General Mills in Sustainability-Linked Revolving Credit Facility

April 15 2021 - 10:42AM

Dow Jones News

By Michael Dabaie

General Mills said it entered into a sustainability-linked

revolving credit facility.

The food company on Thursday said it renewed its five-year $2.7

billion revolving credit facility, which now includes a pricing

structure tied to environmental impact metrics.

General Mills said it receives a pricing adjustment based on its

performance against environmental criteria during the credit

facility's term.

General Mills will be measured on progress in reducing

greenhouse gas emissions in owned operations and using renewable

electricity for global operations. Sustainability performance will

be measured and communicated in General Mills' annual global

responsibility report, the company said.

The amendment extends the maturity of the credit facility to

2026 and includes 20 of the company's banking partners. Joint lead

arrangers and joint book runners include BofA Securities Inc.,

JPMorgan Chase Bank, Barclays Bank PLC, Citibank N.A, Deutsche Bank

Securities Inc., and BNP Paribas. BofA Securities is acting as the

sustainability coordinator.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

April 15, 2021 10:27 ET (14:27 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

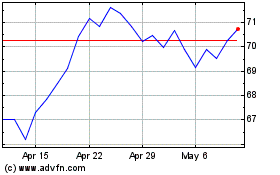

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

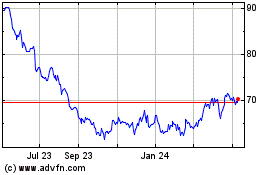

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024