Current Report Filing (8-k)

July 02 2021 - 4:31PM

Edgar (US Regulatory)

GUESS INC0000912463false00009124632021-06-302021-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 30, 2021

GUESS?, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

|

|

|

|

|

|

|

1-11893

|

95-3679695

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

1444 S. Alameda Street, Los Angeles, California 90021

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (213) 765-3100

Not applicable

(Former name or former address, if changed since last report)

|

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which registered

|

|

|

|

|

|

|

|

Common Stock, par value $0.01 per share

|

|

GES

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

|

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 30, 2021, the Compensation Committee (the “Committee”) of the Board of Directors of Guess?, Inc. (the “Company”) approved an amendment (the “Amendment”) to the Executive Employment Agreement, dated January 27, 2019, between the Company and Carlos Alberini, the Company’s Chief Executive Officer (the “Employment Agreement”). Mr. Alberini’s “Employment Term” under the Employment Agreement was scheduled to expire on February 20, 2022 (subject to renewal and earlier termination as provided in the Employment Agreement). The Amendment extends the expiration of the “Employment Term” under the Employment Agreement from February 20, 2022 to June 30, 2025 (subject to renewal and earlier termination as provided in the Employment Agreement).

The foregoing summary of the Amendment is subject to, and qualified in its entirety by, the full text of the Amendment, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 8.01. Other Information.

In connection with the extension of the “Employment Term” under Mr. Alberini’s Employment Agreement as described in Item 5.02 above, on June 30, 2021 the Committee approved the grant to Mr. Alberini of 300,000 restricted stock units under the Company’s 2004 Equity Incentive Plan, as amended, that are scheduled to vest based on the attainment of certain absolute stock price levels as described below (the “Award”).

The Award is separated into four different vesting tranches, with each vesting tranche consisting of 75,000 restricted stock units subject to the Award. A vesting tranche under the Award will vest if on or before June 20, 2025 the Company’s 15-Day Average Stock Price equals or exceeds one of the “Stock Price Targets” set forth below (but in no event earlier than the “Earliest Vesting Date” set forth below corresponding to that target), subject to Mr. Alberini’s continued employment through the applicable vesting date.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock Price Target

|

|

Earliest Vesting Date

|

|

|

|

$35.00

|

|

June 30, 2022

|

|

|

|

$40.00

|

|

June 30, 2023

|

|

|

|

$45.00

|

|

June 30, 2024

|

|

|

|

$50.00

|

|

June 30, 2025

|

|

For purposes of the Award, the Company’s “15-Day Average Stock Price” means the average per-share closing price of a share of Company common stock over a period of fifteen (15) consecutive trading days plus the amount of any dividends paid on a share of Company common stock after the date of grant of the Award through the applicable date.

If Mr. Alberini’s employment is terminated by the Company without “Cause” (as defined in the Employment Agreement), by Mr. Alberini for “Good Reason” (as defined in the Employment Agreement), or due to Mr. Alberini’s death or disability, any portion of the Award as to which the Stock Price Target was achieved prior to such separation from service, but which had not yet vested because such separation from service occurred prior to the applicable Earliest Vesting Date, will vest upon such separation from service. Should a change in control of the Company occur: (1) to the extent the Award is outstanding immediately prior to the change in control, each Stock Price Target not otherwise achieved prior to such event shall be deemed satisfied upon such event, any otherwise unvested restricted stock units subject to the Award will vest upon the change in control to the extent the corresponding Earliest Vesting Date occurred prior to the date of the change in control, and any otherwise unvested restricted stock units subject to the Award will remain subject to time-based vesting through the corresponding Earliest Vesting Date to the extent the Earliest Vesting Date had not occurred prior to the change in control; (2) the Award will fully vest upon the change in control to the extent it is to be terminated in connection with the change in control (and not continued following such event or assumed or converted into restricted stock units of any successor entity to the Company or a parent thereof); and (3) the Award will fully vest if Mr. Alberini’s employment is terminated by the Company without Cause, or by Mr. Alberini for Good Reason, within 12 months prior to or within two years following the change in control.

The foregoing description of the Award is subject to, and qualified in its entirety by, the full text of the Performance Share Award Agreement (Stock Price) setting forth the terms and conditions of the Award, a copy of which is filed as Exhibit 10.2 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

|

|

|

|

|

|

|

|

|

104

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Guess?, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

|

July 2, 2021

|

GUESS?, INC.

|

|

|

|

|

|

|

|

By:

|

/s/ Kathryn Anderson

|

|

|

|

|

Kathryn Anderson

Chief Financial Officer

|

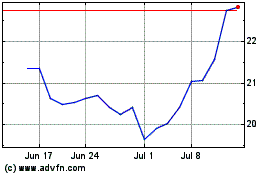

Guess (NYSE:GES)

Historical Stock Chart

From Mar 2024 to Apr 2024

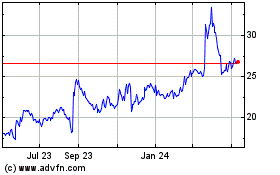

Guess (NYSE:GES)

Historical Stock Chart

From Apr 2023 to Apr 2024