DoorDash, GameStop, Pfizer: What to Watch When the Stock Market Opens Today

December 09 2020 - 9:36AM

Dow Jones News

By Mischa Frankl-Duval

Here's what we are watching as markets kick into gear

Wednesday.

-- U.S. stock futures edged higher, suggesting the major indexes

may grind toward new all-time highs after the opening bell as

investors bet on fresh fiscal stimulus spending.

Futures tied to the S&P 500 ticked up 0.2%, a day after the

benchmark notched its 30th record close of 2020. Nasdaq-100 futures

were down 0.1%, indicating technology stocks may be subdued after

the New York opening bell. Read our full market wrap here.

What's Coming Up

-- DoorDash shares will begin trading today after the

food-delivery company priced its IPO at $102 apiece. That equates

to a valuation of $39 billion. DoorDash was privately valued at

more than $15 billion earlier this year.

-- Shares in software company C3.ai are also expected to start

trading today. The company priced shares at $42 apiece, above their

expected range. Advertising-software company PubMatic is also set

to float.

-- Job openings and wholesale inventories data are due at 10

a.m.

-- Adobe will give results for its most recent quarter after the

market closes.

Market Movers to Watch

-- GameStop shares fell 15% in off-hours trade after the company

released sales figures that missed analysts' expectations.

-- Insurance software company Guidewire dipped 3.4% off-hours

after its quarterly results disappointed investors.

-- United Airlines rose 1.6% in premarket trade. Boeing

yesterday delivered a 737 MAX aircraft to the carrier, which became

the first to receive a newly produced model of the jet after U.S.

regulators ended a nearly two-year grounding last month.

-- Shares in Pfizer rose 1.4% premarket. The Food and Drug

Administration yesterday said a Covid-19 vaccine the company

developed with BioNTech "met the prescribed success criteria" in a

clinical study, paving the way for the agency to green-light

distribution as early as this weekend.

-- Regenerative-medicine company Pluristem Therapeutics tumbled

more than 41% off-hours after the results of an interim analysis of

one of its treatments disappointed investors.

-- Shares in MTS Systems, a maker of test systems and industrial

sensors, rose almost 50% premarket on news that the Amphenol, which

makes electrical communications components, would buy the

company.

Must Reads Since You Went to Bed

Euro Rally Weighs on Inflation, Sapping Appetite for Stocks

Covid-19 Pandemic Puts Squeeze on Pension Plans

U.S. Job Openings Slip in Early December

Luxury Brands Follow Chinese Shoppers Back Home

U.S. Supplies of Covid-19 PPE Fall Short of Targets

Chinese Consumer Prices Show First Annual Decline Since 2009

(END) Dow Jones Newswires

December 09, 2020 09:21 ET (14:21 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

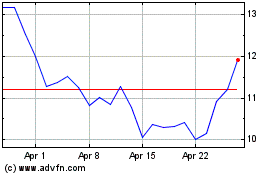

GameStop (NYSE:GME)

Historical Stock Chart

From Mar 2024 to Apr 2024

GameStop (NYSE:GME)

Historical Stock Chart

From Apr 2023 to Apr 2024