

•

2004-2005: Vice President and General Manager, ATV Division, Polaris

•

2001-2004: General Manager, ATV Division, Polaris

•

1997-2001: General Manager, PGA

Division, Polaris

•

1987-1997: Various marketing, product development, and operations positions at Polaris Industries

Mr. Morgan brings to Generac extensive leadership skills, and over 25 years of expertise in international consumer durables products, dealer distribution, and product development and

innovation in such senior roles as President and Chief Operating Officer. Mr. Morgan earned his Master of Business Administration from the Carlson School of Management at the University of Minnesota and his Bachelor of Science in Economics from

St. John's University.

|

DOMINICK P. ZARCONE

|

|

|

|

|

|

|

|

|

Age: 61

Director Since: 2017

|

|

EXPERIENCE & QUALIFICATIONS

•

2017-Current: President and Chief Executive Officer of LKQ Corporation, a global distributor of

vehicle parts and accessories

•

2015-2017: Chief Financial Officer, LKQ Corporation

•

2011-2015: Managing Director and Chief Financial Officer of Baird Financial Group, a capital markets and wealth management company, and certain of its affiliates

•

2011-2015: Treasurer of Baird Funds, Inc., a family of fixed income and equity mutual funds managed by Robert W. Baird & Co. Incorporated, a registered

broker/dealer

•

1995-2011: Managing Director of the Investment Banking department of Robert W. Baird & Co. Incorporated

•

1986-1995: Held various positions with investment banking company Kidder, Peabody & Co., Incorporated, most recently as Senior Vice President of

Investment Banking

Other Board Service

•

Current Director of LKQ Corporation, since 2017

Mr. Zarcone brings to Generac extensive management and leadership experience as a senior

executive gained in roles as Chief Executive Officer and Chief Financial Officer of a public corporation, and over 25 years of expertise in investment banking and capital markets. Mr. Zarcone earned his Bachelor of Science in Finance from

the University of Illinois at Urbana-Champaign and Master of Business Administration from the University of Chicago Graduate School of Business.

|

|

|

|

|

|

|

|

|

|

7

|

|

2020

Proxy

Statement

|

Table of Contents

PROPOSAL 1 – ELECTION OF CLASS II DIRECTORS

Other Members of the Board of Directors

Including the nominees, the Board of Directors currently consists of ten (10) directors, each of whom, other than the nominees, is

described below. The terms of the Class I Directors expire at the 2022 Annual Meeting of Stockholders, subject to the election and qualification of their respective successors. The terms of the

Class III Directors expire at the 2021 Annual Meeting of Stockholders, subject to the election and qualification of their respective successors.

Class I Directors

JOHN D. BOWLIN

|

|

|

|

|

|

|

|

|

Age: 69

Director Since: 2006

|

|

EXPERIENCE & QUALIFICATIONS

•

2008-2011: Consultant to CCMP Capital Advisors, LLC

•

1985-2003: Held various leadership positions with Philip Morris Companies, Inc. and Miller Brewing Company, including

o

President, Oscar Mayer Food Corporation,

o

President and Chief Operating Officer, Miller Brewing Company,

o

President and Chief Operating Officer, Kraft Foods North America,

o

President and Chief Executive Officer, Kraft International, Inc., and

o

President and Chief Executive Officer, Miller Brewing Company.

Other Board Service

•

Current Director of Cerity Partners

•

Former Director of the Schwan Food Company, Quiznos, and ChupaChups

•

Former Director and Non-Executive

Chairman of

o

Vitamin Shoppe, Inc.,

o

Spectrum Brands, and

o

Pliant Corporation.

Mr. Bowlin has extensive leadership skills and operations experience in

senior positions, including as Chairman, Chief Executive Officer and Chief Operating Officer for a number of private companies and divisions of public companies. Mr. Bowlin holds a Bachelor of Business Administration from Georgetown University

and a Master of Business Administration from Columbia University.

|

|

|

|

|

|

|

|

|

|

8

|

|

2020

Proxy

Statement

|

Table of Contents

PROPOSAL 1 – ELECTION OF CLASS II DIRECTORS

AARON P. JAGDFELD

|

|

|

|

|

|

|

|

|

Age: 48

Director Since: 2006

Chairman Since: 2016

|

|

EXPERIENCE & QUALIFICATIONS

•

2008-Current: President and Chief Executive Officer of Generac

•

2007: President of Generac, responsible for sales, marketing, engineering, and product development

•

2002-2006: Chief Financial Officer, Generac

•

1994-2001: Finance Department,

Generac

•

Prior to 1994: Audit Practice, Deloitte & Touche, LLP

Other Board Service

•

Current Director of The Hillman

Group

As the Chief Executive Officer and the only management representative on the Board, Mr. Jagdfeld provides valuable insight to the Board into the day-to-day

business issues facing the Company. Since joining the Company, he has navigated a number of challenges, including our initial public offering, the significant increase in sales, numerous acquisitions and our international expansion. Mr. Jagdfeld

has extensive finance and operational experience and has high-level leadership experience in several prior positions. Mr. Jagdfeld holds a Bachelor of Business Administration in Accounting from the University of Wisconsin-Whitewater.

|

ANDREW G. LAMPEREUR

|

|

|

|

|

|

|

|

|

Age: 57

Director Since: 2014

|

|

EXPERIENCE & QUALIFICATIONS

•

2000-2017: Executive Vice President and Chief Financial Officer, Actuant Corporation, a global

diversified company that designs and manufactures industrial products and systems

•

1999-2000: Applied Power

(Actuant) Business Development Leader

•

1998-1999: Vice President and General Manager-Distribution, Gardner Bender (Actuant subsidiary)

•

1996-1998: Vice President Finance, Gardner Bender

•

1993-1996: Corporate Controller,

Actuant Corporation

•

Prior to 1993: Held various financial positions with Fruehauf Trailer Corporation, Terex Corporation, and Price Waterhouse

Other Board Service

•

Current

Director of Jason Industries, Inc., since 2019

•

Former Director of Robbins & Myers

Mr. Lampereur contributes over 26 years of senior-level financial experience in a variety of businesses complementary to Generac, including as a chief financial officer and director of a public company. Mr. Lampereur graduated

with a Bachelor of Business Administration from St. Norbert College. He is also a Certified Public Accountant.

|

|

|

|

|

|

|

|

|

|

9

|

|

2020

Proxy

Statement

|

Table of Contents

PROPOSAL 1 – ELECTION OF CLASS II DIRECTORS

Class III Directors

ROBERT D. DIXON

|

|

|

|

|

|

|

|

|

Age: 60

Director Since: 2012

|

|

EXPERIENCE & QUALIFICATIONS

•

2014-2016: Chairman and CEO of Natural Systems Utilities LLC, a distributed water

infrastructure company

•

2012-2014: Chief Executive Officer of Seven Seas Water Corporation, an international services corporation

•

1983-2011: Held various leadership roles at Air Products and Chemicals, Inc., including Senior Vice President & General Manager

Other Board Service

•

Former Director of

Valicor Environmental Services, a private equity-owned company that is one of the largest providers of non-hazardous wastewater treatment services in North America.

Mr. Dixon brings to Generac over 30 years of global management, operations and finance experience. Mr. Dixon earned a Master of Business Administration from Pennsylvania State University and a Bachelor of Business Administration from

Miami University. He also attended the Advanced Management Program at INSEAD in Fontainebleau, France.

|

DAVID A. RAMON

|

|

|

|

|

|

|

|

|

Age: 64

Director Since: 2010

|

|

EXPERIENCE & QUALIFICATIONS

•

2014-2018: Chairman and Chief Executive Officer of Diversified Maintenance, a specialized facility

services company

•

1998-Current: Founder and Managing Partner of Vaduz Partners, a private investment firm

•

2000-2007: President, Chief Executive Officer, and Director of USA.NET, Inc.

•

1997-1998: President, Coleman Outdoor Recreation Group

•

1994-1997: Held various senior management positions, including President and Chief Operating Officer

of New World Television, Inc. and Director of New World Communications Group, Inc.

•

1982-1994: Executive Vice

President and Chief Financial Officer of Gillett Holdings, Inc.

•

Prior to 1982: Arthur

Young & Company

Mr. Ramon brings to Generac more than 30 years of broad management, operations, and investment experience with both established and

emerging companies. Mr. Ramon has leadership and financial experience, including as CEO, COO, President and CFO of a number of private and public companies. Mr. Ramon earned a Bachelor of Business Administration degree in accounting from

the University of Wisconsin.

|

|

|

|

|

|

|

|

|

|

10

|

|

2020

Proxy

Statement

|

Table of Contents

PROPOSAL 1 – ELECTION OF CLASS II DIRECTORS

WILLIAM D. JENKINS, JR.

|

|

|

|

|

|

|

|

|

Age: 54

Director Since: 2017

|

|

EXPERIENCE & QUALIFICATIONS

•

2012-Current: President & Chief Executive Officer of Barracuda Networks, a private network

technology company

•

1998-2012: Held various positions at EMC Corporation, an information infrastructure company, including President of the Backup Recovery

Systems division

Other Board Service

•

Current Director of Barracuda Networks

•

Current Director of Sumo Logic

•

Former Lead Director and member of Compensation and Audit Committees for Apigee Corporation (acquired by Google, Inc.)

•

Former Director and member of Audit Committee for Nimble Storage, Inc. (acquired by Hewlett Packard Enterprise Company)

Mr. Jenkins brings to Generac extensive management and leadership experience gained in such senior roles as Chief Executive Officer for a technology company. Mr. Jenkins holds a

Bachelor of Science degree in general engineering from the University of Illinois and a Master of Business Administration degree from Harvard Business School.

|

|

|

|

|

|

|

|

|

|

11

|

|

2020

Proxy

Statement

|

Table of Contents

PROPOSAL 1 – ELECTION OF CLASS II DIRECTORS

KATHRYN V. ROEDEL

|

|

|

|

|

|

|

|

|

Age: 59

Director Since: 2016

|

|

EXPERIENCE & QUALIFICATIONS

•

2005-2016: Held various leadership roles at Sleep Number Corporation, a manufacturer of mattresses

and sleep-related products, including

o

Executive Vice President and Chief Services and

Fulfillment Officer

o

Executive Vice President, Product and Service, and

o

Senior Vice President, Global Supply Chain.

•

1983-2005: Held various leadership roles at GE, including

o

General Manager, Global Supply Chain Strategy, GE Healthcare,

o

General Manager, Global Quality and Six Sigma, GE Healthcare,

o

Vice President Technical Operations and Director/Vice President of Quality Programs for GE Clinical Services, a division of GE Healthcare, and

o

Various roles in Sourcing, Engineering, and Manufacturing at GE Information Services and GE Healthcare.

Other Board Service

•

Current

Director of Columbus McKinnon Corporation, a public company that designs and manufactures material handling systems

•

Current Director of The Jones

Family of Companies, a private, family-owned manufacturer serving the mattress and janitorial industries

Ms. Roedel has over 30 years of extensive global general

management, operations, supply chain and services experience. Ms. Roedel graduated with a B.S., Mechanical Engineering from Michigan State University.

|

|

|

|

|

|

|

|

|

|

12

|

|

2020

Proxy

Statement

|

Table of Contents

Corporate

Governance

Board of Directors Independence Standards for Directors

Pursuant

to our Corporate Governance Guidelines and Principles, a copy of which is available on our website at www.generac.com, the Board of Directors is required to affirmatively

determine whether our directors are independent under the listing standards of the New York Stock Exchange ("NYSE"), the principal exchange on which our

common stock is traded.

|

|

|

|

|

During its annual review of director independence, the Board of Directors considers all information it deems relevant, including without limitation any transactions and relationships between each director or any member of

his or her immediate family and the Company and its subsidiaries and affiliates. The Board of Directors also considers the recommendations of the Nominating and Corporate Governance Committee, which conducts a separate independence assessment of all

directors as part of its nomination process for the Board of Directors and its respective committees. The purpose of this review is to determine whether any such relationship or transaction is considered a "material relationship" that would be

inconsistent with a determination that a director is independent. The Board of Directors has not adopted any "categorical standards" for assessing independence, preferring instead to consider all relevant facts and circumstances in making an

independence determination including, without limitation, applicable independence standards promulgated by the NYSE.

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

2020

Proxy

Statement

|

Table of Contents

CORPORATE GOVERNANCE

Committees of the Board of Directors

Our

Board of Directors has three standing committees: an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. Our Board of Directors has adopted charters for

each of its standing committees. Copies of our committee charters are posted on our website at www.generac.com.

Audit Committee

|

|

|

|

|

Members

|

|

Key

Responsibilities

(9 Meetings in 2019)

|

|

ANDREW G.

LAMPEREUR

(Chair)

DAVID

A.

RAMON

ROBERT D.

DIXON

DOMINICK P.

ZARCONE

|

|

The audit committee, among other things, assists the Board of Directors in fulfilling its responsibility relating to the following:

• the integrity of our financial statements,

• our systems of internal controls and disclosure controls and procedures,

• our compliance with applicable law and ethics programs,

• the annual independent audit of our financial statements, and

• the evaluation of financial and enterprise risks.

The Board has determined that each of Messrs. Lampereur, Ramon, Dixon, and Zarcone is an "audit committee financial expert" as defined in Item 407(d)(5) of Regulation S-K, and the

Board is satisfied that all members of our Audit Committee have sufficient expertise and business and financial experience necessary to effectively perform their duties as members of the Audit Committee.

In connection with its review of the Company's financial statements, the Audit Committee receives reports from the Company's Chief Financial Officer and the Company's independent registered

public accounting firm regarding significant risks and exposures and assesses management's steps to minimize them. The Audit Committee also reviews material legal and regulatory matters and compliance with significant applicable legal, ethical, and

regulatory requirements, and receives reports from the Company's General Counsel relating to these matters.

|

In

discharging its duties, the Audit Committee has the sole authority to select, retain, oversee, and terminate, if necessary, the independent registered public accounting firm, review and approve the

scope of the annual audit, review and pre-approve the engagement of our independent registered public accounting firm to perform audit and non-audit services, meet independently with our independent

registered public accounting firm and senior management, review the integrity of our financial reporting process, and review our financial statements and disclosures and certain SEC filings and

financial press releases.

The

Audit Committee formally met nine (9) times in 2019, and members of the Audit Committee also met informally among themselves, with management and with other members of the Board from time

to time. Decisions regarding audit-related matters were approved by our Board after taking into account the recommendations of the Audit Committee and its members. The Audit Committee maintains a

committee charter and meets with our independent registered public accounting firm without management present on a regular basis.

|

|

|

|

|

|

|

|

|

14

|

|

2020

Proxy

Statement

|

Table of Contents

CORPORATE GOVERNANCE

Compensation Committee

|

|

|

|

|

Members

|

|

Key

Responsibilities

(5 Meetings in 2019)

|

|

JOHN D.

BOWLIN

(Chair)

BENNETT J

MORGAN

WILLIAM D.

JENKINS JR.

MARCIA J.

AVEDON

|

|

• The Compensation Committee plays an integral role in the Company's processes and procedures for the consideration and determination of executive and director compensation.

• The Compensation Committee determines the compensation policies and individual

compensation decisions for our executive officers, and ensures that these policies and decisions are consistent with overall corporate performance.

• The Compensation Committee, in conjunction with the Nominating and Corporate Governance

Committee as needed, reviews the form and amount of director compensation and makes recommendations to the Board related thereto.

• The Compensation Committee has the authority to approve all stock option grants and other equity awards to

our employees, directors, and executive officers.

• The Compensation Committee also reviews and recommends to the Board of Directors the

target annual incentive pool, the annual performance objectives for participants, and actual payouts to participants, including the executive officers.

• In setting compensation, the Compensation Committee works with its independent

compensation consultant and management to create incentives that encourage an appropriate level of risk-taking that is consistent with the Company's business strategy and maximization of stockholder value.

|

The

Compensation Committee has decision-making authority with respect to all compensation decisions for our executive officers, including annual incentive plan awards and grants of equity awards. The

Compensation Committee is responsible for finalizing and approving the performance objectives relevant to the compensation of our CEO and other executive officers.

The

Compensation Committee's recommendations are developed with input from our CEO and, where appropriate, other senior executives. The Compensation Committee reviews management recommendations and

input from compensation consultants, along with other sources of data when formulating its independent recommendations to the Board of Directors. A discussion and analysis of the Company's

compensation decisions regarding the executive officers named in the Summary Compensation Table appears in this proxy statement under the heading "EXECUTIVE COMPENSATION—Compensation

Discussion and Analysis."

To

assist it in performing its duties, the Compensation Committee has the authority to engage outside consulting firms. The Compensation Committee has engaged Willis Towers Watson & Co.

("Willis Towers Watson") as its independent compensation consultant since September 2014. In its capacity as outside and independent compensation consultants, Willis Towers Watson reports directly to

the Compensation Committee.

The

Compensation Committee has sole authority to replace compensation consultants retained from time to time, and to hire additional Compensation Committee consultants at any time. Representatives

from outside consulting firms engaged by the Compensation Committee attend meetings of the Compensation Committee, as requested, and communicate with the Chairman of the Compensation Committee between

meetings.

|

|

|

|

|

|

|

|

|

15

|

|

2020

Proxy

Statement

|

Table of Contents

CORPORATE GOVERNANCE

The

Compensation Committee assessed the independence of Willis Towers Watson pursuant to applicable SEC rules and concluded that no conflict of interest exists that would prevent Willis Towers Watson

from independently advising the Compensation Committee.

The

Compensation Committee reviews and discusses with management proposed Compensation Discussion and Analysis disclosures and determines whether to recommend the Compensation Discussion and Analysis

to the Board of Directors for inclusion in the Company's proxy statement and annual report. The recommendation is described in the Compensation Committee Report included in this proxy statement.

The

Compensation Committee formally met five (5) times in 2019, and members of the Compensation Committee also met informally among themselves, with management and with other members of the

Board and Willis Towers Watson from time to time. Decisions regarding executive compensation were approved by our Board after taking into account the recommendations of the Compensation Committee.

Nominating and Corporate Governance Committee

|

|

|

|

|

Members

|

|

Key

Responsibilities

(4 Meetings in 2019)

|

|

ROBERT D.

DIXON

(Chair)

BENNETT

J.

MORGAN

KATHRYN V.

ROEDEL

|

|

The Nominating and Corporate Governance Committee

• identifies

candidates to serve as directors and on committees of the Board of Directors,

• develops, recommends, and reviews our corporate governance guidelines on a regular

basis, and

• assists the Board of Directors in its annual review of the Board of Directors'

performance.

The Nominating and Corporate Governance Committee also undertakes such other tasks delegated to the committee by the Board of Directors.

|

The

Nominating and Corporate Governance Committee formally met four (4) times in 2019, but members of the Nominating and Corporate Governance Committee met informally among themselves, with

management, and other members of the Board from time to time. Decisions regarding board nominations and corporate governance-related matters were approved by our Board after taking into account the

recommendations of the Nominating and Corporate Governance Committee.

Criteria for Director Nominees

In selecting director candidates, the Nominating and Corporate Governance Committee considers whether the candidates possess the required

skill sets and fulfill the qualification requirements of directors approved by the Board of Directors, including integrity, objectivity, sound judgment, leadership and diversity in all aspects of that

term, including differences of perspective, professional experience, education, skills, and other individual qualities, such as gender, race, and ethnicity. Annually, the Nominating and Corporate

Governance Committee assesses the composition of the Board of Directors, including the Committee's effectiveness in balancing the above considerations.

Other

than the foregoing, there are no minimum criteria for director nominees, although the Nominating and Corporate Governance Committee may consider such other factors as it may deem are in the best

interests of the Company and its stockholders. The Nominating and

|

|

|

|

|

|

|

|

|

16

|

|

2020

Proxy

Statement

|

Table of Contents

CORPORATE GOVERNANCE

Corporate

Governance Committee does not assign specific weights to, and a potential or incumbent director will not necessarily satisfy all of, the foregoing criteria and in evaluating a candidate does

not distinguish on the basis of whether the candidate was recommended by a stockholder. Accordingly, the Nominating and Corporate Governance Committee does not have a formal diversity policy but

considers diversity in all aspects of that term, as noted above, as a component of evaluating the composition of the Board of Directors in connection with the annual nomination process.

Process for Identifying and Evaluating Director Nominees

The Nominating and Corporate Governance Committee identifies nominees by first evaluating the current members of the Board of Directors

willing to continue in service. Current members of the Board of Directors with skills and experience that are relevant to the Company's business and who are willing to continue in service are

considered for re-nomination, balancing the value of continuity of service by existing members of the Board of Directors with that of obtaining a new perspective on the Board. If any member of the

Board of Directors does not wish to continue in service or if the Nominating and Corporate Governance Committee decides not to re-nominate a member for re-election, the Nominating and Corporate

Governance Committee identifies the desired skills and experience of a new nominee based on the criteria listed above. Current members of the Nominating and Corporate Governance Committee and Board of

Directors are polled for suggestions as to individuals meeting the criteria of the Nominating and Corporate Governance Committee. Executive search firms may also be retained to identify qualified

individuals. Ms. Avedon was appointed as a Class II Director, effective December 1, 2019. A third-party search firm engaged by the Nominating & Corporate Governance

Committee recommended Ms. Avedon to serve on our Board. Shareholders who wish to recommend a candidate for consideration by the Nominating & Corporate Governance Committee may do so by

sending the candidate's name and supporting information to Mr. Bob Dixon, Nominating & Corporate Governance Committee Chair, c/o Raj Kanuru, Executive Vice President, General

Counsel, & Corporate Secretary, Generac Power Systems, Inc., S45 W29290 Highway 59, Waukesha, Wisconsin 53189.

Stockholder Nominations

Our Bylaws contain provisions which address the process by which a stockholder may nominate an individual to stand for election to the Board

of Directors at the Company's annual meeting of stockholders. To make a nomination for election to the Board of Directors, a stockholder must submit his or her nomination by providing the person's

name and appropriate background and biographical information by writing to the Nominating and Corporate Governance Committee at Generac Holdings Inc., Attn: Raj Kanuru, Executive Vice

President, General Counsel, and Secretary, S45 W29290 Hwy 59, Waukesha, Wisconsin 53189. A stockholder's nomination must be received by the Company's Secretary (i) no later than the close of

business on the 90th day, nor earlier than the close of business on the 120th day, prior to the first anniversary of the previous year's annual meeting of stockholders, (ii) in

the event the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, notice by the stockholder to be timely must be so delivered not

earlier than

the close of business on the 120th day prior to the date of such annual meeting and not later than the close of business on the later of the 90th day prior to the date of such annual

|

|

|

|

|

|

|

|

|

17

|

|

2020

Proxy

Statement

|

Table of Contents

CORPORATE GOVERNANCE

meeting

or, if the first public announcement of the date of such annual meeting is less than 100 days prior to the date of such annual meeting, the 10th day following the day on which

public announcement of the date of such meeting is first made by the Company, or (iii) in the case of a special meeting of stockholders called for the purpose of electing directors, not earlier

than the close of business on the 120th day prior to such special meeting and not later than the close of business on the later of the 90th day prior to such special meeting or the

10th day following the date on which notice of the date of the special meeting was mailed or public disclosure of the date of the special meeting was made, whichever first occurs. A stockholder

nomination must be accompanied by the information required by the Bylaws with respect to a stockholder director nominee.

We

may require any proposed nominee to furnish other information as we may reasonably require to determine the eligibility of the proposed nominee to serve as a director of the Company. See "PROPOSALS

BY STOCKHOLDERS" for the deadline for nominating persons for election as directors at our 2021 annual meeting of stockholders.

Board of Directors Role in Risk Oversight

Our Board and management continually monitor the material risks facing our Company, including financial risk, strategic risk, operational

risk, and legal and compliance risk. Management regularly reports to the Board on its activities in monitoring and mitigating such risks. Overall responsibility for risk oversight rests with our

Board. In addition, the Board may delegate risk oversight responsibility to a particular committee in situations in which the risk falls within the committee's area of focus or expertise. Our Board

believes that for certain areas of risk, our Company is better served by having the initial risk evaluation and risk monitoring undertaken by a subset of the entire Board that is more focused on the

issues pertaining to the particular risk. For instance, our Compensation Committee assists the Board in evaluating risks relating to our compensation policies and procedures. Also, our Audit Committee

assists the Board in fulfilling the Board's oversight responsibility relating to the

evaluation of financial and enterprise risks, including environmental, health & safety, product regulatory, and social matters. As it deems necessary and on at least an annual basis, the

respective committee to which oversight and monitoring of a particular risk has been assigned reports on risk exposures and mitigation strategies with respect to such risk to the entire Board.

Board of Directors Leadership Structure

Aaron

Jagdfeld has served as a director of the Company since 2006 and is the Company's Chairman of the Board, President and Chief Executive Officer. Bennett Morgan serves as Lead Director.

The Lead Director has broad responsibility and authority, including to:

-

•

-

Review the agendas for and preside over meetings of the independent directors.

-

•

-

Preside at all meetings of the Board of Directors at which the Chairman is not present, including executive sessions of the independent

directors.

-

•

-

Call meetings of the independent directors.

-

•

-

Serve as the principal liaison between the Chairman and the independent directors.

|

|

|

|

|

|

|

|

|

18

|

|

2020

Proxy

Statement

|

Table of Contents

CORPORATE GOVERNANCE

-

•

-

Consult with the Chairman regarding:

-

o

-

Information sent to the Board of Directors, including the quality, quantity,

appropriateness, and timeliness of such information.

-

o

-

Meeting agendas for the Board of Directors.

-

o

-

The frequency of Board of Directors meetings and meeting schedules, assuring there is

sufficient time for discussion of all agenda items.

-

•

-

Be available, when appropriate, for consultation and direct communication with stockholders.

-

•

-

Select, retain, and consult with outside counsel and other advisors as the Lead Director deems appropriate.

Periodically,

our Board assesses these roles and the board leadership structure to ensure the interests of the Company and its stockholders are best served.

Our Board has determined that its current structure, with a combined Chairman and CEO role and an independent Lead Director, is in the best

interests of the Company and its stockholders at this time based on a number of factors, including:

-

•

-

A combined Chairman and CEO structure provides the Company with decisive and effective leadership with clearer accountability to our

stockholders and customers.

-

•

-

The combined role is both counterbalanced and enhanced by the effective oversight and independence of our Board of Directors, and the

independent leadership provided by our Lead Director and independent committee chairs.

-

•

-

The Board believes that the appointment of a strong independent Lead Director and the use of regular executive sessions of the non-management

Directors, along with the Board's strong committee system and all Directors being independent except for Mr. Jagdfeld, allow it to maintain effective oversight of management.

Stockholders

and other parties interested in communicating directly with Mr. Morgan as Lead Director may do so by writing to Mr. Morgan, c/o Generac Holdings Inc., S45 W29290 Hwy.

59, Waukesha, Wisconsin 53189.

Attendance at Meetings

It is our policy that each director is expected to dedicate sufficient time to the performance of his or her duties as a director, including

by attending meetings of the stockholders, Board of Directors and committees of which he or she is a member. All then-serving members of the Board of Directors attended the 2019 Annual Meeting of

Stockholders.

In

2019, the Board of Directors held eight (8) meetings (including regularly scheduled and special meetings) and took action by unanimous written consent from time to time. All incumbent directors

attended at least 75% of (i) the total number of meetings of the Board of Directors (held during the period for which he or she has been a director); and (ii) the total number of

meetings held by all committees on which he or she served (during the periods that he or she served).

|

|

|

|

|

|

|

|

|

19

|

|

2020

Proxy

Statement

|

Table of Contents

CORPORATE GOVERNANCE

Stockholder Communications with the Board of Directors

Stockholders and other parties interested in communicating directly with the Board of Directors, whether individually or as a group, may do so

by writing to the Board of Directors, c/o Generac Holdings Inc., S45 W29290 Hwy. 59, Waukesha, Wisconsin 53189. The Secretary will review all correspondence and regularly forward to the Board

of Directors all such correspondence that, in the opinion of the Secretary, deals with the functions of the Board of Directors or committees thereof or that the Secretary otherwise determines requires

attention. Concerns relating to accounting, internal controls, or auditing matters will immediately be brought to the attention of the Chairman of the Audit Committee. We have adopted a Whistleblower

Policy, which establishes procedures for submitting these types of

concerns, either personally or anonymously through a toll free telephone "hotline" or web transmission operated by an independent party. Our Whistleblower Policy can be found on the Company's website

at www.generac.com.

Stockholders

and other parties interested in communicating directly with Andrew Lampereur, as Chairman of the Audit Committee, may do so by writing to Mr. Andrew Lampereur, Chairman, Audit

Committee, c/o Generac Holdings Inc., S45 W29290 Hwy. 59, Waukesha, Wisconsin 53189.

Code of Ethics and Business Conduct

We have adopted a Code of Ethics and Business Conduct (the "Code"), that applies to all of our

directors, officers and employees, including our principal executive officer and principal financial accounting officer. In addition, we have adopted a Supplemental Code of Ethics and Conduct (the

"Supplement") that applies to all of our directors and executive officers, including our principal executive officer and principal financial accounting

officer. The Code and Supplement are both posted on our website at www.generac.com. Any amendments to, or waivers under, our Code or Supplement which are required to be disclosed by the rules

promulgated by the SEC will be disclosed on the Company's website at www.generac.com.

Corporate Governance Guidelines and Principles

We have adopted Corporate Governance Guidelines and Principles. These guidelines outline the role of our Board of Directors, the composition

and operating principles of our Board of Directors and its committees and our Board of Directors' working process. Our Corporate Governance Guidelines and Principles are posted on our website at

www.generac.com.

|

|

|

|

|

|

|

|

|

20

|

|

2020

Proxy

Statement

|

Table of Contents

CORPORATE GOVERNANCE

Environmental, Social, and Governance Practices

Generac's mission is to ensure peace of mind by developing power products and solutions that make the world safer, brighter, and more

productive. In furthering that mission, Generac takes seriously its environmental, social, and governance ("ESG") responsibilities and, in the course of its business, encounters and manages a broad

range of ESG matters. We have identified the below ESG categories as among the most relevant to our business and of interest to key stakeholders.

Environmental, Health & Safety

We

are committed to developing environmentally responsible products and processes, and care about the safety and well-being of our employees, their families, and our communities. We demonstrate this

commitment through the following:

-

•

-

Upholding our comprehensive Corporate Regulatory Compliance and Environmental Protection Policy and Corporate Safety Handbook

-

•

-

Deploying both corporate and facility Health & Safety Committees to ensure employee and contractor safety

-

•

-

Maintaining ISO 14001 Certification for our Corporate Environmental Management System

-

•

-

Continually training and educating our employees and contractors on their responsibility to identify work that is unsafe or environmentally

unsound and to help mitigate potential negative impacts

-

•

-

Implementing and monitoring a long-term "Vision Zero" plan, under which we evaluate and take advantage of reducing materials and waste

throughout our operating facilities

-

•

-

Providing energy storage, technology solutions and related products that utilize solar and other clean, renewable energy sources

-

•

-

Providing innovative product solutions that utilize natural gas (including bi-fuel options), offering significant environmental benefits

compared to diesel products

-

•

-

Being a leader in LED and hybrid light tower technology, which provide for more fuel-efficient operations

-

•

-

Investing in energy monitoring and management solutions, which provide customers the information and control necessary to allow them to reduce

their overall energy consumption

|

|

|

|

|

|

|

|

|

21

|

|

2020

Proxy

Statement

|

Table of Contents

CORPORATE GOVERNANCE

Social Responsibility

We

practice the highest ethical standards by honoring our commitments and treating everyone with fairness, trust and respect. We also believe our success is directly tied to our employees' personal

and professional growth, and recognize their achievements and share in our mutual success. We demonstrate these values through the following:

-

•

-

Promoting an inclusive corporate culture that prohibits discrimination and harassment and encourages diversity

-

•

-

Maintaining an ongoing global employee engagement initiative with targeted action plans by region, function, and business group. Action plans

and their progress are regularly measured by global annual and pulse employee engagement surveys

-

•

-

Enforcing strong policies related to anti-corruption and anti-competitive practices

-

•

-

Holding suppliers to high ethical standards under our Supplier Code of Conduct

-

•

-

Providing job opportunities to those who face barriers to employment through strong partnerships with community job agencies representing

disabled clients and workforce release programs

-

•

-

Maintaining an employee wellness program

-

•

-

Engaging, through our Generac Gives program, in community outreach and charitable activities across the globe, including fundraising,

charitable nonprofit organizations, supporting local youth education (including STEM and apprenticeship opportunities), and donating to nearly 200 community organizations in 2019. Employees also

participate in charitable efforts like blood drives and other group volunteer activities

-

•

-

Founding the GPS Education Partners program, which provides a high school education through a work-based learning program. Generac hosts a

student classroom and provides work-based learning opportunities on-site sponsoring 420 students since founding the program in 2000

-

•

-

Providing storm relief services to communities affected by major weather-related power outages through free technical support and direct

emergency product repairs in affected regions

Governance

Our

Company is committed to good corporate governance and believes in maintaining policies and practices that serve the interests of all stockholders, including the following:

-

•

-

Board oversight of the Company's risk management framework, as well as its risk assessment and management practices

-

•

-

Adopting and enforcing our Code of Ethics and Business Conduct

-

•

-

Adhering to our Corporate Governance Guidelines and Principles

-

•

-

Regularly engaging with stockholders to seek their feedback on the Company's strategy, performance, and ESG practices

|

|

|

|

|

|

|

|

|

22

|

|

2020

Proxy

Statement

|

Table of Contents

CORPORATE GOVERNANCE

-

•

-

Routinely reviewing the need for Board and Committee refreshment

-

•

-

Maintaining a strong control environment and making effective controls an integral part of our routine business practices

Political Contributions

It

is Generac's policy that Company funds or assets will not be used to make a political contribution to any political party or candidate, unless approval has been given by the Board of Directors or

its authorized designee. Generac did not contribute to any political parties or candidates in 2019.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") requires the Company's officers and directors,

and persons who own more than ten percent of the common stock of the Company, to file with the SEC reports of ownership of Company securities and changes in reported ownership. Officers, directors,

and greater than ten percent stockholders are required by SEC rules to furnish the Company with copies of all Section 16(a) reports they file. Based solely on a review of the copies of such

forms furnished to the Company, or written representations from the reporting persons that no Form 5 was required, the Company believes that during 2019 all Section 16(a) filing

requirements applicable to its officers, directors, and greater than ten percent beneficial owners were complied with, except for the following Form 4 filing that was inadvertently filed late: one

Form 4 for two transactions by Mr. Wilde on August 8, 2019.

Compensation Committee Interlocks and Insider Participation

In 2019, the members of our Compensation Committee were Todd Adams (prior to his resignation from the Board on May 1, 2019), Bennett

Morgan, John Bowlin, William Jenkins, and Marcia Avedon (following her election to the Board on December 1, 2019). No member of the Compensation Committee was, during 2019 or previously, an

officer or employee of Generac or its subsidiaries. In addition, during 2019, there were no Compensation Committee interlocks required to be disclosed.

|

|

|

|

|

|

|

|

|

23

|

|

2020

Proxy

Statement

|

Table of Contents

Beneficial

Ownership of our Common Stock

The following table shows information regarding the beneficial ownership of our common stock as of April 20, 2020

by:

-

•

-

each person or group who is known to own beneficially more than five percent of our common

stock;

-

•

-

each member of our Board of Directors, each nominee for election as a director, and each of our named executive officers;

and

-

•

-

all members of our Board of Directors and our executive officers as a group.

Beneficial

ownership of shares is determined under rules of the SEC and generally includes any shares over which a person exercises sole or shared voting or investment power. Except as noted by

footnote, and subject to community property laws where applicable, we believe based on the information provided to us that the persons and entities named in the table below have sole voting and

investment power with respect to all shares of our common stock shown as beneficially owned by them.

Unless

otherwise indicated, the address for each holder listed below is c/o Generac Holdings Inc., S45 W29290 Hwy. 59, Waukesha, Wisconsin 53189.

|

|

|

|

|

|

|

|

|

|

Name and address of beneficial owner

|

|

|

Number of

Shares

|

|

|

Percentage of

Shares

|

|

|

Principal stockholders

|

|

|

|

|

|

|

|

|

BlackRock, Inc.(1)

|

|

|

7,104,863

|

|

|

11.4%

|

|

|

The Vanguard Group(2)

|

|

|

5,956,644

|

|

|

9.5%

|

|

|

JPMorgan Chase & Co.(3)

|

|

|

5,065,141

|

|

|

8.1%

|

|

|

FMR LLC(4)

|

|

|

4,586,860

|

|

|

7.3%

|

|

|

|

|

|

|

|

|

|

|

|

Directors and Named Executive Officers(5)(6)

|

|

|

|

|

|

|

|

|

Aaron Jagdfeld

|

|

|

1,169,733

|

|

|

1.9%

|

|

|

York Ragen

|

|

|

246,679

|

|

|

0.4%

|

|

|

Russell Minick

|

|

|

46,836

|

|

|

0.1%

|

|

|

Patrick Forsythe

|

|

|

73,853

|

|

|

0.1%

|

|

|

Erik Wilde

|

|

|

24,220

|

|

|

*

|

|

|

Marcia Avedon

|

|

|

396

|

|

|

*

|

|

|

John Bowlin

|

|

|

88,676

|

|

|

0.1%

|

|

|

David Ramon

|

|

|

31,475

|

|

|

0.1%

|

|

|

Bennett Morgan

|

|

|

21,602

|

|

|

*

|

|

|

Robert Dixon

|

|

|

15,299

|

|

|

*

|

|

|

Andrew Lampereur

|

|

|

17,705

|

|

|

*

|

|

|

William Jenkins

|

|

|

7,444

|

|

|

*

|

|

|

Dominick Zarcone

|

|

|

9,690

|

|

|

*

|

|

|

Kathryn Roedel

|

|

|

7,320

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

All members of the Board of Directors and executive officers as a group (16 persons)

|

|

|

1,789,549

|

|

|

2.9%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24

|

|

2020

Proxy

Statement

|

Table of Contents

BENEFICIAL OWNERSHIP OF OUR COMMON STOCK

-

(1)

-

Based

on information obtained from Amendment No. 6 to Schedule 13G filed by BlackRock, Inc. on March 9, 2020. According to that report,

BlackRock, Inc. possesses sole power to vote 6,954,330 of such shares and possesses sole power to dispose of 7,104,863 of such shares. In addition, according to that report,

BlackRock, Inc.'s business address is 55 East 52nd Street, New York, New York 10055.

-

(2)

-

Based

on information obtained from Amendment No. 7 to Schedule 13G filed by The Vanguard Group ("Vanguard") on February 12, 2020. According to

that report, Vanguard possesses shared power to vote or to direct the voting of 9,619 of such shares and possesses shared power to dispose or to direct the disposition of 131,002 of such shares and

possesses sole power to vote or to direct the voting of 129,501 of such shares and possesses sole power to dispose or to direct the disposition of 5,825,642 of such shares. In addition, according to

that report, Vanguard's business address is 100 Vanguard Blvd., Malvern, Pennsylvania 19355.

-

(3)

-

Based

on information obtained from Schedule 13G filed by JPMorgan Chase & Co. ("JPMorgan") on January 24, 2020. According to that report,

JPMorgan possesses sole power to vote 4,757,388 of such shares and possesses sole power to dispose of 5,061,541 of such shares. In addition, according to that report, JPMorgan's business address is

383 Madison Avenue, New York, New York 10179.

-

(4)

-

Based

on information obtained from Schedule 13G filed by FMR LLC on February 7, 2020. According to that report, FMR, LLC. possesses sole power to vote

or to direct the voting of 211,670 of such shares and possesses sole power to dispose or to direct the disposition of 4,586,860 of such shares. In addition, according to that report, FMR LLC's

business address is 245 Summer Street, Boston, MA 02210.

-

(5)

-

With

respect to Messrs. Jagdfeld, Ragen, Minick, Forsythe and Wilde, the number of shares beneficially owned includes 482,393, 134,083, 23,635, 41,993 and

10,172 shares respectively, which may be acquired pursuant to options issued under the 2010 or 2019 Generac Holdings Inc. Equity Incentive Plan as applicable, because such options are exercisable

within 60 days. The respective number of shares for the individuals mentioned above were in each case also added to the denominator for purposes of calculating the percentage ownership of that

individual.

-

(6)

-

With

respect to Ms. Roedel and Messrs. Ramon, Dixon, Morgan, Lampereur, Jenkins and Zarcone, the number of shares beneficially owned includes 7,320,

1,947, 5,904, 8,346, 10,797, 1,417 and 6,661 Deferred Stock Units, respectively, all of which were issued pursuant to the Company's Deferred Stock Unit Plan for Non-Employee Directors, effective

April 1, 2017.

|

|

|

|

|

|

|

|

|

25

|

|

2020

Proxy

Statement

|

Table of Contents

Executive Compensation

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (CD&A) describes our executive compensation program. It provides an overview of the 2019 compensation for the

following named executive officers, practices and policies, and how the Compensation Committee made its decisions.

|

|

|

|

Named Executive Officer

|

|

Title

|

|

|

|

|

|

Aaron Jagdfeld

|

|

President, Chief Executive Officer & Chairman

|

|

York Ragen

|

|

Chief Financial Officer

|

|

Russell Minick

|

|

Chief Marketing Officer

|

|

Patrick Forsythe

|

|

Executive Vice President, Global Engineering

|

|

Erik Wilde

|

|

Executive Vice President, Industrial Americas

|

|

|

|

|

|

|

2019 Business Highlights & Performance

|

2019 was another record year for

Generac....

In

addition to the strong financial performance, the Company had some key accomplishments during the year that are important to the execution of our strategy. We believe 2019 provides further support

that the secular penetration opportunity for home standby generators is as compelling as it has ever been. Home standby shipments increased at a strong rate during the year and we experienced very

encouraging trends with several key performance metrics that we monitor closely, including in-home consultations, activations, and residential dealer count. We made significant progress in ramping up

efforts to capitalize on a dramatic increase in generator interest and demand in California due to the power shutoff events by local utilities, as residential product shipments alone to the state

increased by more than $50 million compared to the prior year. We also launched our new Clean Energy efforts during the year by entering into the energy storage and monitoring markets,

including making the important and strategic acquisitions of Pika Energy and Neurio Technology during the first half of 2019. We achieved an exciting milestone during the fourth quarter by shipping

the first of our new PWRcell storage systems with our PWRview monitoring platform, which has been very well received by the market to date.

|

|

|

|

|

|

|

|

|

26

|

|

2020

Proxy

Statement

|

Table of Contents

EXECUTIVE COMPENSATION

Another

key accomplishment during 2019 was the exceptionally strong growth experienced for domestic commercial & industrial (C&I) stationary generators, which benefitted from market share gains

and the dual secular drivers of increasing penetration for natural gas generators and the impending deployment of next-generation 5G technology. We also further expanded our international business

with the Captiva acquisition in India during the first quarter of 2019—one of the largest power generation markets in the world.

We

generated record earnings and cash flow for 2019, while at the same time significantly increasing our operating and capital investments across the business to align with our long-term core growth

targets, and to capitalize on the numerous growth opportunities that lie ahead for Generac. Accordingly, we planned for a notable increase in operating expenses in order to invest in a variety of

initiatives across the business, and we had nearly a 30% increase in capital expenditures for the year compared to 2018—with the majority relating to "growth" investments within our

operations and facilities.

* A full discussion of our use of non-U.S. generally accepted accounting principles measures to provide a baseline for evaluating and comparing our

operating results, and a reconciliation of Adjusted EBITDA to net income can be found in Item 6 of the Company's Annual Report on Form 10-K for the fiscal year ended December 31,

2019.

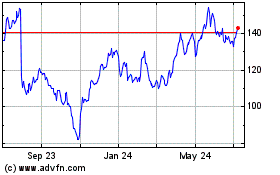

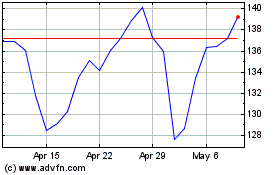

(1) Total Shareholder Return reflects the compound annual price appreciation of Generac shares along with the

assumption of special dividends being reinvested to calculate a total return to shareholders expressed as a percentage.

(2) On January 1, 2018, we adopted ASU 2017-07, Improving the Presentation of

Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost; ASU 2016-15, Statement of Cash Flows: Classification of Certain Cash Receipts and

Cash Payments; and ASU 2014-09, Revenue from Contracts with Customers. These new standards required retrospective application to

all periods presented in our financial statements.

|

|

|

|

|

|

|

|

|

27

|

|

2020

Proxy

Statement

|

Table of Contents

EXECUTIVE COMPENSATION

Generac's Executive Compensation Practices

The following best practices ensure alignment between shareholders and executives while maintaining corporate governance.

|

|

|

|

|

|

|

|

|

|

|

|

|

WHAT WE DO:

|

|

|

|

|

|

|

|

Pay for Performance

|

|

A significant amount of executive officer pay is based on the achievement of specific annual and long-term strategic and financial goals.

|

|

|

Stock Ownership Guidelines

|

|

Stock ownership guidelines have been established for executive officers and Directors.

|

|

|

|

|

|

|

|

Compensation Risk Assessments

|

|

A compensation risk assessment is performed on a regular basis.

|

|

|

|

|

|

|

|

Independent Compensation Consultant

|

|

An independent consultant is retained by the Compensation Committee.

|

|

|

Clawback Policy

|

|

Requires the CEO, CFO and other executive officers to reimburse or forfeit any excess incentive compensation received due to the accounting restatement of the Company's financial statements as a result of the Company's material noncompliance with

any financial reporting requirement under federal securities laws.

|

|

|

|

|

|

WHAT WE DO NOT DO:

|

|

|

|

|

|

|

|

Hedging of Company Stock

|

|

Executive officers and Directors may not engage in speculative transitions in Company securities. Specifically, it is against Company policy to trade in puts or calls in Company securities or sell Company securities short.

|

|

|

Pledging of Company Stock