Genco Shipping & Trading Limited Closes its New Five-Year $460 Million Credit Facility

June 05 2018 - 4:30PM

Genco Shipping & Trading Limited (NYSE:GNK) announced today

that it has closed on a previously announced five-year senior

secured credit facility in an aggregate principal amount of up to

$460 million. Proceeds from the new credit facility were used,

together with cash on hand, to refinance all of the Company’s

existing credit facilities into one facility and pay down the debt

on the oldest seven vessels in Genco’s fleet.

Apostolos Zafolias, Chief Financial Officer,

commented, “We are pleased to have closed on this attractive $460

million facility, which was oversubscribed by approximately 40%.

With this new facility, we have strengthened our position to

capitalize on attractive growth opportunities and have provided

Genco with the ability to pay dividends, while simplifying the

Company’s capital structure. We appreciate the ongoing support of

our banking group, highlighting Genco’s leadership position and

strong prospects for taking advantage of favorable drybulk supply

and demand fundamentals.”

The new $460 million facility lowers Genco’s

interest costs through improved pricing, eliminates near-term

refinancing risk by extending loan maturity to 2023, establishes an

attractive amortization profile, and enhances the Company’s

flexibility to execute its fleet growth and renewal program by

lifting restrictions on vessel acquisitions and additional

indebtedness. The final maturity date of the facility will be May

31, 2023. Borrowings under the facility will bear interest at LIBOR

plus 325 basis points through December 31, 2018 and LIBOR plus a

range of 300 to 350 basis points thereafter, dependent upon total

net indebtedness to the last twelve months EBITDA. Scheduled

amortization payments are $15 million per quarter commencing on

December 31, 2018 and may be recalculated upon the Company’s

request upon certain events.

Nordea Bank AB (publ), New York Branch is the

agent of the facility. Nordea Bank, AB (publ), New York Branch,

Skandinaviska Enskilda Banken AB (publ), ABN AMRO Capital USA

LLC, DVB Bank SE, Crédit Agricole Corporate & Investment Bank,

and Danish Ship Finance A/S acted as Mandated Lead Arrangers and

Bookrunners, and Deutsche Bank AG Filiale Deutschlandgeschäft, and

CTBC Bank Co. Ltd. acted as Co-Arrangers under the facility.

About Genco Shipping & Trading

Limited

Genco Shipping & Trading Limited transports

iron ore, coal, grain, steel products and other drybulk cargoes

along worldwide shipping routes. As of June 5, 2018, Genco Shipping

& Trading Limited’s fleet consists of 13 Capesize, six Panamax,

four Ultramax, 21 Supramax, one Handymax and 15 Handysize vessels

with an aggregate capacity of approximately 4,688,000 dwt.

"Safe Harbor" Statement Under the

Private Securities Litigation Reform Act of 1995

This press release contains forward-looking

statements made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements use words such as “anticipate,”

“budget,” “estimate,” “expect,” “project,” “intend,” “plan,”

“believe,” and other words and terms of similar meaning in

connection with a discussion of potential future events,

circumstances or future operating or financial performance.

These forward-looking statements are based on management’s current

expectations and observations. Included among the factors that, in

our view, could cause actual results to differ materially from the

forward looking statements contained in this report are the

following: (i) declines or sustained weakness in demand in the

drybulk shipping industry; (ii) continuation of weakness or

declines in drybulk shipping rates; (iii) changes in the supply of

or demand for drybulk products, generally or in particular regions;

(iv) changes in the supply of drybulk carriers including

newbuilding of vessels or lower than anticipated scrapping of older

vessels; (v) changes in rules and regulations applicable to the

cargo industry, including, without limitation, legislation adopted

by international organizations or by individual countries and

actions taken by regulatory authorities; (vi) increases in costs

and expenses including but not limited to: crew wages, insurance,

provisions, lube, oil, bunkers, repairs, maintenance and general,

administrative, and management fee expenses; (vii) whether our

insurance arrangements are adequate; (viii) changes in general

domestic and international political conditions; (ix) acts of war,

terrorism, or piracy; (x) changes in the condition of the Company’s

vessels or applicable maintenance or regulatory standards (which

may affect, among other things, our anticipated drydocking or

maintenance and repair costs) and unanticipated drydock

expenditures; (xi) the Company’s acquisition or disposition of

vessels; (xii) the amount of offhire time needed to complete

repairs on vessels and the timing and amount of any reimbursement

by our insurance carriers for insurance claims, including offhire

days; (xiii) the completion of definitive documentation with

respect to charters; (xiv) charterers’ compliance with the terms of

their charters in the current market environment; (xv) the extent

to which our operating results continue to be affected by weakness

in market conditions and charter rates; (xvi) our ability to

maintain contracts that are critical to our operation, to obtain

and maintain acceptable terms with our vendors, customers and

service providers and to retain key executives, managers and

employees; (xvii) the completion of definitive documentation and

fulfillment of conditions precedent under our proposed $460 million

credit facility; and other factors listed from time to time in our

public filings with the Securities and Exchange Commission

including, without limitation, the Company’s Annual Report on Form

10-K for the year ended December 31, 2017 and its subsequent

reports on Form 10-Q and Form 8-K. Our ability to pay dividends in

any period will depend upon various factors, including the

limitations under any credit agreements to which we may be a party,

applicable provisions of Marshall Islands law and the final

determination by the Board of Directors each quarter after its

review of our financial performance. The timing and amount of

dividends, if any, could also be affected by factors affecting cash

flows, results of operations, required capital expenditures, or

reserves. As a result, the amount of dividends actually paid

may vary. We do not undertake any obligation to update or

revise any forward‑looking statements, whether as a result of new

information, future events or otherwise. Concurrently with

the issuance of this press release, we are filing a Current Report

on Form 8-K which will be available on the SEC’s EDGAR website at

www.sec.gov containing further details of the $460 million credit

facility.

CONTACT:Apostolos ZafoliasChief

Financial OfficerGenco Shipping & Trading Limited(646)

443-8550

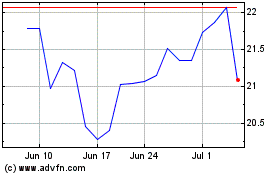

Genco Shipping and Trading (NYSE:GNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

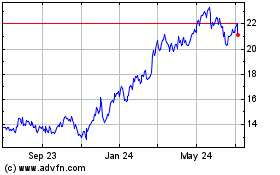

Genco Shipping and Trading (NYSE:GNK)

Historical Stock Chart

From Apr 2023 to Apr 2024