Conagra CEO Sees New Consumer Behaviors Lasting 'Well Into the Future'

January 07 2021 - 11:26AM

Dow Jones News

By Annie Gasparro

Conagra Brands Inc. said it is investing in added manufacturing

capacity and marketing, aiming to maintain pandemic-driven sales

momentum.

The coronavirus pandemic has brought big food companies back

into millions more homes, giving Conagra and its peers a chance to

win over consumers who had dropped their brands for newer or

trendier ones.

Companies such as Campbell Soup Co. and General Mills Inc. also

have said they want to capitalize on the momentum by investing in

marketing and added production capacity.

Conagra Chief Executive Sean Connolly said Thursday that he

expects the new enthusiasm for cooking and packaged foods to

continue "well into the future." That has prompted Conagra to add

more production capacity for popcorn and some frozen meals.

"Critical to our ability to sustain our growing relevancy with

consumers is the physical availability of our products," he said on

a conference call. Conagra is also spending money on marketing and

to modernize some of its recipes and packaging.

Mr. Connolly said consumers, especially younger ones, would

likely continue eating at home more as they have developed skills

in the kitchen and work remotely more often. That would boost

Conagra's grocery business, though the company said it expects its

sales to food-service outlets would continue to struggle.

In its latest quarter, Conagra's sales rose 8% on a comparable

basis. The company said its Marie Callender's frozen meals, Orville

Redenbacher popcorn and Duncan Hines cake mixes have benefited from

people eating more at home. Conagra said it expects comparable

sales for the current quarter to rise 6% to 8%.

Shares of Conagra fell 2% to $35 on Thursday. Conagra's shares

were up 6.6% over the past year through Wednesday, compared with

2.2% for the packaged-foods and meats index, and 15% for the

S&P 500.

Demand for packaged foods at grocery stores has moderated since

the beginning of the pandemic last spring. Still, sales growth at

many companies is at least quadruple levels they reported before

the pandemic.

Credit Suisse food analyst Robert Moskow said in a note to

investors this week that Conagra might be too optimistic about the

potential for brands such as Chef Boyardee and Duncan Hines that

were unpopular before the pandemic to maintain sales momentum after

it ends.

Conagra's projected operating margin for its ongoing quarter was

lower than analysts expected. Some, including Mr. Moskow, have

questioned Conagra's decision to spend more on nontraditional

advertising such as social media.

Mr. Connolly said higher-quality foods with more provocative

marketing will sell better than outdated foods that aren't marketed

well online. He said that in the latest quarter, Conagra gained

market share.

Overall for the quarter, which ended Nov. 29, Conagra reported a

6.2% rise in sales to about $3 billion. Its profit rose to $380

million from $262 million a year earlier. The company's adjusted

profit of 81 cents a share beat the 74 cents a share analysts

predicted.

(END) Dow Jones Newswires

January 07, 2021 11:11 ET (16:11 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

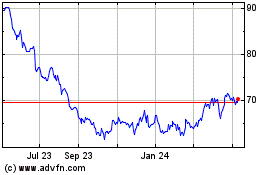

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

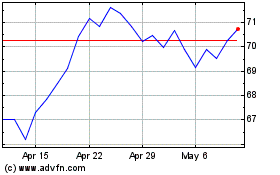

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024